Are you eagerly waiting to decipher the IRS tax payout schedule for 2025? The anticipation surrounding tax refunds and payments can be both exciting and nerve-wracking. Understanding when you can expect to receive your tax refund or make your tax payment is crucial for planning your finances effectively.

In this blog, we will delve deep into the intricacies of the IRS tax payout schedule for 2025. Unveiling the dates and timelines for tax refunds and payments, we aim to demystify the process and provide you with the insights necessary to navigate the tax season seamlessly.

Join us as we crack the code of the IRS tax payout schedule for 2025, ensuring you are well-equipped to manage your tax obligations efficiently and make the most of your financial planning.

Looking forward to your #IRS tax refund? After you see a sent date on “Where’s My Refund,” please wait five days to check with your bank about your money, since banks vary in how and when they credit funds. See https://t.co/PFiedQt3bX pic.twitter.com/vkt5r3DMc9

— IRSnews (@IRSnews) February 22, 2024

Introduction to IRS Tax Payout Schedule 2025

Understanding the IRS Tax Payout Schedule 2025 is crucial for taxpayers to plan their finances effectively. The IRS releases a schedule outlining the dates when individuals can expect to receive their tax refunds or payments. By staying informed about this schedule, individuals can better manage their cash flow and budget accordingly.

IRS Tax Refund Process

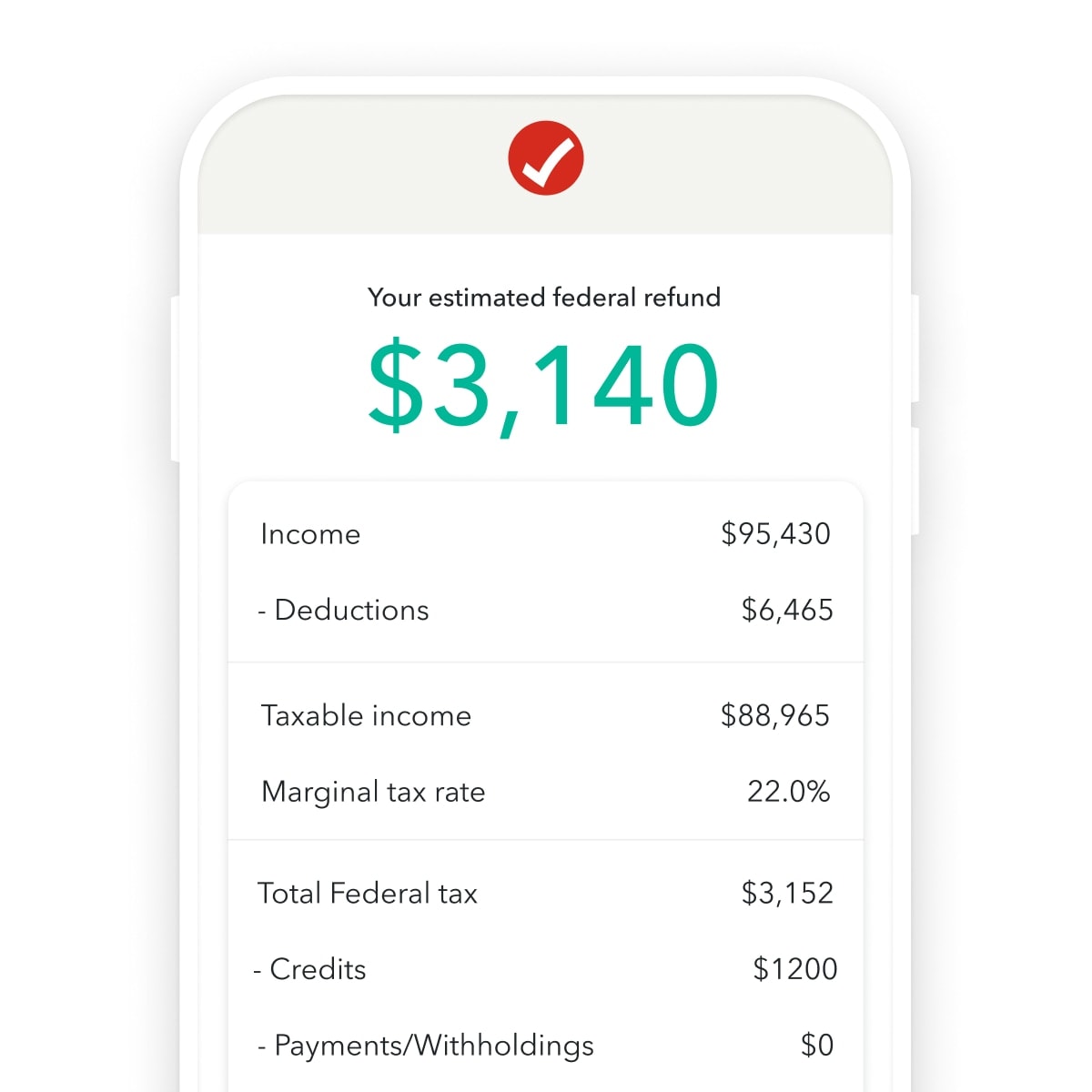

Each year, the IRS processes millions of tax returns and issues refunds to eligible taxpayers. The IRS Tax Payout Schedule 2025 details the timeline for when taxpayers can anticipate receiving their refunds based on the date they filed their returns.

It is important for taxpayers to file their returns accurately and on time to avoid any delays in receiving their refunds. The IRS usually issues refunds through direct deposit, paper check, or prepaid debit card.

Key Dates for Taxpayers in 2025

In 2025, taxpayers can expect the IRS Tax Payout Schedule to follow a similar pattern to previous years. The IRS typically begins accepting tax returns in January, and the deadline for filing is usually in mid-April.

It is recommended that taxpayers file their returns electronically for faster processing and to receive their refunds sooner. Additionally, individuals should be aware of any changes to tax laws or regulations that may impact their tax obligations and refund amounts.

Understanding the IRS Guidelines

When it comes to staying informed about the IRS tax payout schedule 2025, understanding the IRS guidelines is crucial. The IRS, or Internal Revenue Service, sets out rules and regulations that taxpayers must adhere to regarding tax payouts. By familiarizing yourself with these guidelines, you can better navigate the tax system and ensure compliance with the latest regulations.

Key IRS Guidelines for Tax Payouts

One of the key IRS guidelines revolves around the timelines for tax payouts. Taxpayers need to be aware of the specific dates and deadlines for filing their taxes and receiving potential refunds. Additionally, understanding the criteria for tax deductions and credits is essential for maximizing tax benefits.

Staying organized and keeping accurate records of income, expenses, and deductions is vital for complying with IRS guidelines. Failure to maintain proper documentation can lead to potential audits and penalties.

IRS Updates and Changes for 2025

For the year 2025, the IRS may introduce new updates or changes that taxpayers must be aware of. It is important to stay informed about any alterations to tax laws or policies to avoid any surprises during the tax payout process.

- Keep an eye out for updates on the IRS website

- Consult with tax professionals for expert guidance

- Attend IRS seminars or workshops for the latest information

Key Dates to Remember for Tax Payouts in 2025

As per the IRS tax payout schedule 2025, it’s crucial to mark your calendar with the following key dates to stay on top of your tax refunds and payments:

Deadline for W-2 Forms Submission

Employers must provide employees with their W-2 forms by January 31, 2025. Make sure to check for accuracy.

IRS Tax Filing Deadline

The deadline for filing your tax return and paying any taxes owed is April 15, 2025. Consider filing early to avoid penalties.

Estimated Tax Payment Deadlines

For individuals making quarterly estimated tax payments, the deadlines are:

- April 15, 2025: First Quarter Payment

- June 15, 2025: Second Quarter Payment

- September 15, 2025: Third Quarter Payment

- January 15, 2026: Fourth Quarter Payment

Factors Influencing IRS Tax Payout Schedule

When it comes to the IRS tax payout schedule in 2025, several factors play a crucial role in determining when individuals can expect to receive their tax refunds. Understanding these factors can provide insight into the timeline for receiving your tax payout.

1. Filing Method

The method you choose to file your taxes can greatly impact the timing of your tax refund. E-filing typically results in faster processing and payout compared to traditional paper filing.

2. Tax Credits and Deductions

Claiming certain tax credits or deductions may delay the processing of your tax return. Complex tax situations or errors in claiming credits can lead to a longer wait for your tax payout.

3. IRS Processing Times

The IRS processing times can vary based on the volume of tax returns received. High-volume periods, such as the peak of tax season, may result in longer processing times and delayed tax payouts.

Navigating Changes and Updates

As the IRS tax payout schedule for 2025 is revealed, it’s crucial to stay updated and adapt to any changes that may impact your financial planning. Staying informed about the latest updates ensures you can make well-informed decisions regarding your taxes.

Regularly Check for Updates

Make it a habit to regularly check the IRS website for any new announcements or modifications to the tax payout schedule for 2025. This way, you can stay ahead of any changes that could affect your financial obligations.

Stay informed about tax laws to ensure compliance and avoid any penalties.

Consult with Tax Professionals

Consider consulting with tax professionals or financial advisors to navigate through any complex changes in the IRS tax payout schedule for 2025. Their expertise can help you understand the implications and optimize your tax strategy accordingly.

- Seek guidance on tax planning strategies to maximize your financial outcomes.

- Review any alterations in the tax code to avoid errors in your filings.

Tips for Maximizing Your Tax Payout

When it comes to maximizing your tax payout, there are several strategies you can employ to make sure you get the most out of your refund or reduce your liability. One effective tip is to keep track of all your receipts and expenses throughout the year. This meticulous record-keeping can help you claim deductions and credits that you might otherwise overlook.

Plan Your Deductions Wisely

Be strategic about when you claim your deductions. Consider bundling expenses in certain years to exceed the standard deduction threshold, allowing you to itemize and maximize your deductions.

Additionally, consider contributing to tax-advantaged accounts like a 401(k) or an IRA to reduce your taxable income and potentially increase your refund.

Stay Informed About Tax Law Changes

It’s crucial to stay up-to-date on any changes to the tax laws that could impact your tax payout. Consult with a tax professional or use reliable resources to understand how updates in the tax code might affect your financial situation in IRS tax year 2025.

- Regularly check the IRS website for updates

- Review tax publications and news sources

- Consider seeking advice from a qualified tax advisor

Frequently Asked Questions

- What is the IRS Tax Payout Schedule?

- The IRS Tax Payout Schedule determines when taxpayers can expect to receive their tax refunds or stimulus payments from the IRS.

- Why is it important to know the IRS Tax Payout Schedule?

- Knowing the IRS Tax Payout Schedule helps individuals and businesses plan their finances accordingly by anticipating when they will receive their tax refunds or stimulus payments.

- How can I access the IRS Tax Payout Schedule for 2025?

- The IRS usually releases the Tax Payout Schedule for the upcoming year on their official website or through official announcements in the media.

- Are there specific dates mentioned in the IRS Tax Payout Schedule for 2025?

- Yes, the IRS Tax Payout Schedule for 2025 will contain specific dates when tax refunds or stimulus payments will be distributed to eligible recipients.

- What factors can affect the IRS Tax Payout Schedule?

- Factors such as the individual’s filing method, any errors on the tax return, or additional reviews by the IRS can impact the timing of tax refunds or payments.

In Summary: Understanding the IRS Tax Payout Schedule for 2025

As we conclude our exploration of the IRS tax payout schedule for 2025, it is evident that knowledge is power when it comes to managing your finances and planning for the future. By delving into the details of the schedule, taxpayers can stay informed about when to expect their refunds or payments, helping them better budget and make financial decisions.

Remember to mark important dates, stay updated with any changes from the IRS, and seek professional guidance if needed. By being proactive and well-informed, individuals can navigate the tax season with confidence and ease, ensuring a smoother financial journey ahead.