Are you a small business owner or a self-employed individual trying to navigate the complexities of tax filing? Understanding the ins and outs of the 1040 Schedule C is essential for reporting your business income and expenses accurately. So, what is a 1040 Schedule C exactly? In simple terms, the 1040 Schedule C is a form used to report profit or loss from a business you operate as a sole proprietor. This crucial document plays a significant role in determining your taxable income and ultimately, your tax liability. In our blog, “Unveiling the Mysteries of the 1040 Schedule C: Everything You Need to Know,” we delve deeper into this form, providing you with the knowledge and guidance needed to navigate tax season with confidence.

Introduction to the 1040 Schedule C

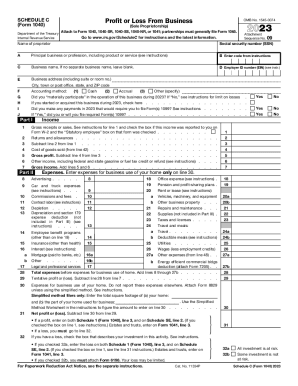

When it comes to filing taxes as a self-employed individual or small business owner, the 1040 Schedule C plays a crucial role. This form is used to report income or loss from a sole proprietorship or single-member limited liability company (LLC). By completing the 1040 Schedule C, you can calculate your net profit or loss, which is then transferred to your personal tax return.

Understanding the Purpose of 1040 Schedule C

For those wondering what a 1040 Schedule C is, it essentially helps in determining the taxable profit of your business. This form allows you to deduct ordinary and necessary business expenses from your revenue to arrive at your net income.

Key Components of 1040 Schedule C

The 1040 Schedule C includes sections where you provide information about your business, such as gross income, various expenses, and deductions. It is vital to accurately fill out each part to ensure compliance with IRS regulations and minimize tax liabilities.

- Income: Report all income earned through your business activities.

- Expenses: Deductible expenses like supplies, utilities, and travel costs should be listed.

- Profit or Loss: Calculate the net profit or loss for the year based on the data provided.

Importance of Filing a 1040 Schedule C

Filing a 1040 Schedule C is crucial for self-employed individuals and small business owners as it allows them to report their business income and expenses to the IRS. This form is used to calculate the net profit or loss of the business, which ultimately impacts the amount of taxes owed or refunded.

Maximizing Deductions

By accurately completing a 1040 Schedule C, taxpayers can take advantage of various deductions and credits available to businesses. These deductions can significantly lower the taxable income, resulting in lower tax liabilities.

Moreover, keeping detailed records of business expenses throughout the year can help in claiming all eligible deductions on the Schedule C.

Compliance with IRS Regulations

Failure to file a 1040 Schedule C when required can lead to penalties and audits by the IRS. Staying compliant with IRS regulations is essential for avoiding legal issues and maintaining the integrity of your business.

By accurately reporting your business income and expenses on Schedule C, you demonstrate transparency and accountability to the IRS.

Understanding the Components of Form 1040 Schedule C

Form 1040 Schedule C is a tax form used by sole proprietors to report their business income and expenses to the IRS. It is a crucial document for those who are self-employed or operate a small business. By filling out Schedule C, individuals can determine their net profit or loss from their business activities.

Income Section

The first part of Schedule C focuses on reporting business income, including sales, services, and any other sources. Businesses need to list all income generated during the tax year.

Expenses Section

This section allows businesses to determine their deductible expenses that can be used to offset their income. Expenses such as supplies, rent, utilities, and other necessary costs are included here.

Here is the general flow for reporting expenses on Schedule C:

- Begin with the total amount of all expenses.

- Subtract any non-deductible expenses.

- Add back any expenses not included in the total.

- Calculate the final amount of deductible business expenses.

Steps to Fill Out a 1040 Schedule C

Filing a 1040 Schedule C is essential for self-employed individuals and small business owners to report their income and expenses accurately. To complete the form correctly, follow these step-by-step instructions:

Gather Necessary Documents

Collect all relevant financial records, including receipts, invoices, and bank statements for the tax year 2022.

Fill Out Personal Information

Enter your personal details, such as name, address, Social Security number, and filing status, in the designated sections.

Report Business Income

List your total business income in the appropriate section, including any income from services, sales, or other sources.

Calculate Business Expenses

Deduct qualified business expenses, such as supplies, rent, utilities, and insurance, from your total income to determine your net profit.

Complete the Schedule C Form

Transfer the calculated net profit or loss to the Schedule C form and ensure all sections are accurately filled out.

Tips for Maximizing Deductions on Schedule C

When it comes to maximizing deductions on your 1040 Schedule C, there are several strategies you can employ to ensure you are taking full advantage of all available tax benefits.

Keep Accurate Records

One of the key tips for maximizing deductions is to keep detailed and accurate records of all your business expenses throughout the year. This will make it easier to identify potential deductions come tax season.

Remember, what is a 1040 Schedule C focuses on the profits and losses of your business, so having organized records is crucial.

Claim all Allowable Expenses

Be sure to claim all allowable expenses on your Schedule C. This includes deductions for items such as office supplies, advertising, travel, and utilities related to your business.

Reviewing and ensuring you have claimed all legitimate expenses can significantly reduce your taxable income.

Take Advantage of Home Office Deduction

If you work from home, don’t forget to take advantage of the home office deduction. This deduction allows you to claim expenses related to the business use of your home, such as a portion of your rent or mortgage interest, utilities, and home insurance.

By accurately calculating and claiming this deduction, you can further reduce your taxable income.

Common Mistakes to Avoid When Filing a 1040 Schedule C

When filing a 1040 Schedule C, it’s essential to be aware of common mistakes that can potentially lead to issues or audits. Understanding these pitfalls can help you navigate the process smoothly and accurately.

Incorrect Reporting of Income

One common mistake is failing to report all income earned through your business accurately. This can include forgetting to include income from freelance work, consulting services, or any other sources of revenue related to your business.

Improper Expense Documentation

Another mistake to avoid is inadequate documentation of business expenses. Without proper records, you risk inaccurately claiming deductions, which can raise red flags during an audit.

Ensure you keep detailed records, receipts, and invoices to support your claimed business expenses.

Failure to Understand Tax Deductions

Many filers often miss out on valuable tax deductions available to them. It’s essential to familiarize yourself with the deductions specific to your business type to maximize your tax savings.

Consulting with a tax professional can also help ensure you are taking advantage of all eligible deductions.

:max_bytes(150000):strip_icc()/Term-l-losscarry-forward_Final-7d7cf6e694dd4a84bad7267015a542d3.png)

Benefits of Keeping Accurate Records for Schedule C

Keeping accurate records for Schedule C can benefit sole proprietors in various ways. Let’s explore some key advantages:

Maximizing Deductions

By maintaining detailed and precise records of all business expenses, a sole proprietor can accurately track and claim eligible deductions on their Schedule C, thereby reducing their taxable income significantly.

Evidence in Case of an Audit

Thorough record-keeping serves as solid evidence of all financial transactions, which can be crucial in case of an IRS audit. Having organized records can help defend the business owner’s deductions and prevent penalties.

Facilitating Financial Planning

Accurate records provide valuable insights into the financial health of the business. This information can be used for strategic planning and decision-making, enabling the owner to identify opportunities for growth and optimize profitability.

Resources for Assistance with Completing a 1040 Schedule C

When it comes to completing a 1040 Schedule C, there are various resources available to help navigate the process. One valuable resource is seeking assistance from certified tax professionals or accountants. These experts can provide personalized guidance based on individual circumstances.

IRS Website

For the most up-to-date and official information on filling out a 1040 Schedule C, the IRS website is an invaluable resource. Here, you can find detailed instructions, forms, publications, and FAQs related to self-employment income and deductions.

Tax Software Programs

Utilizing reliable tax software programs like TurboTax or H&R Block can simplify the process of completing a 1040 Schedule C. These platforms provide step-by-step guidance, automated calculations, and error checks to ensure accuracy.

- Include relevant business income and expenses

- Calculate deductions and credits

- Generate the necessary forms

Frequently Asked Questions

- What is Schedule C?

- Schedule C is a form used by sole proprietors to report their business income and expenses to the IRS. It is part of the regular Form 1040 tax return.

- Who is required to file a Schedule C?

- Individuals who operate a business as a sole proprietor must file a Schedule C if their business generated a profit or a loss during the tax year.

- What kind of information is reported on Schedule C?

- On Schedule C, taxpayers report their business income, expenses, and deductions. This form is crucial in determining the net profit or loss for the business.

- Can I deduct business expenses on Schedule C?

- Yes, business expenses such as office supplies, advertising costs, utilities, and other necessary expenses related to running the business can be deducted on Schedule C.

- What if my business didn’t make a profit?

- If your business operated at a loss during the tax year, you can use that loss to offset other income on your tax return, which may help reduce your overall tax liability.

In Conclusion: Decoding the 1040 Schedule C

Understanding the complexities of the 1040 Schedule C is crucial for self-employed individuals and small business owners. This form serves as the gateway to reporting business profits and losses to the IRS, impacting your tax obligations significantly. By demystifying the 1040 Schedule C in our blog, we have shed light on its importance, requirements, and key components. Remember, accurate record-keeping and meticulous documentation are the foundations for completing this form correctly. Stay informed, seek professional guidance when needed, and empower yourself with the knowledge to navigate the tax season confidently. Embrace this opportunity to optimize your business finances and ensure compliance with tax regulations.