Understanding tax forms can be overwhelming, but none more so than Schedule K-1. So, what exactly is a Schedule K-1? In the realm of taxation, a Schedule K-1 is a tax form used to report the income, deductions, and credits from partnerships, S corporations, estates, and trusts. It serves as a vital document for shareholders or partners as it details their share of the entity’s income. This often-confusing form requires a deeper dive to comprehend its intricacies so that you can effectively navigate your tax obligations. In this blog, we will demystify Schedule K-1, guiding you through everything you need to know to manage this crucial tax document with confidence.

Understanding Schedule K-1

A Schedule K-1 is an IRS tax form used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It is important for taxpayers who receive income from these entities as they need to report this information on their individual tax returns.

Importance of Schedule K-1

Understanding what is a schedule K-1 is vital as it helps individuals accurately report their share of income, losses, and dividends from pass-through entities.

Components of Schedule K-1

The Schedule K-1 typically includes information on income, deductions, credits, and distributions allocated to the taxpayer. It is crucial for taxpayers to review this form carefully to ensure accurate reporting.

- Box 1: Ordinary business income

- Box 2: Net rental real estate income

- Box 10: Distributions

:max_bytes(150000):strip_icc()/gantt-chart.asp-Final-9dc0992ed31545d382ff46f495afa0c5.png)

Purpose of Schedule K-1

A Schedule K-1 is a tax form used to report the incomes, losses, and dividends of a partnership or S-corporation to its shareholders or partners, for tax filing purposes.

Understanding Income Distribution

Partnerships and S-corporations are pass-through entities, meaning the income, deductions, and credits are passed through to the shareholders or partners. The Schedule K-1 outlines each recipient’s share of these items.

This form ensures that the shareholders or partners report their allocated income on their individual tax returns, avoiding double taxation.

Tracking Investment Activities

Another crucial purpose of the Schedule K-1 is to track the investment activities of each partner or shareholder. It provides detailed information regarding the distributions, holdings, and adjustments.

- It helps in understanding the financial performance of the entity.

- Enables partners/shareholders to account for their share of gains or losses accurately.

Components of Schedule K-1

Schedule K-1 is a tax form used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts to the IRS and the respective partners or shareholders. Understanding the components of Schedule K-1 is vital for taxpayers involved in such entities, as it affects their individual tax returns.

Income Allocations

Partnerships and S corporations distribute income and losses to partners or shareholders based on their ownership percentages. This section of Schedule K-1 details the specific amounts allocated to each partner or shareholder.

Deductions and Credits

The deductions and credits reported on Schedule K-1 represent the partner’s or shareholder’s share of expenses and tax credits generated by the entity. These can include business expenses, investment interest, or renewable energy credits.

- Example: Depreciation deductions and foreign tax credits

Information for Tax Reporting

This section provides details necessary for partners or shareholders to accurately report their share of income, deductions, and credits on their individual tax returns. It includes information such as the entity’s Employer Identification Number (EIN) and any foreign taxes paid.

Importance of Schedule K-1

A Schedule K-1 is a tax form used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. Understanding its importance is crucial for taxpayers to accurately report their share of income and losses.

Transparency in Income

By receiving a Schedule K-1, individuals gain insight into their portion of the profits or losses generated by the entity in which they are invested. It helps ensure transparency in reporting income and managing tax liabilities.

Tax Planning and Compliance

Using information from Schedule K-1, taxpayers can engage in effective tax planning to optimize their financial situation. It also aids in complying with tax laws and regulations, preventing potential penalties.

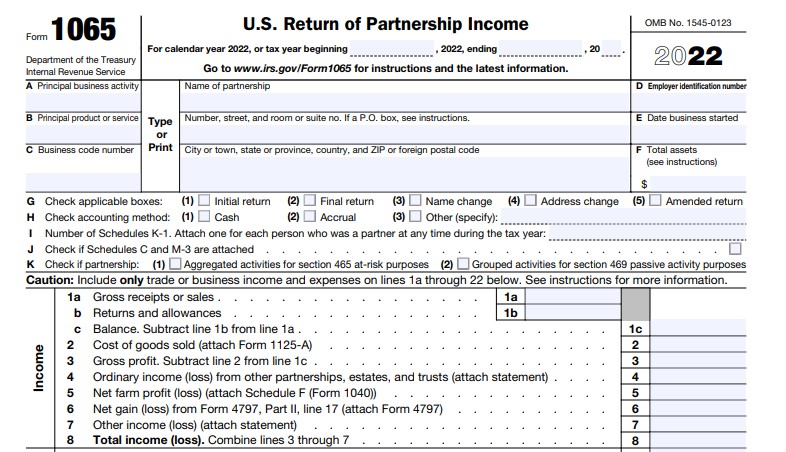

Image:

How to Use Schedule K-1

Schedule K-1 is a tax form used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information that individual partners, shareholders, or beneficiaries need to report on their personal tax returns.

Understanding the Information on Schedule K-1

Each Schedule K-1 form includes details such as business income, losses, dividends, interest, and capital gains. Partners or shareholders should carefully review this information to accurately report it on their tax returns. It is essential to understand the different sections and codes on the form.

Filing Requirements and Deadlines

Partnerships and S corporations issue Schedule K-1 to partners or shareholders annually. It is crucial to ensure timely receipt of the form to meet individual tax filing deadlines. Missing or incorrect information can result in penalties or delays in tax preparation.

- Partnerships typically issue K-1s by March 15th.

- S corporations issue K-1s by March 15th as well.

- Estate and trust K-1s are usually issued by April 15th.

Common Mistakes to Avoid with Schedule K-1

When dealing with Schedule K-1, there are some common mistakes that taxpayers should avoid to ensure accuracy and compliance with tax regulations. One of the most prevalent errors is failing to report all income listed on the Schedule K-1 form. It’s essential to carefully review each section of the form and include all relevant information on your tax return.

Incorrect Reporting of Pass-Through Income

One crucial mistake to steer clear of is incorrectly reporting pass-through income from partnerships, S corporations, or trusts. Make sure to accurately report each type of income and ensure it aligns with the information provided on your Schedule K-1 form. Filing accurately is key to avoiding audits.

Omitting Share of Deductions and Credits

Another common error is overlooking your share of deductions and credits listed on the Schedule K-1. These tax breaks can significantly impact your overall tax liability, so be sure to include them when filing your tax return. Double-checking this information can prevent costly mistakes.

Benefits of Properly Handling Schedule K-1

Properly handling Schedule K-1 can bring several benefits to individuals involved in partnerships, S corporations, estates, and trusts. When these forms are accurate and submitted on time, it ensures compliance with IRS regulations, avoiding penalties and audits.

Minimizing Tax Liability

By correctly handling Schedule K-1, individuals can take advantage of deductions, credits, and losses allocated by the entity, leading to potential tax savings. This can significantly reduce the tax liability for the partners or shareholders.

Optimizing Reporting

Properly handled Schedule K-1 facilitates accurate reporting of income, losses, and distributions from partnership or S corporation activities. This ensures the correct disclosure of financial information to the IRS, shareholders, and partners.

Frequently Asked Questions

- What is Schedule K-1?

- Schedule K-1 is a tax form used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It is issued to partners or shareholders to report their share of the entity’s income and expenses for tax purposes.

- Who receives a Schedule K-1?

- Partners in a partnership, shareholders in an S corporation, beneficiaries of estates and trusts, and members of LLCs taxed as partnerships or S corporations typically receive a Schedule K-1.

- What information is included in a Schedule K-1?

- A Schedule K-1 typically includes information on the taxpayer’s share of the entity’s income, deductions, credits, and other tax-related items. It also provides details on distributions received and any tax liabilities or carryover amounts.

- How is Schedule K-1 used for tax purposes?

- Taxpayers use the information on Schedule K-1 to report their share of income, deductions, and credits on their individual tax returns. The amounts from the K-1 flow through to the taxpayer’s personal tax return and are taxed at their individual tax rate.

- Are there different types of Schedule K-1 forms?

- Yes, there are different types of Schedule K-1 forms depending on the type of entity (partnership, S corporation, estate, trust) issuing the form. Each type of entity has its own specific Schedule K-1 form with unique reporting requirements.

Unlocking the Mysteries of Schedule K-1

Understanding Schedule K-1 is crucial for anyone involved in partnerships, trusts, or S corporations. This tax form not only reports your share of income, deductions, and credits but also provides valuable insight into the financial health of the entity. By demystifying Schedule K-1, we have shed light on its importance and how it impacts your tax obligations. Remember, accurate record-keeping and timely communication with the issuing entity are key to ensuring the information on your K-1 is correct. In summary, Schedule K-1 is a vital document that requires attention to detail and proactive management for a smooth tax filing process.