As taxpayers, it’s crucial to stay informed about looming deadlines, and one of the most significant dates on the financial calendar is the last day to pay taxes. Planning ahead and marking your calendars for the last day to pay taxes in 2025 is essential to avoid penalties and ensure compliance. The schedule for the last day to pay taxes in 2025 has been revealed, creating a sense of urgency for individuals and businesses alike. Understanding this schedule will help you manage your finances effectively and make timely payments. Let’s delve into the details of the last day to pay taxes in 2025 schedule to empower you with the knowledge needed to stay on top of your tax obligations.

We’ve created a form you can submit to cancel a scheduled income tax payment: https://t.co/DuM3Vrtg6G – Just be sure you schedule your new payment to meet the July 15 deadline. pic.twitter.com/KaOlDRVui5

— Oklahoma Tax Commission (@oktaxcommission) April 13, 2020

Introduction: Understanding the Importance of Tax Due Dates

Ensuring that you mark your calendars for the last day to pay taxes in 2025 is crucial for staying compliant with tax regulations and avoiding potential penalties. Understanding the significance of tax due dates helps individuals and businesses plan and budget effectively to meet their tax obligations on time.

The Consequences of Missing Tax Due Dates

Missing the last day to pay taxes in 2025 schedule can result in financial consequences such as late payment penalties and interest charges. It may also lead to additional scrutiny from tax authorities, potentially triggering audits or other investigations.

Benefits of Timely Tax Payments

By adhering to the tax due dates, individuals and businesses can avoid unnecessary stress and disruptions to their financial planning. Timely tax payments also contribute to a positive relationship with tax authorities and demonstrate good faith in fulfilling tax obligations.

Overview of Tax Filing Deadlines

As we gear up for the tax season in 2025, it’s crucial to mark your calendars with the last day to pay taxes 2025 schedule. Staying informed about important tax filing deadlines helps avoid any penalties and ensures a smooth tax filing process. The deadlines vary based on the type of taxpayer and the specific tax obligations they have.

Individual Taxpayers

For individual taxpayers, the deadline to file and pay personal income taxes is typically on or around April 15th of each year. However, in case April 15th falls on a weekend or holiday, the deadline may be extended to the next business day. Extensions may be available under certain circumstances, but it’s essential to confirm details from the IRS website.

Business Taxpayers

Business entities, including corporations and partnerships, have different tax filing deadlines. S-corporations typically have a deadline of March 15th, while C-corporations usually file by April 15th. It’s important for business taxpayers to understand their specific tax obligations and compliance requirements to avoid any late filing penalties.

Image: Tax Filing Deadline Clock

Key Dates for the 2025 Tax Year

As we look ahead to the last day to pay taxes in 2025, it’s essential to stay informed about the key dates for the upcoming tax year. Below are some important dates to mark on your calendar to ensure a smooth tax season.

Deadline for W-2 Forms

Employers must provide employees with their W-2 forms by January 31, 2025. This form outlines your annual earnings and tax withholdings.

April 15, 2025: Tax Filing Deadline

April 15, 2025, is the last day to pay taxes for the 2025 tax year. Ensure you file your tax return or request an extension by this date to avoid penalties and interest.

If you need more time to file, submit Form 4868 by April 15 to request an extension until October 15, 2025.

Estimated Tax Payments

Quarterly estimated tax payments for the 2025 tax year are due on the following dates:

- April 15, 2025

- June 15, 2025

- September 15, 2025

- January 15, 2026

Highlights of the Last Day to Pay Taxes in 2025

As the year 2025 comes to a close, the anticipation for the last day to pay taxes is at its peak. The schedule for the last day to pay taxes in 2025 is crucial information for taxpayers to mark on their calendars. Knowing the exact deadline ensures timely compliance and avoids any penalties or fines.

Importance of Being Aware of the Last Day to Pay Taxes

Understanding the last day to pay taxes in 2025 schedule is vital for all taxpayers. Missing the deadline can result in penalties and interest, increasing the overall amount owed to the tax authorities. By being aware of the deadline, individuals and businesses can plan their finances accordingly to meet their tax obligations on time.

It’s essential to stay updated with any changes in the schedule to avoid last-minute rush or confusion among taxpayers.

Key Dates and Deadlines Leading to the Last Day of Tax Payment

Before the final day to pay taxes in 2025, there are several important dates and deadlines that taxpayers should be mindful of. These dates may include estimated tax payments, filing deadlines for various forms, and extension requests.

- Deadline for filing certain tax forms

- Second installment for estimated tax payments

- Deadline for extension requests

Tax Payment Options and Procedures

As the deadline for tax payment approaches, understanding the various options and procedures for paying your taxes is crucial. Below, we outline the available methods for making your tax payment this year, 2025.

Online Payment

One convenient way to pay your taxes is through online payment portals provided by the tax authorities. Using secure online platforms, you can easily submit your payment from the comfort of your home. Remember to initiate your transaction before the last day to pay taxes 2025 schedule ends to avoid late fees.

Bank Transfers

If you prefer traditional methods, bank transfers are another viable option for tax payment. You can transfer the required amount directly from your bank account to the designated tax account. Ensure to include the necessary details and references to correctly allocate your payment.

In-Person Payments

For those who prefer in-person transactions, some tax offices allow taxpayers to make their payments at designated locations. Check the nearest tax office or authorized payment centers for this option. Be mindful of operating hours and any additional requirements for in-person payments.

Tips for Efficiently Managing Your Taxes

Managing your taxes efficiently is vital to ensure you meet the last day to pay taxes 2025 schedule without any hassle. Here are some useful tips to help you navigate the tax season smoothly:

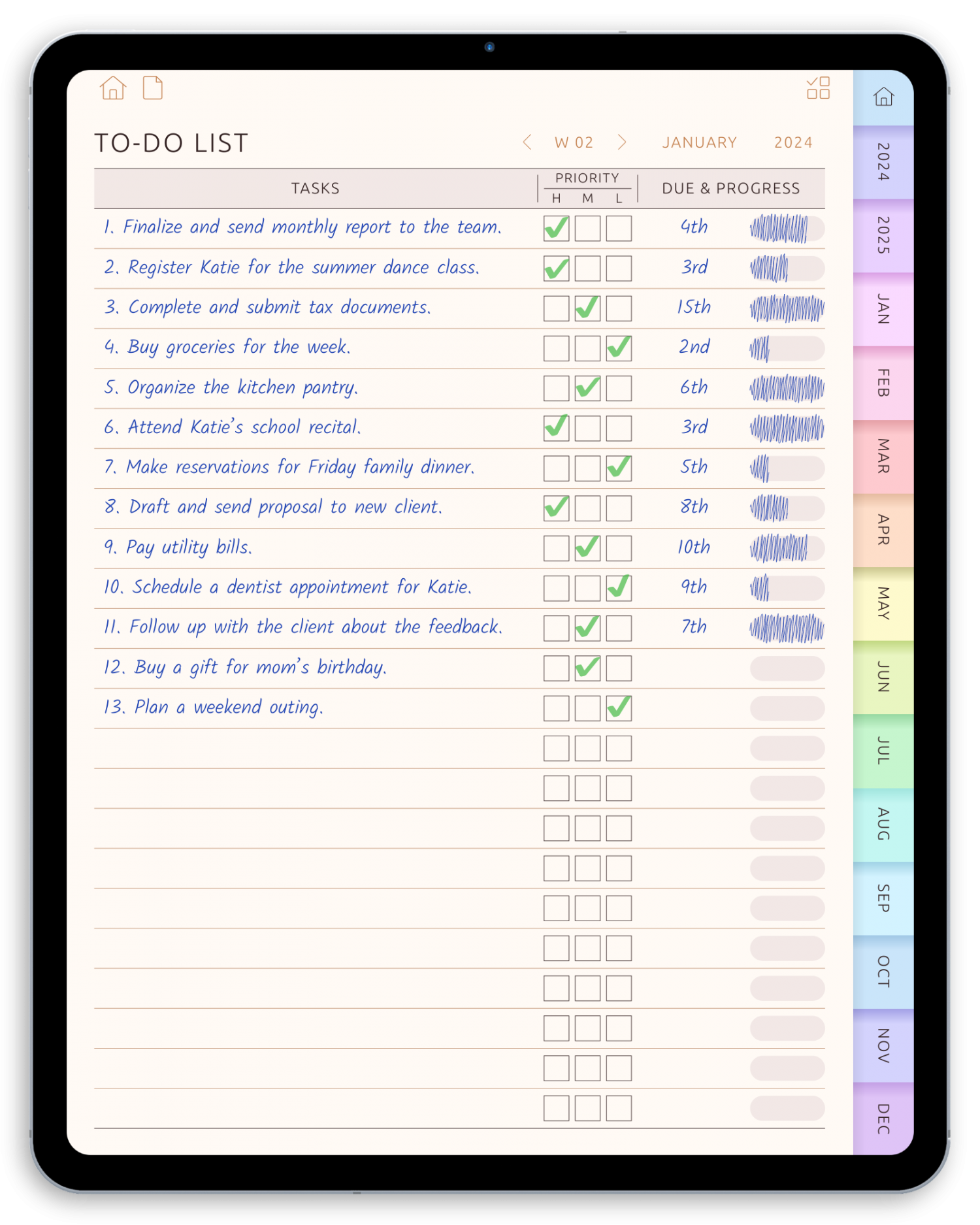

Organize Your Documents

Keep all your tax-related documents in one place, such as W-2 forms, receipts, and financial statements. Label each document with the current tax year to stay organized.

Start Early

Don’t wait until the last minute to start preparing your taxes. Begin gathering necessary information as soon as possible to avoid any rush.

Maximize Deductions

Explore all possible deductions and credits available to you. Consult with a tax professional to ensure you maximize your savings.

Frequently Asked Questions

- When is the last day to pay taxes in 2025?

- The last day to pay taxes in 2025 is April 15th, as revealed in the schedule.

- What happens if I miss the deadline to pay taxes in 2025?

- If you miss the deadline to pay taxes in 2025, you may face penalties and interest on the amount owed. It’s important to pay on time to avoid additional charges.

- Can I request an extension for paying taxes in 2025?

- Yes, you can request an extension to file your taxes in 2025, but you will still need to estimate and pay any taxes owed by the original deadline to avoid penalties.

- Where can I find the official tax schedule for 2025?

- You can find the official tax schedule for 2025 on the IRS website or through your tax preparation software provider.

Final Thoughts: Stay Prepared for Tax Season 2025

As we approach the tax season in 2025, it is essential to mark your calendars with the last day to pay taxes as per the newly revealed schedule. By being aware of this deadline, you can avoid unnecessary penalties and ensure a smooth tax filing process. Remember, staying organized and informed about the tax deadlines can save you from last-minute stress and financial hassles. Make use of any available resources or assistance to meet the tax obligations promptly and accurately. Plan ahead, stay updated, and always be proactive when it comes to managing your taxes.