Welcome to our comprehensive guide on IRS taxes schedule for the year 2025. Understanding the IRS taxes schedule 2025 is crucial to ensuring you meet all important dates and deadlines set by the Internal Revenue Service. As tax regulations evolve each year, staying informed about key dates and deadlines can help you avoid potential penalties and navigate the tax filing process successfully.

In this blog, we will provide you with essential information on the important dates and deadlines ahead in the IRS taxes schedule 2025. Whether you are an individual taxpayer, a small business owner, or a tax professional, keeping track of these dates is vital for a smooth tax filing experience. Let’s dive into the details of what you need to know to stay compliant with the IRS for the upcoming tax year.

Get the free #IRS tax calendar to keep your business on track in 2018: https://t.co/6k1v8BSAtf pic.twitter.com/OlZq3OIiMQ

— IRSnews (@IRSnews) June 7, 2018

Introduction to IRS Taxes Schedule 2025

As we gear up for the tax season of 2025, understanding the IRS Taxes Schedule 2025 is crucial for all taxpayers. The schedule lays out important dates and deadlines that individuals and businesses need to adhere to in order to stay compliant with tax laws. Keeping track of these dates ensures a smooth and stress-free tax filing process.

Key Dates to Remember

One of the critical aspects of IRS Taxes Schedule 2025 is knowing the key dates. These include deadlines for filing different types of tax returns, making estimated tax payments, and other important milestones.

- April 15, 2025: Deadline for filing individual tax returns.

- June 15, 2025: Deadline for the second installment of estimated tax payments for individuals.

- October 15, 2025: Final extended deadline for filing individual tax returns.

Preparing for Tax Season

It’s never too early to start preparing for the upcoming tax season. Make sure to gather all necessary documents, such as W-2s, 1099s, and receipts, to ensure a smooth filing process. Consider consulting with a tax professional or using tax software to help streamline the process.

Key Dates and Deadlines to Remember

As you navigate through IRS taxes schedule 2025, it’s crucial to mark your calendar with key dates and deadlines to stay on top of your tax obligations. Missing these deadlines could result in penalties and interest charges.

Quarterly Estimated Tax Payment Due Dates

For self-employed individuals and those with income not subject to withholding, quarterly estimated tax payments are due on:

- April 15, 2025: 1st Quarter Deadline

- June 15, 2025: 2nd Quarter Deadline

- September 15, 2025: 3rd Quarter Deadline

- January 15, 2026: 4th Quarter Deadline

Individual Income Tax Filing Deadlines

Mark your calendars for these important deadlines for filing your income tax return:

- April 15, 2025: Deadline for filing your federal income tax return.

- October 15, 2025: Extension deadline if you filed Form 4868 for an extension.

Filing Requirements for Taxpayers

When it comes to IRS taxes schedule 2025, taxpayers need to be aware of various filing requirements to avoid penalties and stay compliant with the law. One crucial aspect is determining whether you need to file a tax return based on your income, filing status, and age. For tax year 2025, individuals whose income exceeds a certain threshold are generally required to file a federal tax return.

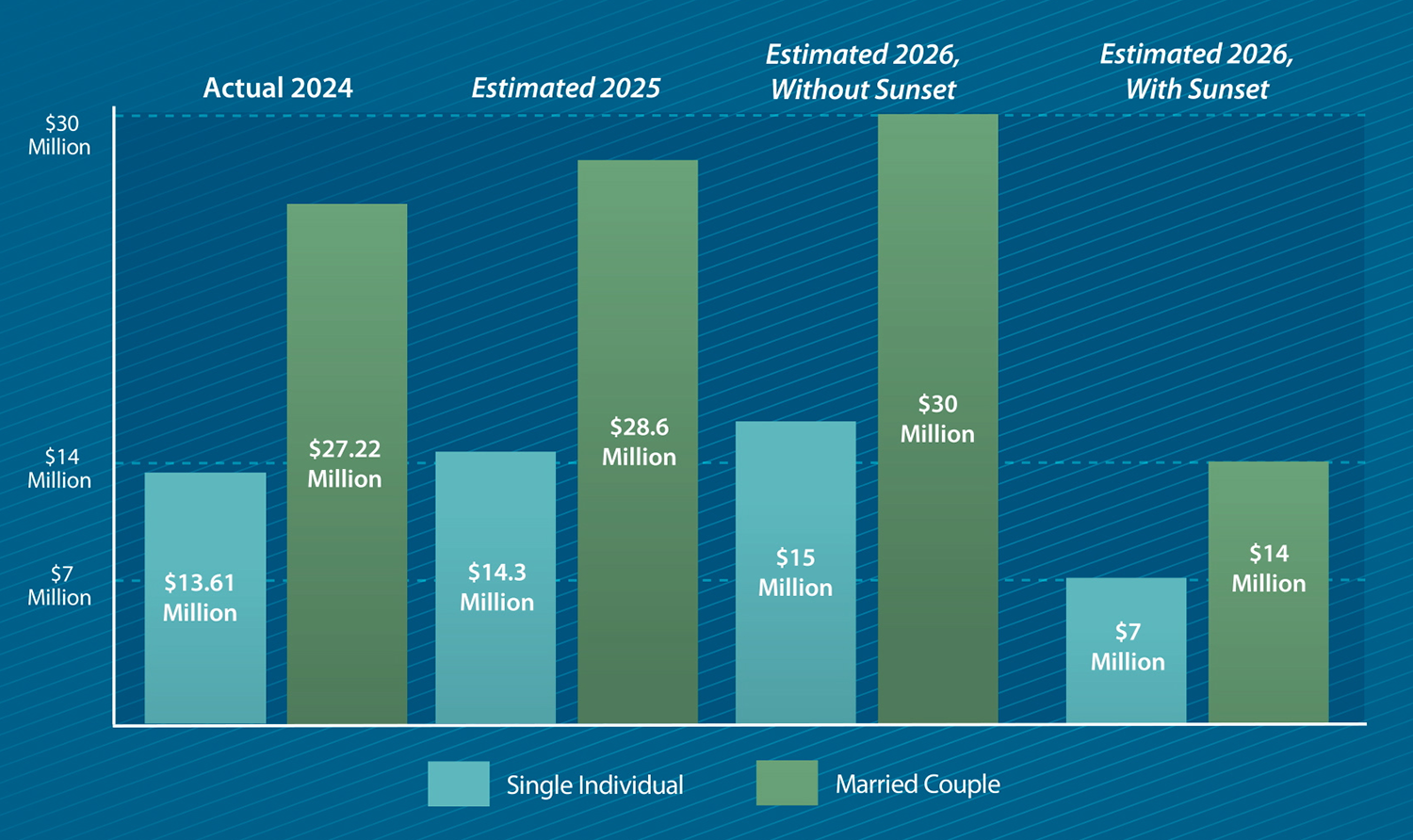

Income Thresholds and Filing Status

IRS taxes schedule 2025 stipulates specific income thresholds that dictate whether you must file a tax return based on your filing status. Different thresholds apply to single filers, married individuals filing jointly, heads of household, and so on. It is essential to understand these thresholds to fulfill your filing obligations accurately.

For the tax year 2025, the income thresholds may vary slightly from the previous year, so be sure to check the latest IRS guidelines to determine your filing requirements.

Deductions and Credits

Claims for deductions and credits can impact your filing requirements and tax liability. Taxpayers eligible for various deductions, such as student loan interest deduction, tuition fees deduction, or credits like the Earned Income Tax Credit, may need to file a return to claim these benefits. Make sure to review the IRS guidelines for deductions and credits to see how they affect your tax return for 2025.

- Educational Credits: Ensure you are aware of the eligibility criteria for educational credits to determine if you need to file a tax return.

- Retirement Savings Contributions: Contributions to retirement accounts may influence your filing requirements, so keep track of these contributions for tax purposes.

Changes and Updates for the Tax Year 2025

As we enter the tax year 2025, there are several significant changes and updates to be aware of regarding IRS taxes schedule 2025.

New Tax Brackets and Rates

The IRS has adjusted the tax brackets and rates for 2025 to account for inflation. Taxpayers should review the new brackets to ensure accurate tax calculations.

Additionally, there are changes to standard deduction amounts which may impact individual tax liability. Consulting with a tax professional is recommended.

Enhanced Child Tax Credit

For the tax year 2025, the Child Tax Credit has been enhanced to provide greater financial support for families with children. Eligibility criteria have been updated to include more families.

- Families may now receive a higher credit amount per child.

- New income thresholds have been established for receiving the full credit.

Tips for Filing Your Taxes on Schedule

Staying organized and prepared is key to filing your IRS taxes schedule 2025 on time. Here are some essential tips to help you meet important dates and deadlines:

Start Early and Gather Documents

Begin gathering necessary documents such as W-2s, 1099s, receipts, and any other relevant paperwork as soon as possible. Having everything in one place will make the process smoother.

Create a Filing Checklist

Develop a checklist of all the forms and information needed for your tax return. This will help ensure you don’t miss any important details and avoid delays.

Set Reminders and Deadlines

Mark important IRS taxes schedule 2025 deadlines on your calendar and set reminders to stay on track. Consider using tax software or enlisting the help of a tax professional for added assistance.

Review Before Submitting

Before submitting your tax return, carefully review all information for accuracy. Double-check calculations and ensure all forms are complete to prevent errors that could lead to delays in processing.

Resources for Assistance and Support

When navigating IRS taxes and schedules for 2025, it’s crucial to have reliable resources for assistance and support. Here are some essential avenues to explore:

IRS Website

Visit the official IRS website for the most up-to-date information on tax schedules and deadlines. Utilize their tools, forms, and publications to ensure compliance.

Local IRS Office

Contact your local IRS office for personalized assistance. They can provide guidance on specific tax issues and even offer in-person support for complex matters.

Online Forums and Communities

Engage with online forums and communities focused on IRS tax schedules 2025. Interacting with peers facing similar challenges can offer valuable insights and practical tips.

Frequently Asked Questions

- What is IRS Taxes Schedule 2025?

- IRS Taxes Schedule 2025 refers to the specific timeline and deadlines set by the Internal Revenue Service for taxpayers to file their taxes for the year 2025.

- What are some important dates to keep in mind for IRS Taxes Schedule 2025?

- There are several important dates and deadlines to remember for IRS Taxes Schedule 2025, such as the deadline for filing federal income tax returns, deadline for filing extensions, and deadlines for estimated tax payments.

- When is the deadline for filing federal income tax returns for IRS Taxes Schedule 2025?

- The deadline for filing federal income tax returns for IRS Taxes Schedule 2025 is typically April 15th, unless it falls on a weekend or holiday, in which case it is moved to the next business day.

- What should I do if I need more time to file my taxes for IRS Taxes Schedule 2025?

- If you need more time to file your taxes for IRS Taxes Schedule 2025, you can file for an extension, which gives you an additional six months to submit your tax return. It is important to note that while an extension gives you more time to file, it does not extend the time to pay any taxes owed.

- Are there any penalties for missing deadlines in IRS Taxes Schedule 2025?

- Yes, there are penalties for missing deadlines in IRS Taxes Schedule 2025. Late filing penalties, late payment penalties, and interest on unpaid taxes may apply if you fail to meet the deadlines set by the IRS.

In Conclusion: Navigating IRS Taxes Schedule 2025

As we come to the end of our guide on IRS Taxes Schedule 2025, it’s crucial to emphasize the importance of staying informed and organized when it comes to your tax obligations. By marking key dates and deadlines on your calendar, you can avoid potential penalties and ensure a smooth tax filing process.

Remember to keep track of quarterly estimated tax payments, extension deadlines, and any changes in tax laws that may impact your filings. Utilize online resources and consulting with tax professionals can go a long way in simplifying the process and maximizing your returns.

With proactive planning and timely action, you can navigate IRS Taxes Schedule 2025 with confidence and peace of mind.