Understanding the DCF payment schedule for 2025 is crucial for businesses and individuals alike. This comprehensive guide delves into the intricacies of the DCF payment schedule 2025, shedding light on its significance and impact. As we navigate through the complexities of financial planning and projections, having insights into the DCF payment schedule can provide a competitive edge and strategic advantage. By unlocking the secrets of the DCF payment schedule 2025, we can make informed decisions, optimize cash flows, and achieve financial goals effectively. Join us on this journey to unravel the mysteries behind the DCF payment schedule for the year 2025.

Introduction to DCF Payment Schedule

Understanding the DCF Payment Schedule is crucial for businesses striving for financial clarity and stability in 2025. The DCF, or Discounted Cash Flow, Payment Schedule outlines the expected future cash inflows and outflows associated with an investment, project, or business. By discounting these cash flows back to their present value, organizations can make informed decisions regarding potential investments or projects.

Key Components of DCF Payment Schedule

The DCF Payment Schedule consists of various components that include projected cash flows, the discount rate used for calculations, and the terminal value. These elements collectively determine the net present value (NPV) of the investment.

The future cash flows need to be estimated accurately to ensure the reliability of the DCF analysis. This involves predicting revenues, expenses, and any other financial implications over the specified time horizon.

Importance of DCF Payment Schedule in Financial Planning

DCF Payment Schedule 2025 plays a crucial role in financial planning and decision-making for businesses. It provides a structured approach to evaluating the feasibility and profitability of potential investments, guiding organizations towards making sound financial choices.

By incorporating the time value of money and considering the risk associated with future cash flows, the DCF Payment Schedule enables companies to assess the true value of an investment opportunity, leading to more informed strategies and improved financial performance.

Understanding the DCF Payment Schedule 2025

When it comes to comprehending the DCF Payment Schedule in 2025, it is crucial to analyze how this schedule impacts financial planning and cash flow projections for the upcoming year. It provides a structured outline of the expected payments over the course of 2025, enabling businesses to forecast their financial obligations accurately.

Importance of DCF Payment Schedule

The DCF Payment Schedule for 2025 plays a significant role in budgeting and decision-making processes for companies. By outlining the precise timings and amounts of cash inflows and outflows, organizations can strategically allocate resources and manage their liquidity effectively.

Key Elements of DCF Payment Schedule 2025

The DCF Payment Schedule for 2025 includes details such as projected revenues, expenses, and anticipated cash flows month by month. By examining these components, businesses can identify trends, plan for contingencies, and optimize their financial performance in the upcoming year.

- Projected revenues and income streams

- Anticipated expenses and financial obligations

- Cash flow projections for each month

Key Components of the DCF Payment Schedule 2025

When it comes to understanding the DCF Payment Schedule for the year 2025, it is crucial to grasp the key components that drive the process. The DCF Payment Schedule 2025 consists of several important elements that determine how payments are calculated and distributed.

Forecasted Cash Flows

The forecasted cash flows play a pivotal role in the DCF Payment Schedule for 2025. This involves projecting the expected cash inflows and outflows for the upcoming year, which are essential for determining the payment amounts.

The accuracy of these forecasts is critical to ensure that the payment schedule aligns with the financial realities of the organization.

Discount Rate

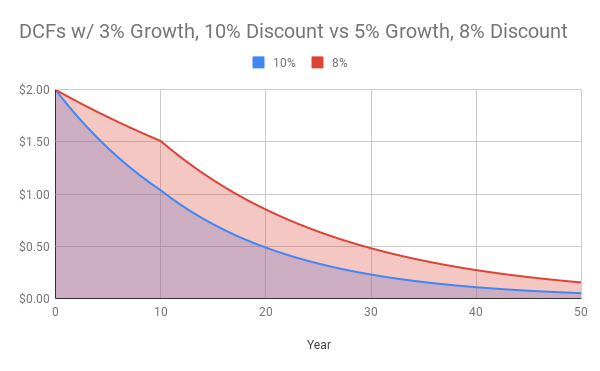

The discount rate used in the DCF Payment Schedule 2025 is another vital component. This rate is applied to the future cash flows to determine their present value, taking into account factors such as inflation and the time value of money.

It is imperative to use an appropriate discount rate to accurately assess the value of future cash flows and calculate the payment schedule accordingly.

Changes and Updates in the DCF Payment Schedule 2025

As we delve into the intricacies of the DCF Payment Schedule for the year 2025, it is crucial to stay abreast of the latest changes and updates that may impact stakeholders.

New Payment Structure Implemented

One significant change in the DCF Payment Schedule for 2025 is the introduction of a new payment structure that aims to streamline the disbursement process and enhance transparency.

This bold move is designed to ensure that funds are allocated efficiently and reach the intended beneficiaries promptly.

Revised Payment Deadlines

Another key update pertains to the revised payment deadlines outlined in the DCF Payment Schedule 2025.

It is crucial for recipients to anticipate these deadlines and adhere to the timelines to avoid any delays or disruptions in payment processing.

- Increased Flexibility in Payment Options

- Enhanced Security Measures Implemented

Benefits of Following the DCF Payment Schedule 2025

Following the DCF Payment Schedule 2025 offers several key advantages for individuals and organizations alike. By adhering to the prescribed payment timeline, stakeholders can ensure financial stability and predictability. This can help in effective budget planning and resource allocation.

Enhanced Financial Planning

Adhering to the DCF Payment Schedule 2025 enables better financial planning opportunities. The structured payment timelines provide clarity, allowing for more accurate forecasting of cash flow and expenses.

Improved Creditworthiness

Consistently following the DCF Payment Schedule 2025 can enhance creditworthiness. Timely payments showcase financial responsibility and reliability, which can positively impact credit scores and relationships with lenders.

Implementation Strategies for the DCF Payment Schedule 2025

When it comes to implementing the DCF Payment Schedule 2025, businesses need to strategically plan for the upcoming changes. One of the key strategies is to stay updated with the latest guidelines and regulations set forth by the authorities to ensure compliance and efficiency in payment processes.

Utilize Payment Management Software

Implementing payment management software can streamline the DCF Payment Schedule 2025 process, enabling businesses to schedule and track payments effectively. Utilizing automation features can reduce errors and processing time, ensuring timely payments.

Training and Education

Conducting training sessions to educate employees on the new payment schedule is crucial for successful implementation. Providing comprehensive training materials and resources can help employees adapt to the changes seamlessly.

Regular Compliance Audits

Performing regular compliance audits can help businesses identify any discrepancies or issues in their payment processes. By conducting audits, organizations can ensure that they are adhering to the DCF Payment Schedule 2025 guidelines.

Frequently Asked Questions

- What is DCF payment schedule 2025?

- The DCF payment schedule 2025 is a structured plan detailing the dates and amounts of payments to be made in the year 2025.

- Why is understanding the DCF payment schedule important?

- Understanding the DCF payment schedule is crucial for individuals and organizations to plan their finances effectively and ensure timely payments.

- How can one access the DCF payment schedule 2025?

- The DCF payment schedule 2025 can often be accessed through official channels such as government websites or financial institutions involved in the payments.

- Are there any significant changes in the DCF payment schedule for 2025?

- It is important to review the DCF payment schedule for 2025 as there may be changes in payment amounts, due dates, or other key details compared to previous years.

- What factors can affect the DCF payment schedule 2025?

- Various factors such as economic conditions, policy changes, and regulations can impact the DCF payment schedule for 2025, leading to potential adjustments.

Unlocking the Secrets of the DCF Payment Schedule 2025

Final Thoughts

As we delve into the intricacies of the DCF payment schedule for 2025, it becomes evident that understanding this system is crucial for financial planning and decision-making. By decoding the complexities of DCF calculations and schedules, individuals and businesses can make informed choices to optimize their cash flows and investments effectively. It is clear that the DCF payment schedule for 2025 carries significant implications for budgeting, forecasting, and investment strategies. Embracing this knowledge empowers us to navigate the financial landscape with confidence and foresight, unlocking opportunities for growth and stability in the years ahead.