Are you eagerly anticipating your tax refund in 2025? Understanding the tax refund schedule is key to managing your finances this year. In this guide, we will delve into the intricacies of the tax refunds 2025 schedule to provide you with everything you need to know to navigate this process seamlessly. From important dates to filing deadlines, we have got you covered. Stay informed to ensure you receive your refund in a timely manner while making informed financial decisions. Let’s explore the tax refund 2025 schedule together and make sure you are well-prepared to handle your taxes like a pro!

A lot of Indians invest in US stocks. What they are not told is just how complex tax filing becomes. Today, @Shiprasorout does a deep dive into Schedule FA, the schedule you have to fill if you own any kind of foreign asset – stocks, bonds, property, ESOPs etc.

Big things to… pic.twitter.com/czMNDzHAFl

— Neil Borate (@ActusDei) June 28, 2023

Understanding Tax Refunds

When it comes to tax refunds in 2025, it is essential to know the schedule to ensure you receive your refund in a timely manner. Understanding how tax refunds work can help you plan your finances accordingly.

Importance of Tax Refunds

Receiving a tax refund can provide financial relief and help individuals meet their financial goals. It can be used to pay off debts, save for the future, or make a significant purchase.

Knowing the tax refunds 2025 schedule will help you anticipate when you can expect to receive your refund, allowing you to plan ahead.

Factors Influencing Tax Refunds

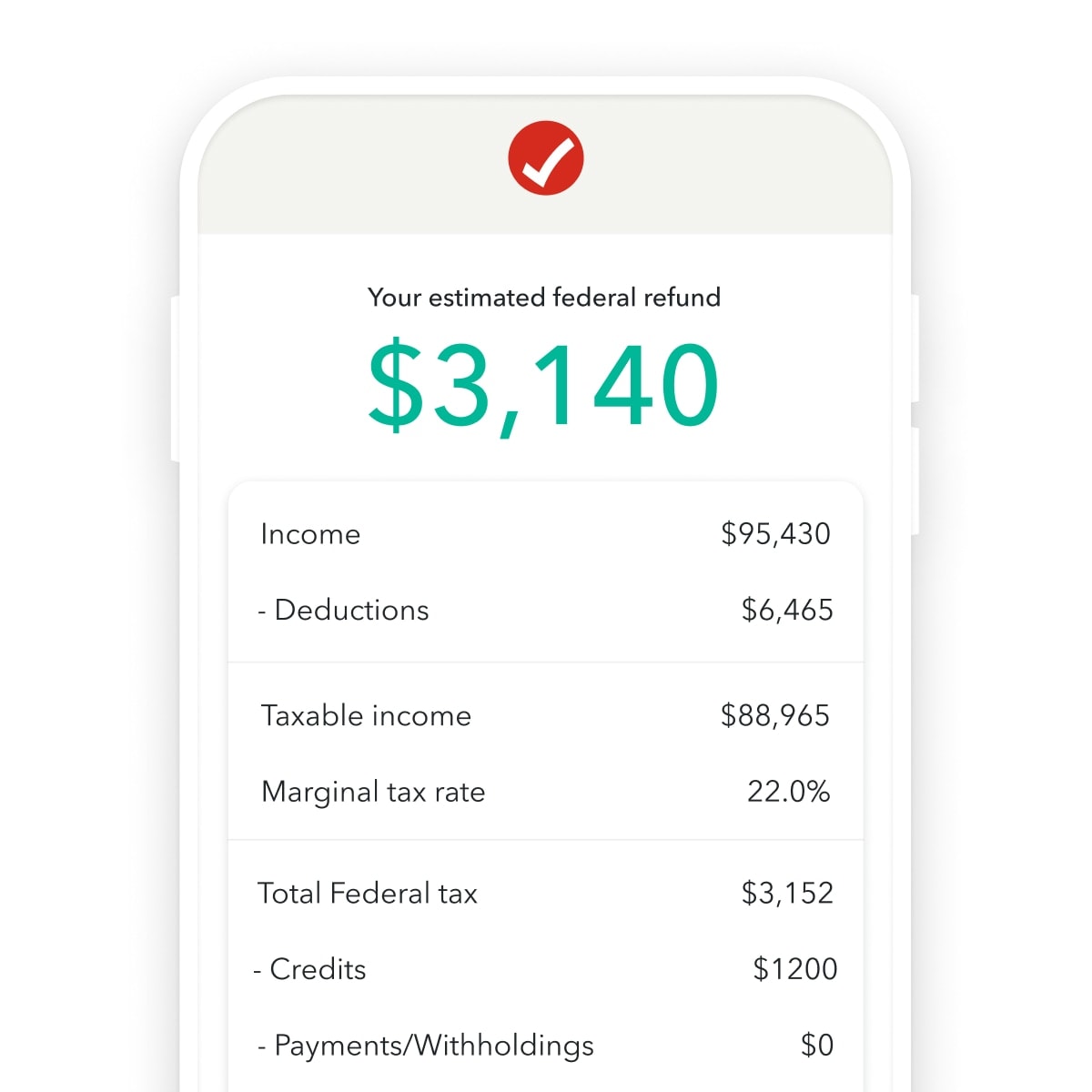

The amount of your tax refund is influenced by various factors, including your income, deductions, credits, and filing status. It’s essential to file your taxes accurately and on time to receive the maximum refund you are entitled to.

Understanding these factors and how they impact your refund can help you make informed decisions when filing your taxes.

Overview of the 2025 Tax Refund Schedule

As we look forward to the 2025 tax season, understanding the tax refund schedule is crucial for many individuals and families. The tax refunds 2025 schedule provides a timeline for when taxpayers can expect to receive their refunds from the IRS. It outlines the processing times and estimated dates for refunds based on when the tax return was filed.

Key Dates to Remember

One of the essential aspects of the tax refund schedule is knowing the key dates to remember. Starting from January 15, 2025, taxpayers can begin filing their tax returns. The IRS typically processes electronic returns faster than paper returns, so filing online can expedite your refund.

Additionally, February 1, 2025 marks the official start of the IRS processing tax returns, and they aim to issue 90% of refunds within 21 days. This means that by mid to late February, most taxpayers can expect to receive their refunds.

Factors Affecting Refund Timing

Several factors can impact the timing of your tax refund. Errors in the tax return, missing documents, or claims for additional credits may result in delays. It’s important to double-check your return for accuracy to avoid any issues that could slow down the refund process.

Furthermore, choosing direct deposit for your refund can expedite the process compared to receiving a paper check through the mail. If there are any discrepancies or issues with your return, the IRS may need additional time to review and process your refund.

Important Dates to Remember

When it comes to the tax refunds 2025 schedule, it’s crucial to keep track of key dates to ensure you receive your refund in a timely manner. Here are some important dates you need to remember:

Filing Start Date

The filing for tax year 2025 is set to begin on January 27th, 2026. It’s recommended to file your taxes as early as possible to expedite the refund process.

Deadline for Filing

The deadline for filing your taxes for the tax year 2025 is April 15th, 2026. It’s essential to ensure you submit your tax return before this date to avoid penalties and interest.

Expected Refund Date

Typically, if you file your taxes electronically and choose direct deposit, you can expect to receive your refund within 21 days of the date the IRS accepts your return. For tax refunds 2025 schedule, it’s estimated that refunds will start being issued in mid-February 2026.

Changes and Updates for 2025

As we delve into the tax season of 2025, there are some significant changes and updates that taxpayers need to be aware of. Understanding these updates will help you navigate the tax refunds 2025 schedule more effectively.

New Tax Laws Implemented

In 2025, several new tax laws have been implemented that could impact your tax return. It is crucial to stay up to date with these changes to ensure compliance and maximize your refunds.

One of the key changes includes adjustments to the tax brackets, which could potentially affect your tax liability for the year.

Electronic Filing Enhancements

The IRS has introduced enhancements to electronic filing for the 2025 tax season. Taxpayers can now experience a more streamlined and efficient process when submitting their returns online.

With the updated e-filing system, taxpayers can expect faster processing times and quicker refunds, making the entire tax filing process more convenient.

Enhanced Security Measures

Security is a top priority for the IRS in 2025. Enhanced security measures have been put in place to protect taxpayers’ sensitive information and prevent identity theft.

- Multi-factor authentication is now required for certain online transactions to ensure the safety of taxpayer data.

- Secure document upload portals have been implemented to allow for safe and encrypted transmission of tax documents.

Tips for Maximizing Your Tax Refund

When it comes to maximizing your tax refund in 2025, there are several strategies you can use to ensure you get the most out of your return. One key tip is to file your taxes early to avoid any delays in processing and receiving your refund.

1. Claim All Deductions and Credits

Make sure you claim all eligible deductions and credits to reduce your taxable income and increase your refund amount. This includes deductions for education expenses, medical costs, and charitable contributions.

Leverage tax credits like the Child Tax Credit or the Earned Income Tax Credit if you qualify, as they can significantly boost your refund.

2. Contribute to Retirement Accounts

Consider contributing to retirement accounts such as an IRA or 401(k) to lower your taxable income. Contributions to these accounts are often tax-deductible and can help increase your refund.

Maximizing your contributions before the tax year ends can have a positive impact on your refund amount.

3. Review and Amend Previous Returns

If you believe you missed out on deductions or credits in previous tax returns, consider amending them to potentially receive additional refunds. Reviewing past returns can uncover overlooked opportunities to maximize your refund.

Frequently Asked Questions

- When can I expect to receive my tax refund in 2025?

- The tax refund schedule for 2025 typically starts in late January, but the exact date may vary each year. You can check the IRS website for updates on the tax refund schedule.

- How can I track the status of my tax refund?

- You can track the status of your tax refund through the IRS website using the ‘Where’s My Refund’ tool. Make sure to have your social security number, filing status, and exact refund amount handy.

- What factors can affect the timing of my tax refund?

- Several factors can impact the timing of your tax refund, including errors in your tax return, filing a paper return, claiming certain tax credits, or if your return is selected for additional review.

- Can I receive my tax refund via direct deposit?

- Yes, you can choose to have your tax refund deposited directly into your bank account. Make sure to provide the correct account information on your tax return to avoid any delays.

- What should I do if I haven’t received my tax refund on the expected date?

- If you haven’t received your tax refund on the expected date, you can contact the IRS or check the status online. There may be delays due to various reasons, such as errors in your tax return or processing times.

Unlocking the Tax Refunds 2025 Schedule: Recap & Next Steps

In conclusion, understanding the tax refunds 2025 schedule is crucial for maximizing your refunds and planning your financial well-being. By familiarizing yourself with the timelines and processes outlined in the schedule, you can stay ahead of the game and avoid unnecessary delays. Remember to file your taxes on time and utilize e-filing for faster processing. Keep track of important dates to ensure you receive your refund in a timely manner. Planning ahead and staying informed are key to making the most of the tax refunds 2025 schedule. Here’s to a successful tax season!