When diving into the world of tax returns, one might come across the term “Schedule A” – but what exactly is it? Schedule A is a crucial component of your tax filing that allows you to itemize your deductions, potentially reducing your taxable income. This schedule is used for reporting expenses such as medical costs, charitable donations, mortgage interest, and state and local taxes paid. Understanding Schedule A can help taxpayers maximize their deductions and minimize their tax liability. Join us as we delve deeper into the intricacies of Schedule A and learn how to leverage it to your advantage this tax season.

Overview of Tax Returns

When dealing with tax returns, understanding what is a Schedule A is crucial for taxpayers. This schedule, also known as Form 1040 Schedule A, is used by individuals who want to itemize their deductions rather than taking the standard deduction. By itemizing deductions through Schedule A, taxpayers can potentially reduce their taxable income, leading to lower tax liabilities.

Importance of Schedule A

For individuals with significant deductible expenses such as mortgage interest, medical expenses, state and local taxes, and charitable contributions, Schedule A provides a way to maximize tax savings. By carefully documenting and reporting these expenses, taxpayers can potentially lower their tax bill.

How to Fill Out Schedule A

Filling out Schedule A requires attention to detail and accurate record-keeping. Taxpayers need to gather all relevant documents and receipts that support their itemized deductions. These deductions are categorized into different sections on the form, and each section may have specific requirements for documentation. It’s essential to follow the instructions provided with Schedule A to ensure accurate reporting.

- Include expenses such as medical and dental costs, taxes, interest, and charitable contributions.

- Ensure that the total itemized deductions exceed the standard deduction for your filing status.

- Double-check all calculations and input to avoid errors that could lead to tax penalties or audits.

Understanding Schedule A

When it comes to tax returns, Schedule A plays a crucial role in determining your itemized deductions, potentially reducing your taxable income. Schedule A, also known as “Itemized Deductions,” is a form attached to your Form 1040 that allows you to list your eligible expenses that can be deducted from your gross income. This form is especially beneficial for individuals who have higher expenses in certain categories than the standard deduction offered by the IRS.

Importance of Schedule A

By utilizing Schedule A, taxpayers can benefit from deductions related to medical expenses, state and local taxes, mortgage interest, charitable contributions, and other qualifying expenses. These deductions can lead to significant tax savings, especially for individuals who have considerable expenses in these categories.

Understanding which expenses qualify for itemized deductions and maintaining accurate records throughout the year are essential steps in maximizing the benefits of Schedule A.

How to Fill Out Schedule A

To fill out Schedule A correctly, you need to gather all relevant documentation, such as receipts, invoices, and statements, to support your itemized deductions. Follow the instructions provided by the IRS carefully and ensure that you accurately report each expense in the corresponding category.

- Medical Expenses: Include eligible medical and dental expenses that exceed a certain percentage of your adjusted gross income.

- State and Local Taxes: Report state income taxes, property taxes, and other local taxes paid during the tax year.

- Mortgage Interest: Enter the amount of mortgage interest paid on your primary residence and any second homes.

- Charitable Contributions: Document donations made to qualified charities, including cash contributions and donated goods.

Benefits of Using Schedule A

When it comes to tax returns, utilizing Schedule A can offer numerous advantages. This form allows taxpayers to itemize their deductions, potentially resulting in lower taxable income and increased tax savings.

Maximizing Deductions

By using Schedule A, individuals can maximize their deductions by including expenses such as medical and dental costs, state and local taxes, mortgage interest, and charitable donations.

Additionally, deductions for unreimbursed job expenses, investment interest, and casualty or theft losses can also be claimed, further reducing taxable income.

Reducing Taxable Income

Through itemizing deductions on Schedule A, taxpayers can potentially lower their taxable income significantly, leading to a lower tax liability and possibly resulting in a higher refund.

It is essential to gather and organize all relevant documentation to ensure accurate reporting and maximize the benefit of these deductions.

Common Deductions on Schedule A

When filing your tax returns, **Schedule A** is crucial for itemizing deductions. This form allows you to deduct various expenses to reduce your taxable income, providing potential savings. Understanding the common deductions on **Schedule A** can help you maximize your savings. Below are some deductions you should consider:

Mortgage Interest

Deducting mortgage interest on your primary or secondary residence is a significant benefit. This deduction includes not only the interest on your home loan but also **mortgage insurance premiums** in some cases.

State and Local Taxes

You can deduct **state and local income taxes** or **sales taxes**, whichever benefits you more, as well as property taxes paid on real estate. These deductions are valuable for reducing your tax liability.

Charitable Contributions

Donating to qualified charitable organizations allows you to deduct the **value of your contributions**. Whether you donate cash, goods, or services, make sure to keep detailed records for tax purposes.

Medical Expenses

You can deduct **qualifying medical expenses** that exceed a certain percentage of your adjusted gross income. This includes healthcare costs, prescription medications, and medical services.

How to Fill Out Schedule A

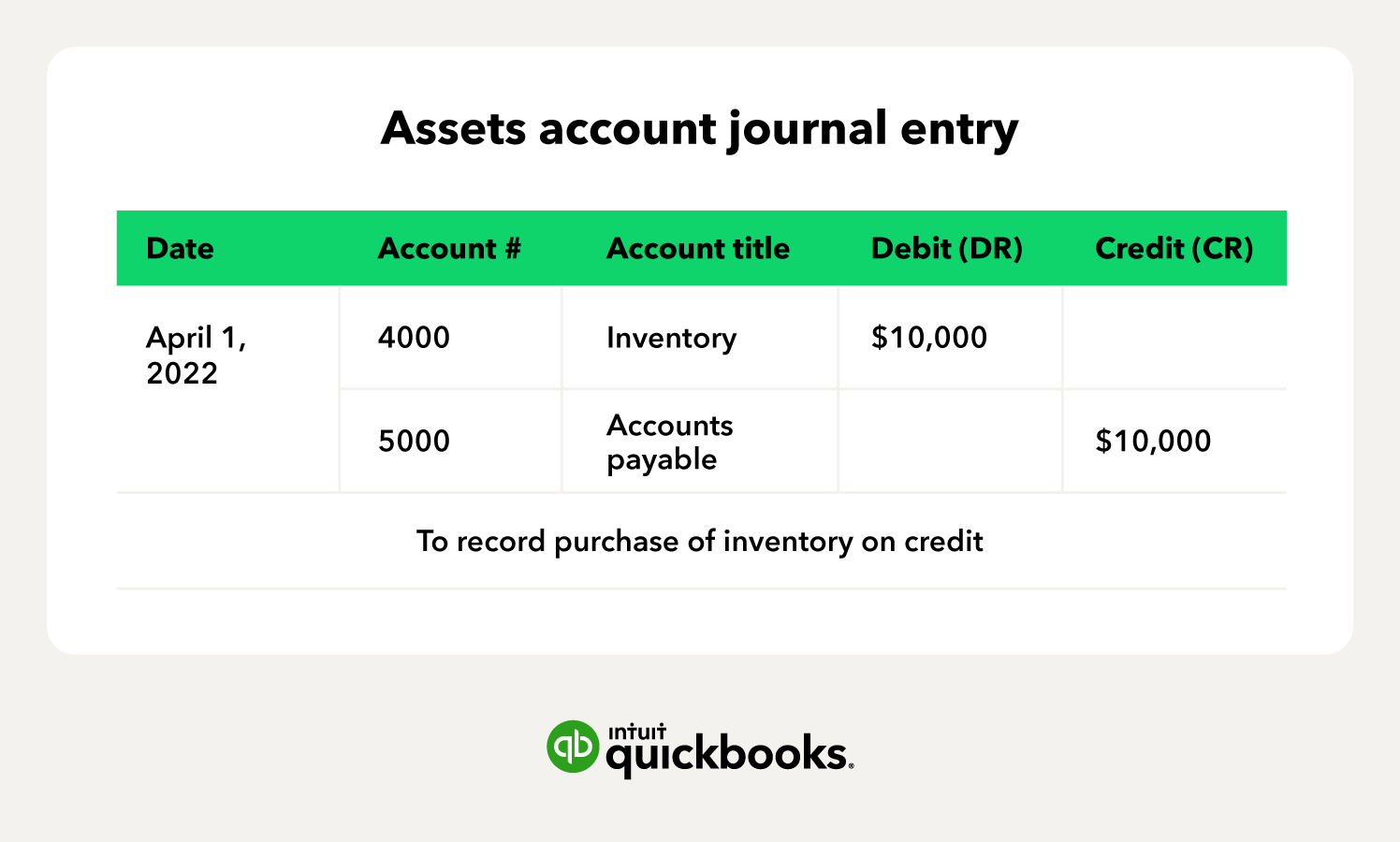

For those wondering what is a schedule a for tax returns, Schedule A is used by taxpayers to report their itemized deductions on their tax returns. To fill out Schedule A correctly, you need to gather all the necessary documentation to support your deductions.

Gather Supporting Documents

Before you start filling out Schedule A, make sure you have all the relevant documents such as receipts, invoices, and statements that support your itemized deductions. These may include expenses related to medical and dental care, state and local taxes, mortgage interest, and charitable contributions.

Complete the Form

Once you have all your supporting documents in hand, you can begin filling out Schedule A. Include the total amount for each deduction category in the appropriate lines on the form. Make sure to follow the instructions provided by the IRS carefully to avoid errors.

- Enter your medical and dental expenses.

- Report state and local taxes paid.

- Include mortgage interest and points.

- Document charitable contributions.

Frequently Asked Questions

- What is Schedule A for tax returns?

- Schedule A is a form used by taxpayers in the United States to itemize their deductions. It allows taxpayers to deduct certain expenses from their taxable income, potentially reducing the amount of tax owed.

- What kind of expenses can be included on Schedule A?

- Expenses that can be included on Schedule A typically involve medical expenses, state and local taxes, mortgage interest, charitable contributions, and certain miscellaneous deductions. It is important to ensure these expenses meet the IRS requirements for deduction.

- Is it better to take the standard deduction or itemize with Schedule A?

- The decision to take the standard deduction or itemize with Schedule A depends on the total amount of qualifying expenses you have. If your itemized deductions total more than the standard deduction amount, it may be beneficial to itemize using Schedule A.

- How do I fill out Schedule A?

- To fill out Schedule A, you will need to gather all supporting documents for your deductible expenses. You will then follow the instructions provided on the form and report each category of deductions separately. Make sure to keep accurate records in case of an IRS audit.

Unlocking the Mystery: Decoding Schedule A for Tax Returns

As we conclude our journey into the realm of tax returns and Schedule A, it becomes evident that this form plays a crucial role in itemizing deductions for millions of taxpayers. Understanding what Schedule A is for tax returns is like gaining access to a treasure trove of potential tax savings. By itemizing expenses such as medical costs, charitable donations, and mortgage interest, taxpayers can significantly reduce their taxable income. So, the next time you file your taxes, remember the power of Schedule A and how it can impact your financial bottom line. Dive into the details, keep your receipts organized, and unlock the savings waiting for you!