Are you eagerly awaiting your state refund in 2025? The newly unveiled state refunds 2025 schedule is here to help you plan ahead and mark your calendar. This schedule provides valuable insights into when you can expect to receive your refund, allowing you to better manage your finances and budget effectively. By staying informed about the state refunds 2025 schedule, you can avoid any surprises and ensure a smoother tax season experience. Let’s dive into the details of this schedule and understand how it can benefit you in preparing for your upcoming state refund. Get ready to take charge of your finances with the state refunds 2025 schedule!

In the past few days, we have made significant progress on processing Tax Year 2023 returns. As of 2/21, we have processed 382,983 returns and sent approximately 209k refunds. It is currently taking between 7 and 10 business days to process returns, with an additional two or… pic.twitter.com/S0qiO17JHn

— Comptroller of Maryland (@MDComptroller) February 21, 2024

Introduction: Understanding the Importance of State Refunds

State refunds play a crucial role in the financial well-being of individuals and families, offering a much-needed boost to their budgets. As the year 2025 approaches, it’s essential to familiarize yourself with the state refunds 2025 schedule to plan ahead effectively. Whether you are anticipating a tax refund or a specific state benefit, being aware of the schedule can help you manage your finances more efficiently.

The Benefits of State Refunds

Receiving a state refund can provide financial relief, allowing you to cover essential expenses, save for the future, or indulge in a small luxury. Planning how to utilize your state refund wisely can help you achieve your financial goals and build a more secure financial foundation.

Strategic Financial Planning

By understanding the state refunds 2025 schedule, you can strategically plan your finances to maximize the benefits of your refund. Creating a budget or setting aside funds for specific goals can ensure that you make the most of your refund when it arrives.

Overview of State Refunds 2025 Schedule

Planning ahead for your finances is crucial, and knowing the schedule for state refunds in 2025 can help you better manage your budget. The State Refunds 2025 Schedule has been unveiled, so mark your calendar now to ensure you don’t miss out on important deadlines.

Key Dates to Remember

For taxpayers eagerly awaiting their state refunds in 2025, here are some key dates to remember:

- March 15, 2025: Deadline for filing state tax returns to be eligible for the earliest refunds.

- April 30, 2025: Last day to submit state tax returns for timely processing of refunds.

- May 30, 2025: Anticipated date for the release of the first batch of state refunds.

Maximizing Your State Refund

While waiting for your state refund, consider these tips to maximize your financial gain:

- File Early: Submitting your tax returns early can expedite the refund process.

- Direct Deposit: Opt for direct deposit to receive your refund faster and securely.

- Use Refund Wisely: Consider saving or investing your refund for future financial stability.

Key Dates and Deadlines to Remember

For those eagerly awaiting their state refunds in 2025, it is crucial to mark your calendars with the key dates and deadlines to ensure a smooth refund process. Familiarizing yourself with the schedule will help you stay organized and prepared for any important submissions or updates required.

Submission Deadline

One of the most critical dates to remember is the submission deadline for your state tax refund. Ensure you file your taxes accurately and promptly to avoid any delays in receiving your 2025 state refunds. Stay informed about any changes or extensions announced by the department of revenue.

Expected Refund Arrival

Understand the anticipated timeframe for your state refunds in 2025 to manage your finances effectively. Typically, refunds are processed within a certain number of weeks after filing, so plan your budgeting accordingly to accommodate the refund amount.

How to Check Your Refund Status

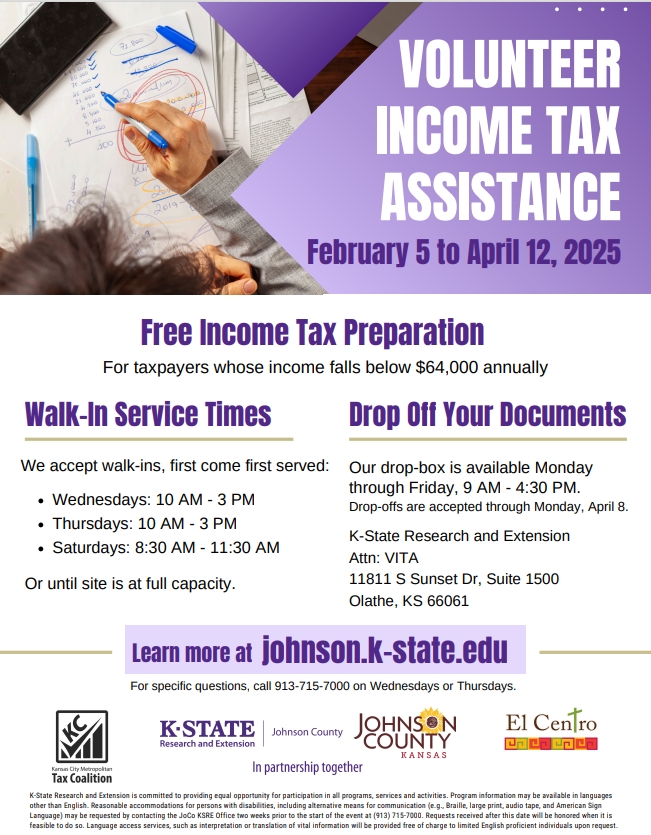

If you’re eagerly awaiting your state refunds 2025 schedule, it’s important to know how to check your refund status for this year. The process is relatively simple and can provide you with peace of mind knowing when to expect your refund.

Online Refund Status Check

To check your refund status online, visit the official website of your state’s tax department. Look for the section dedicated to refunds or a specific tool to track your refund. Enter your 2025 tax year information, including your Social Security Number and refund amount to get real-time updates.

Using Mobile Apps

Many states now offer mobile apps for taxpayers to conveniently check their refund status on the go. Download the official tax department app from the app store, log in with your credentials, and navigate to the refund status section. Stay updated on your state refunds 2025 schedule easily through your smartphone.

Tips for Maximizing Your State Refund

Are you looking to make the most of your state refund for the year 2025? Here are some essential tips to help you maximize your return:

1. File Early

Submitting your tax return early can expedite the refund process, ensuring you receive your money sooner rather than later.

Make sure all your documents are in order and file well ahead of the deadline to avoid any delays.

2. Claim All Deductions

Take advantage of all available deductions to lower your taxable income and increase your refund amount.

Be sure to include deductions for education expenses, charitable donations, and medical costs, among others.

3. Utilize Tax Credits

Explore eligible tax credits such as the Earned Income Tax Credit (EITC) or Child Tax Credit to reduce your tax liability.

These credits can directly lower the amount of tax you owe and potentially result in a larger refund.

Common FAQs about State Refunds

As the state refunds 2025 schedule has been unveiled, it’s essential to be informed about the process to ensure timely receipt of your refund. Here are some common FAQs that can help you prepare for the upcoming refund season:

When can I expect to receive my state refund?

State refunds for the tax year 2025 are scheduled to be issued starting from mid-May 2025. The exact timing may vary based on factors such as the method of filing and any discrepancies in the return.

How can I track the status of my state refund?

You can track the status of your state refund by visiting the official state tax department website and entering your social security number and refund amount. Alternatively, you can call the state tax department’s refund hotline for updates.

What should I do if there is a delay in receiving my state refund?

If you experience a delay in receiving your state refund, you should first check the status online or contact the state tax department for assistance. Delays can occur due to various reasons, such as incomplete information on the return or high volume during peak refund season.

Can I opt for direct deposit for my state refund?

Yes, you can choose to receive your state refund via direct deposit into your bank account. This option is not only faster but also more secure than receiving a paper check in the mail. Be sure to provide accurate banking information to avoid any delays in processing.

Resources for Further Assistance

As you plan ahead for the State Refunds in 2025, it’s crucial to have access to reliable resources for any assistance you may need along the way. Below are some helpful resources to guide you through the 2025 schedule of state refunds:

State Revenue Department Website

For the most up-to-date information on the state refunds schedule, visit the official State Revenue Department website. You can find comprehensive details, updates, and guidelines on the reimbursement process. Stay informed and check regularly for any amendments.

Online Tax Filing Platforms

If you prefer the convenience of online tax filing, consider using reputable platforms that cater to the 2025 state refunds. These platforms offer user-friendly interfaces and step-by-step guidance to simplify the filing process.

Frequently Asked Questions

- When will the State Refunds 2025 Schedule be unveiled?

- The State Refunds 2025 Schedule will be unveiled soon, make sure to mark your calendar to stay updated.

- Why is it important to plan ahead for the State Refunds 2025 Schedule?

- Planning ahead for the State Refunds 2025 Schedule is crucial to ensure you are prepared for any refund payments or changes expected.

- How can I stay informed about the State Refunds 2025 Schedule?

- Keep an eye out for official announcements from the state authorities or agencies regarding the State Refunds 2025 Schedule.

- What should I do after marking my calendar for the State Refunds 2025 Schedule?

- Once you mark your calendar, stay proactive in checking for updates or changes to the State Refunds 2025 Schedule to avoid missing important dates.

Final Thoughts: Don’t Miss Out on Your State Refunds in 2025!

As we conclude our discussion on the state refunds 2025 schedule, it is crucial to highlight the importance of planning ahead and marking your calendar for key dates. By staying informed about the schedule, you can ensure timely filing and processing of your refund, avoiding unnecessary delays and maximizing your financial benefits.

Remember, proactive approach pays off when it comes to managing your state refunds. Keep track of the deadlines, stay organized, and leverage online resources provided by the state tax authorities for a smooth refund experience.

So, gear up, mark your calendar, and stay ahead of the game to make the most of your state refunds in 2025!