Are you eagerly waiting for the IRS Gov $300 direct deposit payment as part of the 2025 stimulus schedule? Understanding the payment schedule and its implications is essential in the current economic landscape. This blog aims to provide all the information you need about the IRS Gov $300 direct deposit payment in 2025. From the distribution schedule to the eligibility criteria, we have you covered. Stay informed about when to expect the deposit, how to ensure you receive it promptly, and any changes in the stimulus payment process. Let’s navigate the intricacies of the IRS Gov $300 direct deposit payment together.

View this post on Instagram

Introduction to IRS Gov $300 Direct Deposit Payment

IRS has announced the implementation of the $300 direct deposit payment in 2025 as part of the stimulus package. This payment aims to assist eligible individuals and families during these challenging times. Understanding the schedule and requirements for this direct deposit payment is crucial for those expecting this support.

IRS Gov $300 Direct Deposit Payment Eligibility

To qualify for the IRS Gov $300 direct deposit payment in 2025, individuals must meet specific criteria set by the IRS. This includes having a valid Social Security number, meeting income thresholds, and filing the necessary tax documents. Eligibility criteria may vary, so it is essential to verify your eligibility status.

Understanding the IRS Gov $300 Direct Deposit Payment Schedule

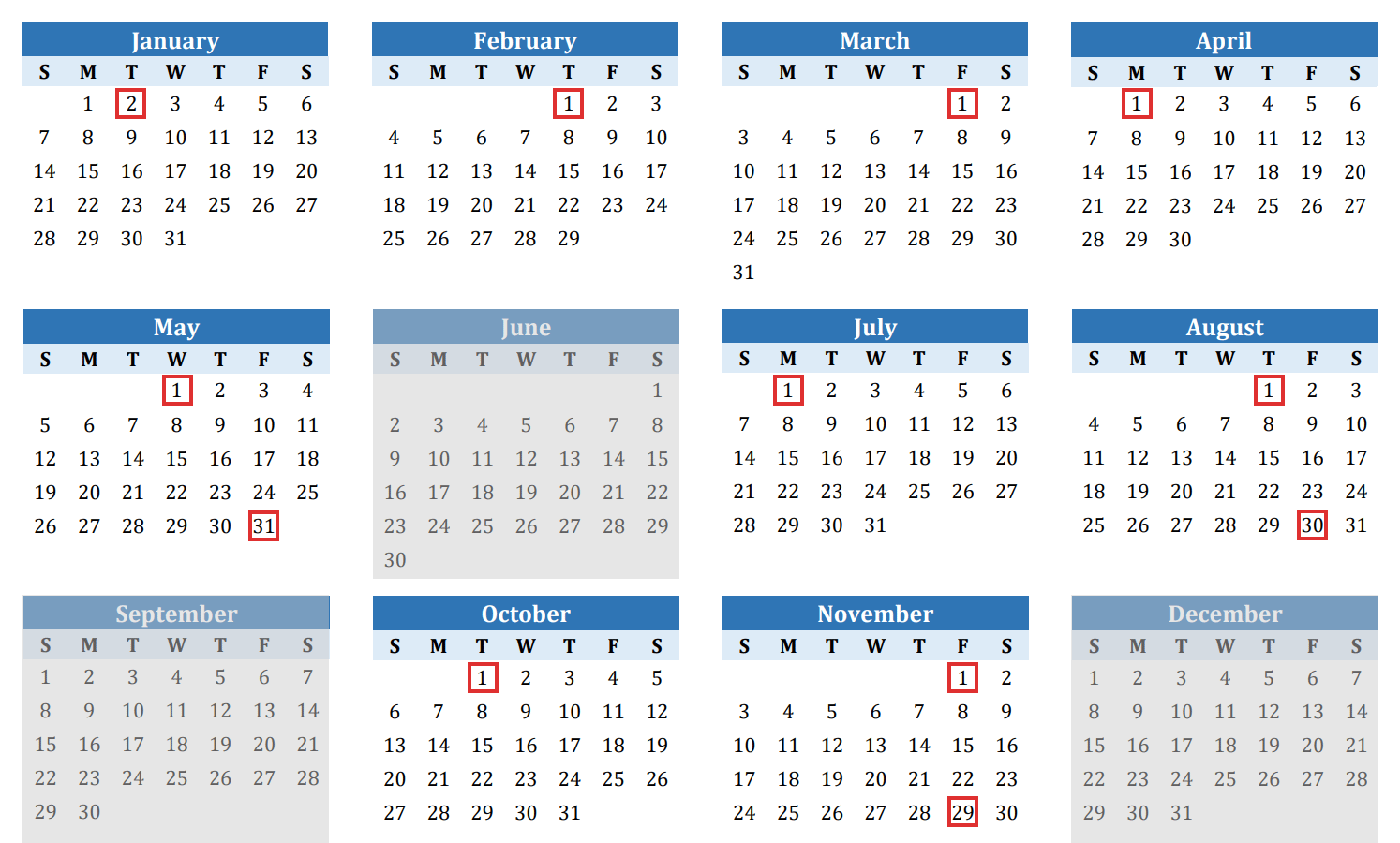

The IRS Gov $300 direct deposit payment schedule for 2025 outlines when eligible individuals can expect to receive their payments. It is crucial to stay updated on the schedule to ensure timely receipt of the funds. The IRS typically releases a payment schedule detailing when payments will be processed and deposited into recipients’ accounts.

Understanding the 2025 Schedule Stimulus

The 2025 Schedule Stimulus is a proposed plan by the IRS Gov for direct deposit payments of $300 in 2025. This stimulus aims to provide financial assistance to eligible individuals and families to boost the economy and alleviate economic strains.

Key Features of the 2025 Schedule Stimulus

The 2025 Schedule Stimulus includes provisions such as direct deposit payments of $300 per individual or household. IRS Gov has set specific criteria to determine eligibility, including income thresholds, employment status, and tax filing requirements.

Individuals who qualify for the stimulus will receive the payment through direct deposit, ensuring fast and secure distribution of funds.

How to Check Your Eligibility

To find out if you qualify for the 2025 Schedule Stimulus, visit the official IRS Gov website. You can also contact the IRS helpline or consult with a tax professional for assistance.

- Ensure you meet the specified income criteria.

- File your taxes promptly and accurately.

- Keep track of updates and announcements related to the stimulus package.

How to Qualify for the $300 Direct Deposit Payment

If you are looking to qualify for the IRS Gov $300 Direct Deposit Payment in 2025, there are certain criteria you need to meet to receive this stimulus:

- Eligibility: Individuals who meet the income thresholds set by the government will qualify for the $300 direct deposit payment. Ensure you fall within the specified income range to be eligible.

- Valid Bank Account: To receive the direct deposit payment securely, make sure you have a valid bank account linked to your tax filing.

- Up-to-date Tax Filing: Ensure your tax filings are up-to-date for the year 2025 to receive the stimulus payment without any delays.

Additional Information to Note for Qualification:

It’s important to double-check all the information in your tax returns and ensure they are accurate to prevent delays in receiving the stimulus payment.

Applying for the IRS Gov Payment

When it comes to applying for the IRS Gov $300 direct deposit payment in 2025, it is essential to follow the correct procedures to ensure you receive the stimulus in a timely manner. To apply for this payment, you will need to visit the official IRS website and fill out the necessary forms with accurate information. Ensure to provide all required details to avoid delays in receiving your payment.

IRS Website Registration Process

To start the process, you must create an account on the IRS website if you don’t already have one. Fill in your personal information and set up your account securely. This account will be used to track the status of your application and payments.

Submitting the Payment Application

After registering on the IRS website, navigate to the payment section and fill out the application form accurately. Double-check all the information provided before submitting the form to avoid any errors that could delay your payment processing.

Remember to include your bank account details for direct deposit. This will ensure that the $300 payment is directly credited to your account without any delays or issues in receiving the stimulus.

Important Dates and Deadlines to Remember

Stay informed about the critical dates and deadlines related to the IRS Gov $300 direct deposit payment schedule stimulus in 2025. Missing deadlines can result in delays in receiving your payment.

Submission Deadline

The deadline for submitting your information for the IRS Gov $300 direct deposit payment is typically announced at the beginning of the stimulus program.

Ensure you provide accurate details to avoid any issues with the processing of your payment.

Payment Schedule

Payments are usually disbursed on specific monthly dates, depending on the IRS schedule.

Monitor the payment schedule to know when your funds will be deposited into your account.

Verification Period

After submitting your information, there may be a verification period where the IRS checks the details provided.

Be patient during this process, as it ensures the accuracy and security of your payment.

Checking Your Payment Status

If you eagerly await your IRS Gov $300 direct deposit payment in 2025 under the stimulus program, it is crucial to check your payment status regularly to stay informed.

Using the IRS Online Tool

To check your payment status, visit the official IRS website and use the “Get My Payment” tool. This tool allows you to track your payment and get updates on the deposit schedule.

Setting Up Payment Notifications

Enable notifications on your banking app to receive alerts when the deposit hits your account. This helps you stay on top of your finances and avoid missing the payment.

Common FAQs about the $300 Direct Deposit Payment

Taxpayers might have questions as the IRS Gov rolls out the $300 direct deposit payment schedule for the 2025 stimulus. Here are some common FAQs answered:

1. What are the eligibility criteria for the $300 direct deposit payment?

To be eligible for the $300 direct deposit payment, individuals must meet certain income requirements, as per the IRS guidelines for the 2025 stimulus.

2. When can I expect to receive the $300 direct deposit payment?

Payments are scheduled to be made as per the specified IRS Gov $300 direct deposit payment 2025 schedule, which may vary based on different factors.

3. Are there any tax implications associated with the $300 direct deposit payment?

Understanding the tax implications of the $300 direct deposit payment is essential. Consult a tax professional for personalized advice.

Tips for Managing Your Stimulus Payment

Managing your stimulus payment efficiently is crucial to ensure you receive it in a timely manner. Below are some tips to help you navigate the process smoothly.

Ensure Your Direct Deposit Information is Up to Date

Ensure your bank account details with the IRS are accurate and current to avoid delays in receiving your payment. Providing the correct information enables the direct deposit of the stimulus into your account.

Monitor IRS Announcements Regularly

Stay updated on any announcements or changes made by the IRS regarding stimulus payments. Keeping yourself informed will help you understand the latest guidelines and requirements for receiving the payment.

Set Up Alerts for Payment Notifications

Enable notifications or alerts from your financial institution regarding any incoming deposits. This will help you stay informed once the stimulus payment hits your account, allowing you to manage your finances effectively.

Frequently Asked Questions

- What is the $300 Direct Deposit Payment by IRS Gov in 2025?

- The $300 Direct Deposit Payment by IRS Gov in 2025 is a stimulus payment provided by the Internal Revenue Service to eligible individuals to help boost the economy and support financial needs during designated times.

- How can I know the schedule for the $300 direct deposit payment in 2025?

- The IRS usually releases a schedule or timeline for distributing direct deposit payments. You can check the official IRS website or stay updated through official announcements for the specific schedule relating to the $300 direct deposit payment in 2025.

- Who is eligible to receive the $300 direct deposit payment in 2025?

- Eligibility criteria for receiving the $300 direct deposit payment may vary and are usually determined based on factors such as income level, filing status, and other qualifying conditions. To understand eligibility criteria for the payment, it is recommended that you refer to IRS guidelines or consult with tax professionals.

- What do I need to do to ensure I receive the $300 direct deposit payment in 2025?

- To increase your chances of receiving the $300 direct deposit payment in 2025, it is important to ensure that your banking information is up to date with the IRS. Additionally, meeting all eligibility requirements and fulfilling any necessary documentation or verification processes will be crucial.

- Are there any specific dates for the $300 direct deposit payment distribution in 2025?

- The official schedule released by the IRS will outline specific dates for the distribution of the $300 direct deposit payment in 2025. It is advisable to closely monitor updates from the IRS to know the exact dates for when the payments will be processed and deposited.

Final Thoughts

As we navigate through the intricate landscape of IRS Gov $300 direct deposit payment 2025 schedule stimulus, it is essential to stay informed and prepared. The scheduled payments are aimed at providing much-needed support to individuals during these challenging times.

Make sure to familiarize yourself with the payment schedule to anticipate potential payments and manage your finances effectively. Remember to keep your information updated with the IRS to ensure smooth and timely transactions.

Overall, staying informed, being proactive, and understanding the process can help you make the most of the stimulus payments provided by the IRS Gov. Let’s stay vigilant and informed as we move forward.