Are you feeling overwhelmed by the complexities of understanding an amortization schedule? Worry not, as we are here to decode it for you in simple, easy-to-follow steps. In this comprehensive guide titled “Decoding the Amortization Schedule: A Step-by-Step Guide to Figure It Out,” we will demystify the process and help you grasp the ins and outs of how to figure out an amortization schedule. By breaking down the calculations and explaining each component thoroughly, you will gain a clear understanding of how this essential financial tool works. Join us on this enlightening journey as we navigate through the intricate world of amortization schedules together.

Introduction to Amortization Schedule

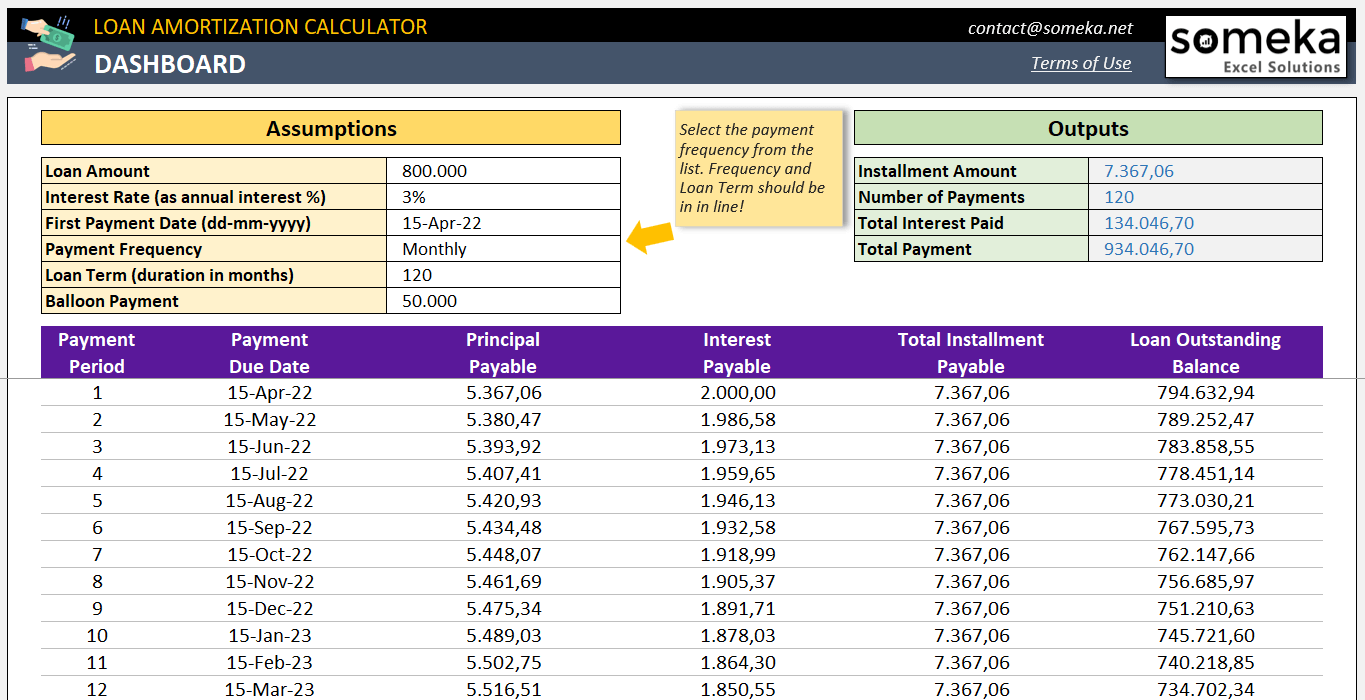

An amortization schedule is a table detailing each periodic payment on a loan, showing the amount of principal and the amount of interest that comprise each payment until the loan is paid in full. This tool is commonly used in mortgage loans to understand how payments are allocated over time.

Understanding Amortization

Amortization is the process of paying off debt with a fixed repayment schedule in regular installments over a period of time. In the context of a loan, amortization breaks down the total payment into portions that go towards reducing the principal amount and paying interest.

It is important to have a clear understanding of how amortization works to effectively manage your debt and finances.

Components of an Amortization Schedule

An amortization schedule typically includes the payment date, payment amount, interest, principal, and remaining balance for each payment period. This schedule helps borrowers visualize how their payments are distributed throughout the loan term.

By following the amortization schedule, borrowers can track their progress in repaying the loan and make informed financial decisions.

Understanding Amortization and its Importance

Amortization is the process of gradually paying off a loan over a period of time through regular fixed payments. These payments typically cover both the principal amount borrowed and the interest accrued. Understanding amortization is crucial for borrowers as it helps in visualizing how payments are allocated towards reducing the debt outstanding.

The Basics of Amortization

Amortization schedules are detailed tables that outline each periodic payment’s allocation between principal and interest. These schedules provide borrowers with a clear breakdown of how much of each payment goes towards reducing the loan balance versus paying interest.

Why Amortization Matters

Amortization can be beneficial as it allows borrowers to see the progression of debt repayment over time. By following the amortization schedule, individuals can track how their payments contribute to building equity in an asset or property, resulting in increased financial stability.

Factors Affecting Amortization Schedule

When figuring out an amortization schedule, there are several factors that come into play. Understanding these factors is crucial to accurately calculating your loan payments over time.

Loan Amount

The principal loan amount plays a significant role in determining the amortization schedule. A higher loan amount will result in larger monthly payments compared to a smaller loan amount.

Interest Rate

The interest rate on the loan directly impacts the amortization schedule. A higher interest rate leads to higher monthly payments and vice versa. It’s important to compare interest rates to find the best loan terms.

Loan Term

The length of the loan term affects how quickly the loan will be paid off. Shorter loan terms typically result in higher monthly payments but less overall interest paid over the life of the loan.

Payment Frequency

The frequency of loan payments, whether monthly, bi-weekly, or quarterly, influences the amortization schedule. Choosing a payment frequency that aligns with your budget can help you stay on track with payments.

Additional Payments

Any extra payments made towards the principal loan amount can alter the amortization schedule by reducing the total amount owed and shortening the loan term. It’s recommended to make additional payments whenever possible.

Methods to Calculate Amortization Schedule

Calculating an amortization schedule is essential to understand the payment structure of a loan, including how much of each payment goes towards the principal and interest. Here is a step-by-step guide on how to calculate an amortization schedule using the latest methods:

Gather Loan Information

Begin by gathering crucial loan details: the loan amount, interest rate, loan term (in years or months), and the start date of the loan. This information is vital for accurate calculation.

Utilize an Online Amortization Calculator

One of the easiest and quickest methods to calculate an amortization schedule is by using online tools or calculators. These tools allow you to input the loan details and generate an accurate schedule instantly.

Manual Calculation Method

If you prefer to calculate the amortization schedule manually, you can use the following formula:

Monthly Payment = P * (r * (1 + r)^n) / ((1 + r)^n – 1)

where:

P = Loan Amount

r = Monthly Interest Rate (Annual Rate / 12)

n = Total Number of Payments

By using this formula, you can calculate the monthly payment amount and the breakdown of principal and interest for each payment in the schedule.

Visual Representation

Creating a visual representation of the amortization schedule can help in better understanding the payment structure. Use graphs or charts to illustrate how the loan balance decreases over time.

:max_bytes(150000):strip_icc()/AverageCollectionPeriod-4201163-Final-2eeeb0f96410477c8016a7d936a28932.jpg)

Step-by-Step Guide to Figure Out Amortization Schedule

Understanding how to figure out an amortization schedule is essential for managing loans effectively. An amortization schedule is a table that shows the periodic payments towards a loan’s principal and interest. It helps borrowers visualize how their loan balance decreases over time.

Calculate Monthly Payment

To begin, use the loan amount, interest rate, and loan term to calculate the monthly payment using the formula for an amortizing loan. This calculation will give you a fixed monthly payment amount.

You can use online amortization calculators or spreadsheet software to simplify this calculation (How to Figure Out Amortization Schedule).

Determine Interest and Principal Breakdown

Each month, a portion of the payment goes towards interest, and the remainder reduces the principal balance. The interest payment decreases over time as the principal balance decreases, leading to more of the payment going towards the principal.

- Track the interest and principal components of each payment to see how they change over the loan term.

- This breakdown helps borrowers understand how much of each payment contributes to reducing the total debt.

Frequently Asked Questions

- What is an amortization schedule?

- An amortization schedule is a table that details each periodic payment on a loan, showing how much of each payment goes towards principal and interest.

- Why is it important to understand the amortization schedule?

- Understanding the amortization schedule helps borrowers see how much of their payments are reducing the loan balance and how much is going towards interest over time.

- How is an amortization schedule calculated?

- An amortization schedule is typically calculated using the loan amount, interest rate, loan term, and payment frequency to determine the amount of each payment that goes towards principal and interest.

- What does the term ‘amortization’ refer to?

- Amortization refers to the process of paying off a debt over time through regular payments that cover both principal and interest.

- Can you provide an example of an amortization schedule?

- Yes, an example would be a mortgage amortization schedule that outlines monthly payments, showing how much of each payment is applied to the loan balance and how much goes towards interest.

Unlocking the Secrets of the Amortization Schedule

As we conclude our journey into decoding the amortization schedule, we have equipped you with the essential knowledge and tools to confidently navigate this complex financial concept. By following the step-by-step guide outlined in this blog, you can easily figure out your own amortization schedule and gain a deeper understanding of your loan repayment process.

Remember, the amortization schedule is not just a table of numbers; it’s a roadmap to financial empowerment. By grasping how to calculate interest and principal payments over time, you can make informed decisions about your loans and accelerate your path to debt-free living.