Are you eagerly anticipating your tax refund in 2025? The IRS has officially revealed the much-awaited IRS 2025 refund schedule, providing taxpayers with clear timelines. Understanding this schedule is crucial for effective tax planning and financial management. By familiarizing yourself with the IRS 2025 refund schedule, you can strategize your financial decisions, expense management, and savings goals. This blog will delve into the key dates and details outlined in the schedule, offering insights and tips to help you navigate the refund process smoothly. Stay tuned to learn how to maximize your refund by planning based on the IRS 2025 refund schedule.

View this post on Instagram

Introduction to IRS 2025 Refund Schedule

As taxpayers eagerly anticipate their refunds from the IRS in 2025, understanding the IRS 2025 Refund Schedule is crucial for effective financial planning. The refund schedule provides a timeline for when individuals can expect to receive their tax refunds based on filing dates and other factors.

Key Features of IRS 2025 Refund Schedule

The IRS 2025 Refund Schedule outlines specific dates and timelines for processing and issuing tax refunds to eligible taxpayers. The schedule may vary based on the method of filing, such as e-filing or traditional paper filing.

- Electronic Filing: Taxpayers who file their returns electronically can typically receive their refunds faster than paper filers. The IRS encourages e-filing for quicker processing.

- Direct Deposit: Opting for direct deposit can further expedite the refund process, with funds being deposited directly into the taxpayer’s bank account.

Estimated IRS 2025 Refund Schedule Timeline

Based on historical data and trends, the IRS 2025 Refund Schedule is expected to follow a similar timeline as previous years. Depending on various factors, taxpayers can anticipate receiving their refunds within a few weeks to a month after filing.

IRS 2025 Refund Schedule Timeline (Estimated):

- January – February: Early filers who submit their tax returns in January or February may receive their refunds sooner, especially if they opt for e-filing and direct deposit.

- March – April: Most taxpayers can expect to receive their refunds during this period, as the IRS processes a higher volume of returns.

- May – June: Individuals with more complex tax situations or delayed processing may receive their refunds towards the later months of the schedule.

Importance of Planning Ahead

Planning is crucial when managing your finances effectively, particularly regarding IRS 2025 refund schedules. By having a clear plan in place well in advance, you can ensure that you are prepared for any financial obligations and maximize your refund potential.

Financial Stability

Planning allows you to budget effectively and avoid financial stress. It enables you to strategically allocate funds for taxes, ensuring you can meet your obligations without causing financial strain.

Being aware of the IRS 2025 refund schedule helps you to plan your expenses, savings, and investments better, contributing to long-term financial stability.

Tax Efficiency

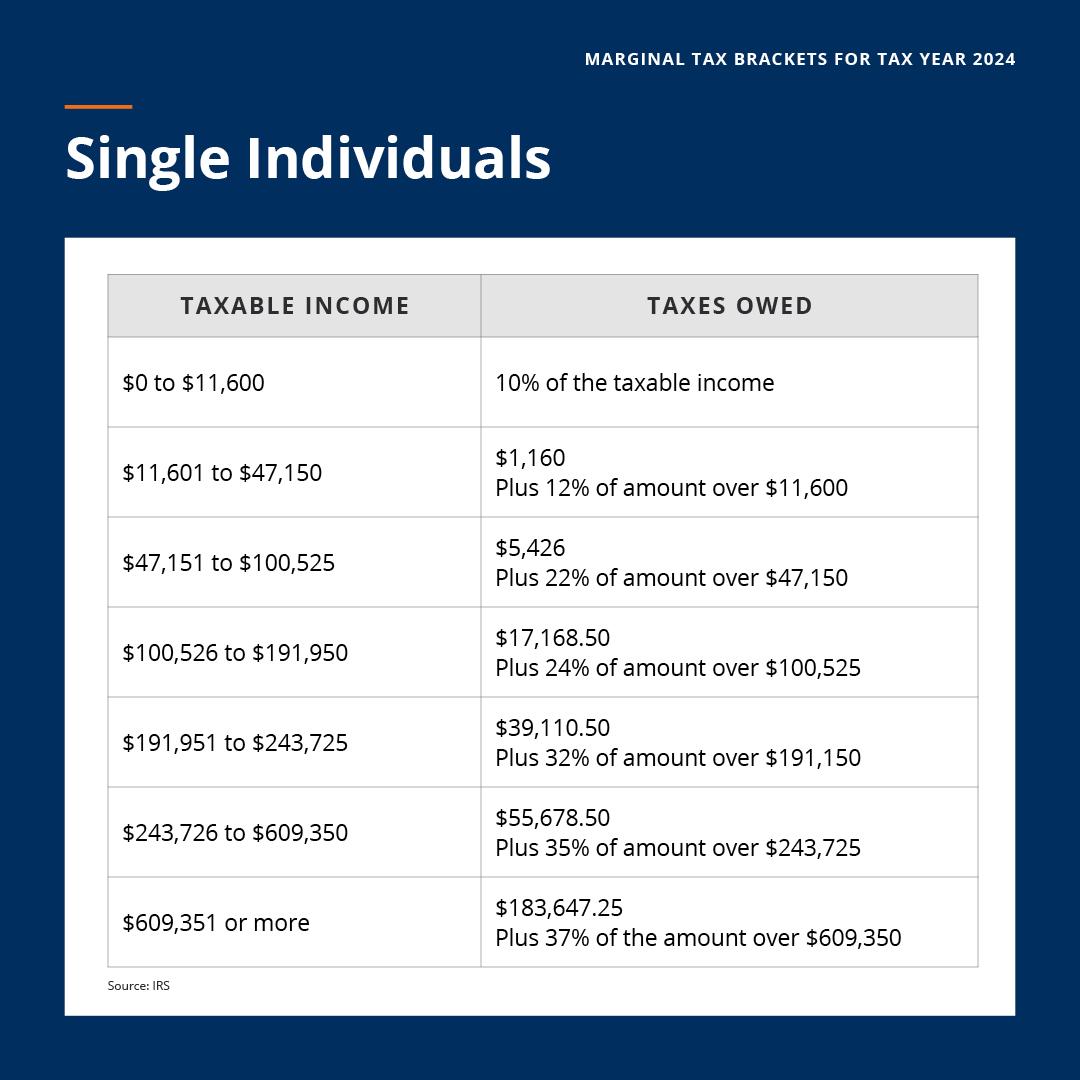

Planning allows you to take advantage of various tax-saving opportunities and deductions. Familiarizing yourself with the IRS 2025 refund schedule details will enable you to make informed decisions that can optimize your tax refund.

- Maximizing deductions

- Utilizing tax credits

- Strategically timing investments

Critical Dates for IRS 2025 Refunds

Filing taxes can be stressful, but knowing the critical dates for IRS 2025 refunds can help you plan. Here are some important dates to keep in mind:

IRS 2025 Refund Schedule Release Date

The IRS usually releases the official refund schedule in the early months of the year. Look for the announcement in January 2025.

IRS Tax Filing Deadline

Submit your tax return by the April 15, 2025, deadline to avoid penalties or late fees.

Direct Deposit Vs. Mailed Check

Opting for direct deposit can expedite your refund process. If you choose this option, you can expect to receive your refund in 2 to 3 weeks.

Checking Your Refund Status

Stay updated on your refund status by visiting the IRS website. You can check your refund status within 24 hours of e-filing or four weeks after mailing your return.

How to Track Your Refund Status

When eagerly waiting for your IRS 2025 refund, tracking its status can provide peace of mind. The process is straightforward, and it ensures you stay updated throughout.

1. Check the IRS Website

Visit the official IRS website and use the “Where’s My Refund?” tool. Input your Social Security number, filing status, and refund amount for the most current information.

2. Contacting the IRS

If online tools don’t provide clarity, contact the IRS directly through their hotline. Please provide them with the necessary details so they can inquire about your refund.

Tips for Maximizing Your Refund

Maximizing your refund with the IRS 2025 refund schedule requires planning and preparation. Here are some tips to help you get the most out of your tax refund:

Organize Your Documents

Before you file your taxes, ensure you have all the documents, such as W-2s, receipts, and investment statements, organized and ready. This will streamline the process and ensure you don’t overlook any deductions.

Consider creating a dedicated or digital folder for all yoto stay organized ur tax-related documents to stay ol Deductions and Credits

Take advantage of all the deductions and credits available to you. Include expenses like mortgage interest, charitable donations, and education expenses to lower your taxable income.

Don’t forget to check for any new tax breaks for 2025 that could further boost your refund.

File Early and Electronically

Filing early can help prevent identity theft and fraud by processing your return before a scammer can file a fake one in your name. Additionally, filing electronically can speed up processing and get your refund sooner.

Consider using the IRS’s Free File program for a user-friendly and cost-effective way to file your taxes online.

Common Mistakes to Avoid

When understanding and planning for the IRS 2025 refund schedule, avoiding common mistakes is crucial for a smooth tax refund process. Here are some key pitfalls to steer clear of:

1. Missing Filing Deadlines

One of the most critical errors taxpayers make is missing the filing deadlines. This could lead to penalties and delays in receiving your refund. Ensure you are aware of the deadline and file your taxes promptly.

2. Incorrect Information

Providing inaccurate information on your tax return can result in processing delays and potential errors. To avoid discrepancies, it is vital to double-check all details before submission.

3. Failure to Claim Deductions

Overlooking eligible deductions and credits can cause your refund amount to be lower than it should be. Be thorough in identifying all potential tax breaks to maximize your refund.

Changes in the 2025 Tax Season

As per the latest update, the IRS has announced significant changes for the 2025 tax season, impacting the refund schedule and tax filing process. Taxpayers must stay informed about these changes to avoid surprises and delays.

Extended Filing Deadlines

Due to various factors, including the ongoing global situation, the IRS has extended the filing deadlines for the 2025 tax season. This extension provides taxpayers additional time to gather necessary documents and file their returns accurately.

Enhanced Security Measures

The IRS has implemented enhanced security measures for the 2025 tax season to safeguard taxpayers’ sensitive information and prevent fraudulent activities. Taxpayers may need to undergo additional verification steps to ensure the security of their refunds.

Frequently Asked Questions

- Is it essential to plan for an IRS refund?

- Yes, it is important to plan ahead for your IRS refund to ensure you receive it on time and accurately.

- What is the significance of the IRS 2025 refund schedule?

- The IRS 2025 refund schedule provides important dates and timelines for taxpayers to know when they can expect to receive their refunds.

- How can taxpayers use the IRS refund schedule for planning?

- Taxpayers can use the IRS refund schedule to plan their finances, budgeting, and expenses based on when they expect to receive their refunds.

- Where can I find the IRS 2025 refund schedule?

- The IRS 2025 refund schedule can be found on the official IRS website or through tax preparation software.

- Are there any changes to the IRS refund schedule for 2025?

- It’s always recommended to stay updated with the latest IRS announcements regarding any changes to the refund schedule for 2025.

In Summary: Be Ready for the IRS 2025 Refund Schedule!

As we navigate the upcoming tax season, knowing the IRS 2025 refund schedule is crucial for financial planning. Understanding when to expect your refund can help you manage your finances and avoid unnecessary stress. Remember to file your taxes early, stay informed about updates, and utilize e-filing for faster processing. By staying proactive and organized, you can ensure a smoother tax refund experience in future years. Keep track of important deadlines, stay informed about policy changes, and always consult with tax professionals when in doubt. Let’s plan and make the most of the IRS 2025 refund schedule!