Are you eagerly awaiting your tax refund from the IRS in 2025? Understanding the IRS refund schedule for 2025 is crucial to managing your finances effectively. The refund schedule outlines the timeline when you can expect to receive your tax refund after filing your return. By familiarizing yourself with this schedule, you can plan your finances and avoid unnecessary delays in receiving your refund. In this blog, we will delve into what the IRS refund schedule for 2025 looks like, key dates to remember, and tips on how to navigate the process smoothly. Let’s make sure you are well-informed and prepared to maximize your tax refund this year!

Understanding the IRS Refund Schedule for 2025

As taxpayers eagerly await their refunds, understanding the IRS refund schedule for 2025 is crucial for proper planning. The IRS issues refunds on a schedule, with specific dates based on when your return was accepted. This schedule can vary each year, so staying informed is essential to avoid any surprises.

IRS Refund Schedule Timeline

The IRS typically issues refunds within 21 days of receiving your tax return. However, this timeframe can be longer if there are errors or incomplete information on your return. It’s important to file your taxes accurately to avoid delays in receiving your refund.

Checking Your Refund Status

To track the status of your refund, you can use the IRS “Where’s My Refund” tool on their website. You will need to provide your Social Security number, filing status, and the exact refund amount. This tool allows you to monitor the progress of your refund and get an estimated date of when it will be issued.

Key Dates to Remember for Taxpayers

As a taxpayer, it is crucial to keep track of key dates to ensure you meet important deadlines and avoid penalties. Below are some key dates that you should remember for the IRS refund schedule for 2025:

Deadline for Filing Taxes

One of the most important dates to remember is the deadline for filing your taxes. For the tax year 2025, the deadline is usually April 15th. However, if this date falls on a weekend or holiday, the deadline is typically extended to the next business day.

Estimated Tax Payment Due Dates

For individuals who are required to make estimated tax payments, the due dates are usually April 15th, June 15th, September 15th, and January 15th of the following year. It is essential to make these payments on time to avoid penalties and interest.

If you need to know what is the IRS refund schedule for 2025, staying informed about these dates will help you plan your finances accordingly.

Extension Request Deadline

If you are unable to file your taxes by the initial deadline, you can request an extension. The deadline to file for an extension is typically October 15th. Remember that an extension to file is not an extension to pay any taxes owed.

Factors Affecting the IRS Refund Timeline

When it comes to understanding the IRS refund schedule for 2025, several factors can influence the timeline of receiving your tax refund.

1. Filing Method

The method you choose to file your taxes can impact how quickly you receive your refund. E-filing typically results in faster processing times compared to filing by mail.

2. Accuracy of Information

Ensuring all your information is accurate and up-to-date is crucial. Any mistakes or discrepancies in your tax return can lead to delays in receiving your refund.

3. Claiming Certain Credits

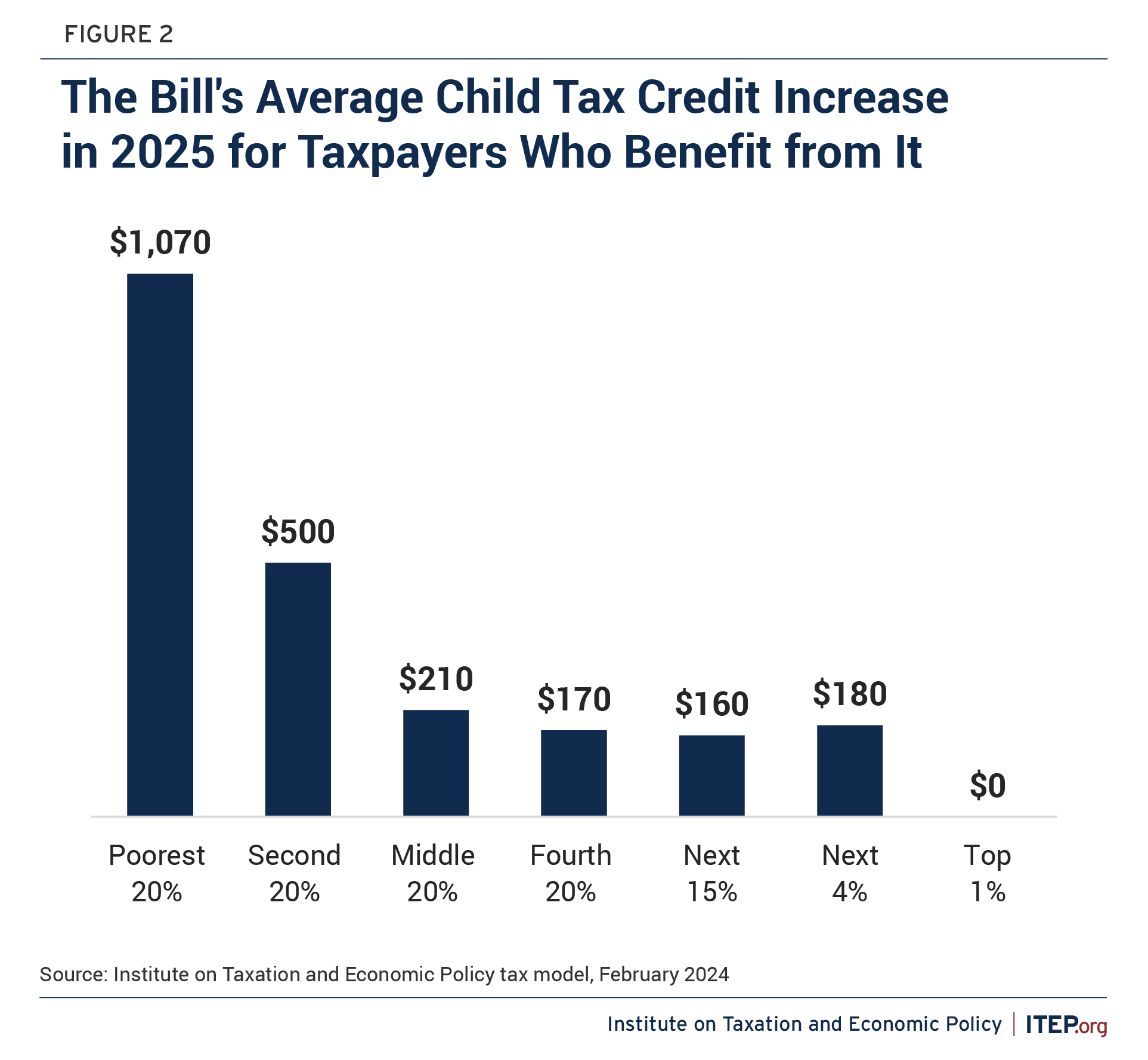

Claiming certain tax credits or deductions, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit, can cause a delay in processing your refund due to the additional verification required by the IRS.

Tips for Ensuring Timely IRS Refunds

Ensuring timely IRS refunds is crucial for many taxpayers. Here are some essential tips to help you navigate the IRS refund schedule for 2025.

File Electronically

Filing your taxes electronically can significantly speed up the refund process. The IRS processes e-filed returns faster than paper returns, resulting in quicker refunds.

Provide Accurate Information

Ensure all your provided information is accurate and up-to-date to avoid delays in processing your refund. Errors can lead to processing time extensions.

Common Issues and How to Resolve Them

When dealing with the IRS refund schedule for 2025, there are some common issues that taxpayers might encounter. It’s important to be aware of these issues and know how to resolve them efficiently to avoid any delays in receiving your refund.

Incorrect Information Submission

If you have provided incorrect information on your tax return, such as your Social Security number or bank account details, it can lead to delays in receiving your refund. Double-check all the information before submission to ensure accuracy.

Missing Tax Documents

One common issue is missing tax documents, such as W-2s or 1099s. Without these documents, the IRS may not be able to process your refund. Request these documents from your employer or financial institutions promptly to avoid delays.

Identity Theft Concerns

Identity theft is a serious issue that can affect your tax refund. If you suspect that your identity has been compromised, report it to the IRS immediately to safeguard your refund.

Resources for Further Assistance and Information

When it comes to understanding the IRS refund schedule for 2025, there are various resources available to provide assistance and information.

IRS Website

The official IRS website is a valuable resource for checking the latest updates on the refund schedule for 2025. They provide detailed information on payment timelines, eligibility criteria, and FAQs.

IRS Refund Tracker

The IRS offers an online refund tracker tool where you can input your details to check the status of your refund in real-time. It’s a convenient way to stay informed about your refund progress.

IRS Customer Service

If you need personal assistance or have specific questions regarding the IRS refund schedule for 2025, you can reach out to the IRS customer service helpline at 1-800-829-1040. They are available to provide support and guidance.

Frequently Asked Questions

- What is the IRS refund schedule for 2025?

- The IRS refund schedule for 2025 is a timeline that indicates when taxpayers can expect to receive their tax refunds based on when they file their tax returns.

- When can I expect to receive my tax refund in 2025?

- The timing of when you can expect to receive your tax refund in 2025 depends on various factors such as how you filed your taxes, if there are any errors on your return, and if you chose to receive your refund via direct deposit or check.

- How can I check the status of my tax refund for 2025?

- You can check the status of your tax refund for 2025 by using the IRS Where’s My Refund? tool on the IRS website. This tool allows you to track the progress of your refund after you have filed your tax return.

- Are there any changes to the tax refund process for 2025?

- There may be changes to the tax refund process for 2025, such as updates to tax laws or procedures. It’s important to stay informed about any changes that may impact when you can expect to receive your tax refund.

- What should I do if I haven’t received my tax refund according to the schedule?

- If you haven’t received your tax refund according to the schedule provided by the IRS, you can contact the IRS directly to inquire about the status of your refund and address any potential issues that may be causing a delay.

Unlocking the IRS Refund Schedule for 2025

In conclusion, understanding the IRS refund schedule for 2025 is crucial for taxpayers to effectively plan their finances and manage expectations. By familiarizing yourself with the key dates and factors influencing the refund process, you can avoid unnecessary stress and delays when awaiting your refund. Remember to e-file your taxes, choose direct deposit, and consider using online tools for tracking your refund status. Being proactive and informed is the key to a smooth tax refund experience. Stay organized, stay updated, and leverage the resources available to ensure a hassle-free tax season. Here’s to maximizing your refund and achieving financial peace of mind!