As we delve into the intricacies of tax planning and financial forecasting, understanding the 2025 IRS payment schedule becomes paramount. The IRS payment schedule for 2025 lays out the timeline and structure for tax payments, encompassing crucial dates and details that taxpayers must be well-versed in. By decoding this schedule, individuals can streamline their financial strategies, ensure timely payments, and avoid potential penalties. In this blog, we will navigate through the key components of the 2025 IRS payment schedule, shedding light on what taxpayers need to know to effectively manage their tax obligations and plan ahead for a financially secure future.

Slay your taxes now and get your refund as early as 21 days after your return is accepted! Check out the IRS refund schedule for the full list of dates: https://t.co/RSQ05gajcz pic.twitter.com/W6on8zG8Hc

— TaxSlayer (@TaxSlayer) March 8, 2024

Understanding the 2025 IRS Payment Schedule

When it comes to managing your finances, understanding the 2025 IRS payment schedule is crucial. The schedule outlines the dates and deadlines for various tax-related payments and filings throughout the year. Staying informed about these key dates can help you avoid penalties and ensure compliance with IRS regulations.

Key Dates to Remember

One important date to keep in mind is the deadline for filing your federal income tax return, which is typically on April 15th each year. However, in 2025, since April 15th falls on a weekend, the deadline may be extended to the following business day. It’s essential to double-check the exact deadline each year to avoid any confusion.

Another critical date is the deadline for making quarterly estimated tax payments. These payments are typically due on the 15th day of April, June, September, and January. Missing these deadlines can result in penalties, so it’s essential to mark these dates on your calendar.

Payment Methods and Options

Electronic Payments: The IRS offers various electronic payment options, including credit card payments, direct debit, and online payment agreements. These methods are convenient, secure, and can help you avoid missing payment deadlines.

Check Payments: If you prefer to pay by check, make sure to send your payment well in advance of the due date to account for processing and mailing time. Always double-check the payment address to ensure it reaches the correct IRS office.

Key Dates and Deadlines for Tax Payments

Staying informed about the 2025 IRS payment schedule is crucial for timely tax payments. Knowing the key dates and deadlines can prevent any potential penalties or interest charges.

January 15, 2025 – Estimated Tax Deadline

Self-employed individuals and those with other forms of income not subject to withholding must make their fourth estimated tax payment for 2024 by this date.

This deadline is essential for avoiding underpayment penalties. Make sure to submit your payment on time to the IRS.

April 15, 2025 – Tax Filing Deadline

On this day, individual tax returns for the 2024 tax year are due. Make sure to file your taxes by this deadline to avoid late filing penalties.

- Deadline Extension: If you need more time to file, you can request an extension, but remember that this does not extend the deadline for payment.

Changes and Updates for 2025

As we head into 2025, the IRS has announced significant changes to the payment schedule that taxpayers need to be aware of. Staying informed about these updates is crucial to ensuring smooth tax processing and compliance.

Extended Deadlines

In 2025, the IRS has extended certain tax deadlines to provide taxpayers with more time to meet their obligations. This extension reflects the ongoing changes in the tax landscape and aims to reduce the burden on taxpayers.

Taxpayers should take note of these new deadlines and plan their finances accordingly to avoid any penalties or late fees. It is essential to stay updated with the latest information from the IRS.

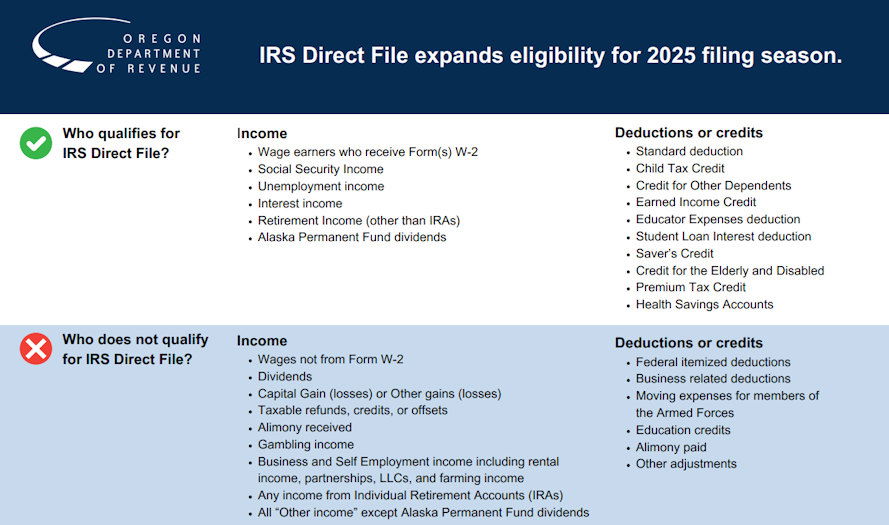

Enhanced Online Services

With the advancement of technology, the IRS has introduced enhanced online services for taxpayers in 2025. These services aim to streamline the tax filing process and provide a more user-friendly experience. taxpayers can now access a wide range of tools and resources online to help them file their taxes more efficiently.

- Online tax calculators

- Virtual assistance for tax-related queries

- Secure document upload portals

How to Prepare for Your IRS Payments

When it comes to managing your IRS payments in the year 2025, it’s crucial to stay organized and proactive. By following these steps, you can ensure that your payments are made on time and accurately, avoiding any potential penalties or issues with the IRS.

Evaluate Your Payment Schedule

Start by reviewing the 2025 IRS payment schedule to understand when your payments are due. Note down the deadlines and mark your calendar to avoid missing any payments. It’s essential to stay informed about the specific dates to prevent delays.

Prepare Your Payment Documentation

Gather all the necessary documentation related to your payments, including tax forms, receipts, and any other supporting documents. Organize them in a secure folder or file to ensure easy access when needed. Keeping your records updated will help streamline the payment process.

Set Up Payment Reminders

Utilize technology to set up payment reminders on your phone or computer. You can also enable automatic reminders through your banking app to prompt you before payment due dates. Staying proactive with reminders will help you stay on track with your IRS payments.

Tips for Managing Your Tax Payments Efficiently

Managing tax payments efficiently is crucial to avoid potential penalties and ensure financial stability. Here are some useful tips to help you stay on top of your tax obligations:

1. Set Reminders

Use a calendar or a tax payment reminder app to mark important deadlines for tax payments. This will help you stay organized and avoid missing any payment due dates.

2. Budget Wisely

Creating a budget that includes provisions for tax payments can help you allocate funds accordingly. Be sure to set aside money regularly to cover your tax liabilities.

Additionally, consider setting up automatic transfers to a separate savings account designated for tax payments.

3. Seek Professional Help

If you find tax management overwhelming, consider hiring a tax professional or accountant. They can provide valuable guidance on tax planning, help you streamline your tax payments, and ensure compliance with tax laws.

Frequently Asked Questions

- What is the 2025 IRS Payment Schedule?

- The 2025 IRS Payment Schedule refers to the timetable set by the Internal Revenue Service for making payments or receiving refunds for taxes due in the year 2025.

- How can I unlock the 2025 IRS Payment Schedule?

- To access the 2025 IRS Payment Schedule, you can visit the official IRS website or consult with a tax professional who can provide you with the relevant information.

- What important details do I need to know about the 2025 IRS Payment Schedule?

- Some key details to know about the 2025 IRS Payment Schedule include payment deadlines, refund processing times, and any changes in tax laws that may affect your payments or refunds.

- Are there any changes in the 2025 IRS Payment Schedule compared to previous years?

- The IRS Payment Schedule can vary from year to year based on legislative changes, economic factors, and other variables. It’s important to stay informed about any updates or revisions to the payment schedule for the year 2025.

- How can I ensure I stay compliant with the 2025 IRS Payment Schedule?

- To remain compliant with the 2025 IRS Payment Schedule, make sure to meet deadlines for filing taxes, making payments, and providing accurate information to the IRS. Consulting with a tax advisor can also help you navigate any complexities in the schedule.

Unlocking the 2025 IRS Payment Schedule: Key Takeaways

Understanding the 2025 IRS payment schedule is crucial for effective financial planning. By delving into the details of the payment schedule, taxpayers can anticipate their obligations and streamline their budgeting process. Keeping track of important deadlines and being aware of any potential changes can help avoid penalties and ensure compliance with IRS regulations. Remember to leverage online resources and tools provided by the IRS for accurate information and updates. Stay informed, stay organized, and stay ahead by unlocking the intricacies of the 2025 IRS payment schedule.