As we step into 2025, businesses are continuing to navigate the complexities of managing their bi-weekly payroll schedules efficiently. The bi-weekly payroll schedule has remained a popular choice for organizations, offering a balance between frequency and administrative ease. In this comprehensive guide, we will delve into the intricacies of the bi-weekly pay periods in 2025, exploring best practices, compliance updates, and technological solutions to streamline your payroll process. Whether you are a seasoned HR professional or a business owner looking to optimize your payroll operations, this guide will equip you with the knowledge and tools needed to master the bi-weekly payroll schedule in 2025.

The Prime Minister announced today that the government will be moving to a bi-weekly pay schedule for all public sector employees with the introduction of Cloud Bahamas. This investment in new technology will ensure accurate tracking of employee attendance and performance,…

— Latrae L. Rahming (DOC)🇧🇸 (@latraelrahming) June 5, 2024

Understanding the Bi-Weekly Payroll Schedule for 2025

Bi-weekly payroll schedule is a popular pay frequency among many companies in 2025, where employees are paid every two weeks, resulting in 26 pay periods a year. This schedule offers a balance between the more frequent weekly payments and the less frequent monthly payments. Understanding how bi-weekly payroll works is essential for both employers and employees to manage finances efficiently.

Benefits of Bi-Weekly Payroll

Bi-weekly pay schedules provide employees with more consistent pay dates and help in budgeting monthly expenses effectively. Employers benefit from reduced payroll processing costs and simplified administration due to the standard pay frequency.

Challenges of Bi-Weekly Payroll

One of the challenges of bi-weekly payroll for employees is budgeting for months with three pay periods, which can lead to fluctuations in their cash flow management. Employers may face challenges with overtime calculations and compliance with labor laws.

Benefits of Implementing a Bi-Weekly Payroll Schedule in 2025

Implementing a bi-weekly payroll schedule in 2025 can offer numerous benefits to both employers and employees alike. Let’s explore some of the advantages:

1. Financial Stability

Switching to a bi-weekly payroll schedule can provide employees with more consistency and predictability in their income, leading to improved financial planning and stability. With regular paychecks every two weeks, employees can better manage their expenses and budget effectively.

2. Increased Efficiency

Bi-weekly payroll processing simplifies payroll administration tasks by reducing the frequency of payroll runs. This streamlines the payroll process, allowing HR and finance teams to focus on other critical initiatives and increasing overall operational efficiency.

3. Cost Savings

By adopting a bi-weekly payroll schedule, businesses can potentially save on payroll processing costs. With fewer payroll runs per month, organizations can lower expenses associated with payroll processing, such as software fees, administrative labor, and printing costs.

4. Improved Employee Satisfaction

Regular pay on a bi-weekly basis can boost employee morale and satisfaction. Employees appreciate the consistent pay schedule, which can lead to higher levels of job satisfaction and engagement. Happy employees are more likely to be motivated and productive in the workplace.

5. Better Cash Flow Management

For employers, a bi-weekly payroll schedule can help improve cash flow management. By aligning payroll cycles with revenue inflows, businesses can better anticipate and manage their financial obligations, ensuring timely payments to employees and vendors.

Challenges and Solutions for 2025

Shift Towards Remote Workforce

In 2025, the bi-weekly payroll schedule faces a significant challenge due to the ongoing trend towards a remote workforce. With employees working from diverse locations, ensuring timely and accurate payroll processing becomes more complex. Companies need to implement advanced cloud-based payroll software solutions to streamline the process. This technology enables real-time data access, ensuring payroll calculations are precise, regardless of the employees’ locations.

Compliance with Evolving Payroll Regulations

As regulations surrounding payroll continue to evolve in 2025, staying compliant becomes a major challenge for organizations. Implementing a robust compliance management system is crucial to navigate through the intricate payroll landscape. Regular audits and training programs can help ensure that the bi-weekly payroll schedule aligns with the latest legal requirements, minimizing the risk of penalties and non-compliance issues.

Integration of AI and Automation

The integration of artificial intelligence (AI) and automation technologies presents both challenges and solutions for the bi-weekly payroll schedule in 2025. While these technologies offer efficiency and accuracy benefits, the initial implementation phase may pose challenges such as data migration and employee training. Companies need to invest in adequate AI training programs to upskill their workforce and effectively integrate automation into the payroll process.

Best Practices for Managing Bi-Weekly Payroll

When it comes to effectively managing a bi-weekly payroll schedule in 2025, there are several best practices that businesses should follow to ensure accuracy and efficiency in their payroll processes. By implementing these practices, organizations can streamline their payroll operations and avoid any potential errors or delays.

Utilize Automated Payroll Systems

One of the key strategies for managing bi-weekly payroll is to invest in automated payroll systems. These systems can help automate the calculation of wages, deductions, and taxes, reducing the likelihood of human errors and ensuring compliance with changing regulations.

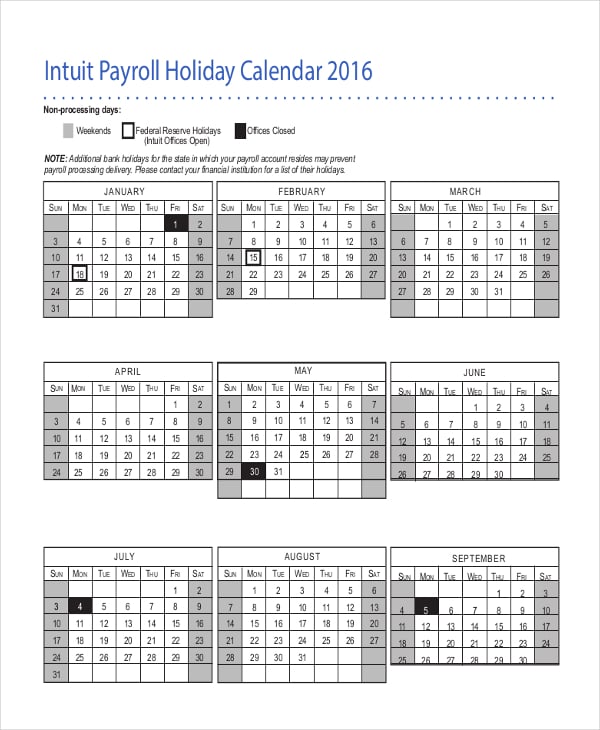

Establish Clear Deadlines

Set clear deadlines for employees to submit their timesheets and for payroll administrators to process the payroll. By establishing a consistent timeline, you can avoid any last-minute rushes and ensure that payroll is processed accurately and on time.

Regularly Audit Payroll Data

Conduct regular audits of your payroll data to identify and rectify any discrepancies or inaccuracies. By reviewing your payroll records on a consistent basis, you can catch errors early on and prevent any potential issues from arising.

Provide Employee Training

Offer training sessions for employees on how to accurately submit their timesheets and address any payroll-related queries they may have. Well-informed employees can help reduce errors and improve overall payroll efficiency.

Frequently Asked Questions

- What is a bi-weekly payroll schedule?

- A bi-weekly payroll schedule is a system in which employees are paid every two weeks, typically resulting in 26 pay periods in a year.

- Why should companies consider using a bi-weekly payroll schedule?

- Bi-weekly schedules offer benefits such as easier budgeting for both employers and employees, less frequent processing, and aligning with many standard accounting periods.

- How should employees budget with a bi-weekly payroll schedule?

- To budget effectively with a bi-weekly schedule, employees should plan for their expenses over a two-week period and consider setting up automatic savings transfers on payday.

- What are some common challenges with bi-weekly payroll?

- Challenges can include synchronizing pay dates with monthly bills, potential cash flow issues for employees, and adjusting to the longer time between paychecks compared to weekly schedules.

- How can companies ensure smooth processing on a bi-weekly payroll schedule?

- To ensure smooth processing, companies should establish clear payroll policies, use reliable payroll software, and communicate effectively with employees about pay schedules and deadlines.

Mastering the Bi-Weekly Payroll Schedule in 2025: Closing Thoughts

As we navigate through the intricacies of the bi-weekly payroll schedule in 2025, it’s evident that businesses must adapt to stay compliant and efficient. With the rapid advancements in technology and evolving workforce dynamics, mastering this payroll system is crucial for success.

By understanding the importance of accurate calculations, compliance with regulations, and the use of automated software, companies can streamline their payroll process and enhance employee satisfaction. Embracing digital solutions, staying informed about industry changes, and prioritizing transparency are key takeaways for achieving payroll mastery in 2025.

Remember, the bi-weekly payroll schedule is more than just a routine task; it’s a reflection of your company’s commitment to professionalism and employee welfare.