Deciphering tax forms can be daunting, especially when it comes to the intricate details of the 1040 Schedule 3. What is 1040 Schedule 3, and why is it important for your tax filing? This comprehensive guide aims to unravel the complexities surrounding this specific form, providing you with a clear understanding of its purpose and how it may impact your tax return.

Whether you’re a seasoned taxpayer or a newcomer to the world of taxes, navigating through the 1040 Schedule 3 can seem overwhelming. By delving into the nuances of this form, we aim to simplify the process for you and empower you to make informed decisions regarding your tax obligations.

Overview of 1040 Schedule 3

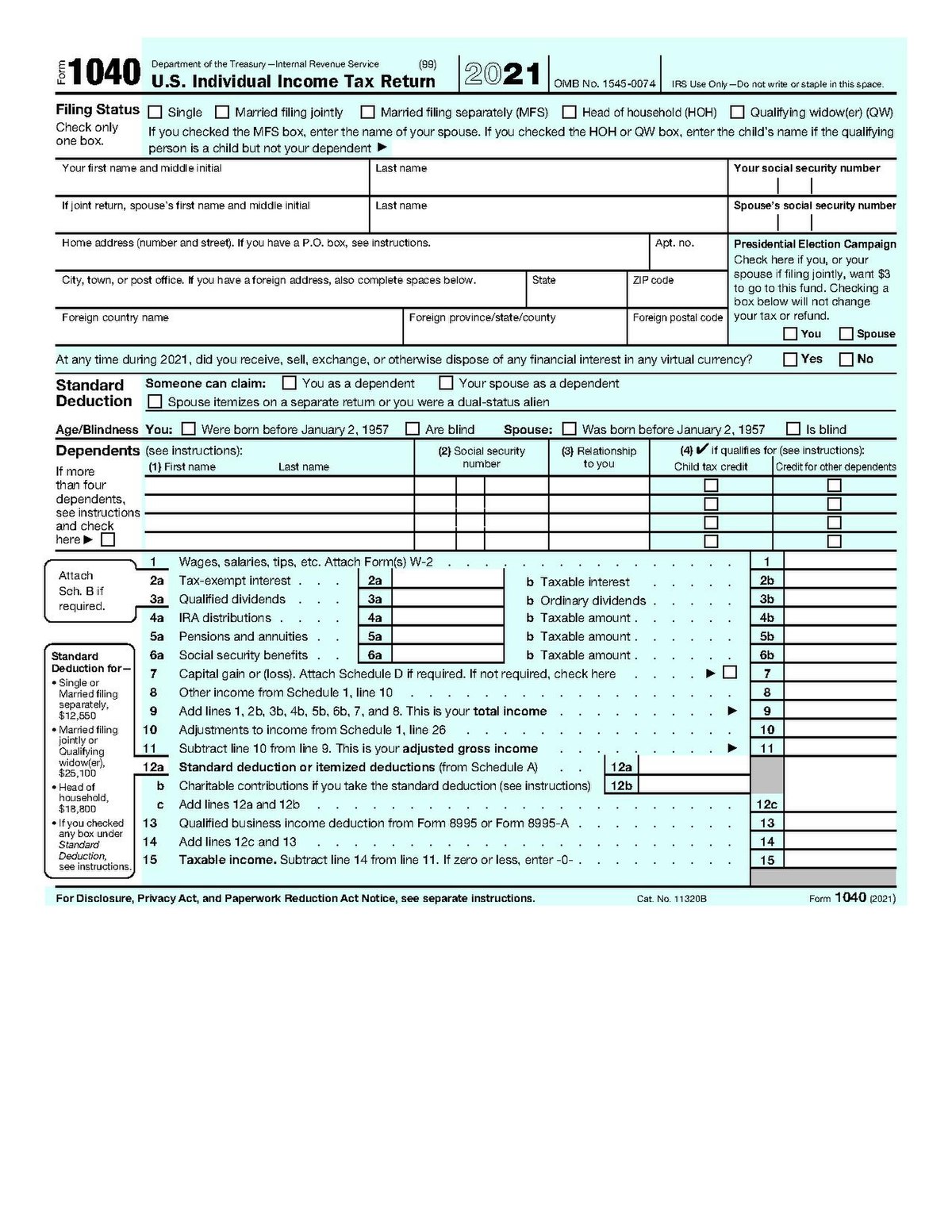

1040 Schedule 3 is a supplementary form to the main 1040 form used for individual income tax returns in the United States. This form is utilized for various tax credits and payments that need to be reported separately. It is crucial to accurately fill out this form to ensure compliance with IRS regulations.

Importance of 1040 Schedule 3

One of the key functions of 1040 Schedule 3 is to report nonrefundable tax credits, such as the credit for child and dependent care expenses, education credits, and retirement savings contributions credit.

These credits can significantly reduce the amount of tax owed or increase the taxpayer’s refund, making it essential to include this schedule when filing your taxes.

Eligibility Criteria

To claim tax credits on Schedule 3, taxpayers must meet specific eligibility criteria outlined by the IRS. It is crucial to review these requirements carefully to ensure you qualify for the credits you are reporting.

Why is 1040 Schedule 3 important?

When it comes to filing your taxes, 1040 Schedule 3 is a crucial form to consider. This particular schedule is essential for reporting additional credits and payments that are not captured on the main Form 1040. By understanding the significance of Schedule 3, you can ensure that all your financial details are accurately documented.

Importance of Reporting Additional Credits

One major reason why 1040 Schedule 3 holds importance is because it allows you to claim various credits that can significantly impact your tax liability. These credits can include education credits, residential energy credits, and more. By accurately reporting these credits on Schedule 3, you can potentially reduce the amount of taxes you owe or increase your refund.

Reporting Additional Payments

Moreover, Schedule 3 is also essential for documenting any additional payments made throughout the year, such as estimated tax payments or excess social security tax withheld. Failure to report these payments accurately can lead to discrepancies in your tax return and potential penalties from the IRS. Therefore, completing Schedule 3 diligently is crucial for maintaining tax compliance.

What to Include in 1040 Schedule 3

When filling out your 1040 Schedule 3, ensure you include all relevant information to accurately report your tax-related transactions.

Income Sources

Include income from sources such as real estate, business, farms, royalties, or partnerships.

Make sure to accurately categorize and report each type of income.

Deductions

Include deductions like student loan interest, educator expenses, health savings account deductions, and more.

- Student loan interest

- Educator expenses

- Health savings account deductions

Common mistakes to avoid on 1040 Schedule 3

When filling out the 1040 Schedule 3, there are some common mistakes that taxpayers should be aware of to prevent errors in their tax return. Understanding these mistakes can help individuals submit accurate and complete information to the IRS.

Incorrect Reporting of Income

One major mistake is the incorrect reporting of income on Schedule 3. Taxpayers must accurately report all sources of income, including wages, self-employment income, and investment earnings. Failure to report income correctly can lead to penalties and additional taxes owed. It is crucial to double-check all income figures before submitting the form.

Missing Tax Credits and Deductions

Another common error is missing out on eligible tax credits and deductions that could reduce a taxpayer’s overall tax liability. Individuals should carefully review the available credits and deductions to ensure they are claiming all that apply to their situation. Missing out on these benefits can result in paying more tax than necessary.

Failure to Include Supporting Documentation

Not including necessary supporting documentation with Schedule 3 is also a common mistake. Taxpayers need to attach relevant forms and paperwork to substantiate their claims for credits, deductions, or income adjustments. Failure to provide documentation can delay the processing of the return and lead to potential audits.

Tips for accurately filling out 1040 Schedule 3

When filling out the 1040 Schedule 3, it’s important to pay attention to detail to ensure accuracy and avoid any potential errors. Here are some helpful tips to guide you through this process:

Understanding the Purpose of 1040 Schedule 3

Before you start filling out the form, it’s crucial to understand why you need to include 1040 Schedule 3. This schedule is used to report nonrefundable credits like the Foreign Tax Credit or Education Credits.

Organize Your Documents

Make sure you have all the necessary documents and information ready before you begin filling out the schedule. This includes any forms or statements related to the credits you are claiming.

Double-Check Your Entries

Take your time to review each entry you make on the form. Even a small mistake can lead to discrepancies and potential issues later on. Be meticulous and precise in your calculations.

Seek Professional Help if Needed

If you find the process confusing or if you have complex tax situations, consider seeking assistance from a tax professional. They can provide guidance and ensure that the form is filled out correctly.

Frequently Asked Questions

- What is the purpose of Schedule 3 on the 1040 form?

- Schedule 3 is used to report additional credits and payments that can’t be entered directly on Form 1040.

- What are some common items included on Schedule 3?

- Common items on Schedule 3 include foreign tax credits, education credits, residential energy credits, and other miscellaneous tax credits.

- Do I need to fill out Schedule 3 even if I don’t have any additional credits or payments?

- If you don’t have any items to report on Schedule 3, you may not need to fill it out. However, it’s always best to review the instructions or consult with a tax professional to ensure you are correctly filing your taxes.

- Where can I find instructions for completing Schedule 3?

- The IRS provides detailed instructions for completing Schedule 3 in the Form 1040 instructions booklet available on their website.

- Can I file my taxes without including Schedule 3?

- If you have items that should be reported on Schedule 3, it’s important to include it when filing your taxes to avoid any discrepancies. Failure to include the necessary schedules could lead to delays in processing your tax return or potential errors.

Unlocking the Mysteries of 1040 Schedule 3: Concluding Insights

As we conclude our exploration into the realms of the 1040 Schedule 3, it becomes evident that this form holds a vital piece in the intricate puzzle of tax filing. Understanding what is 1040 Schedule 3 and deciphering its nuances can empower taxpayers to optimize their returns and ensure compliance with IRS regulations.

By delving into the specifics of credits, such as the Foreign Tax Credit, and payments like estimated tax payments, taxpayers can navigate the complexities of their financial obligations with confidence. Moreover, being aware of the purpose and implications of Schedule 3 aids in promoting financial literacy and proactive tax planning.

In summary, mastering the intricacies of 1040 Schedule 3 equips taxpayers with the knowledge to make informed decisions and enhance their financial well-being. So, embrace this newfound understanding and embark on your tax-filing journey with clarity and assurance!