Are you eagerly anticipating your IRS refund in 2025? Understanding the IRS refund payment schedule 2025 is crucial to managing your finances effectively. Knowing key dates and processes can help you plan your expenses and budget wisely. In this blog, we will delve into the intricacies of the IRS refund payment schedule 2025, providing valuable insights and tips to navigate the refund process smoothly. We’ve got you covered, from the timeline for filing your tax returns to expected refund distribution dates. Stay tuned to unravel the secrets of maximizing your IRS refund in 2025!

View this post on Instagram

Introduction to IRS Refund Payment Schedule 2025

As we enter 2025, taxpayers are eager to understand this year’s IRS refund payment schedule. The IRS refund payment schedule 2025 outlines when taxpayers can expect to receive their refunds for overpaid taxes. It is crucial to stay informed about these schedules to plan your finances and manage your expectations effectively.

Key Features of IRS Refund Payment Schedule 2025

Understanding the key features of the IRS refund payment schedule 2025 can help taxpayers prepare adequately for the refund season. The schedule typically includes specific dates for when taxpayers can expect their refunds based on the date they filed their tax returns and the method of refund receipt.

Factors Influencing the Refund Schedule

Several factors can impact the IRS refund payment schedule in 2025. These may include the volume of tax returns received, any errors or discrepancies in the filings, and delays in processing due to exceptional circumstances. Taxpayers need to be aware of these factors to anticipate potential delays in receiving their refunds.

Tracking Your Refund

One convenient way to stay updated on the status of your refund is to use the IRS’s online “Where’s My Refund?” tool. By entering relevant information such as your Social Security number, filing status, and the exact refund amount, you can track the progress of your refund payment and get an estimated date when it will be deposited into your account.

Changes in IRS Refund Process for 2025

As we move into 2025, staying informed about the latest updates regarding the IRS refund process is crucial. Understanding the changes can help you navigate the system more effectively and ensure a smooth refund experience.

New Tax Legislation Impact

New tax legislation has influenced the IRS refund process for 2025, impacting how refunds are calculated and distributed. Taxpayers need to be aware of these changes to anticipate their refund amounts accurately.

Enhanced Verification Procedures

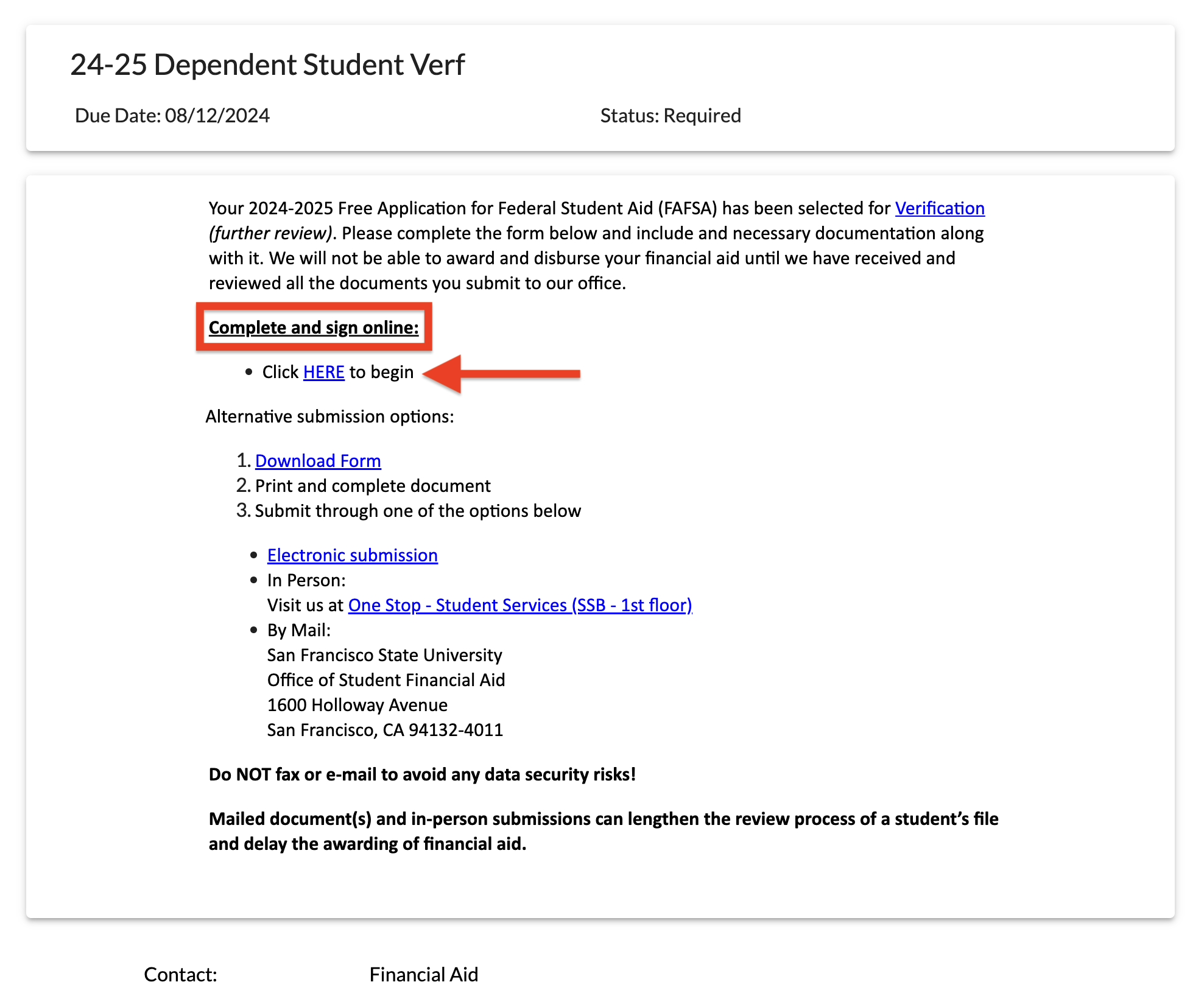

Due to increasing concerns about identity theft and fraud, the IRS has implemented enhanced verification procedures for refund processing in 2025. Taxpayers may experience additional steps to confirm their identities before receiving refunds.

Key Dates to Remember for IRS Refund Payments in 2025

As per the IRS refund payment schedule for 2025, there are several key dates that taxpayers need to keep in mind to ensure they receive their refunds on time.

1. Filing Date

One of the essential key dates is the filing date, which is the deadline for submitting your tax return to the IRS. The deadline for tax year 2025 is April 15, 2026.

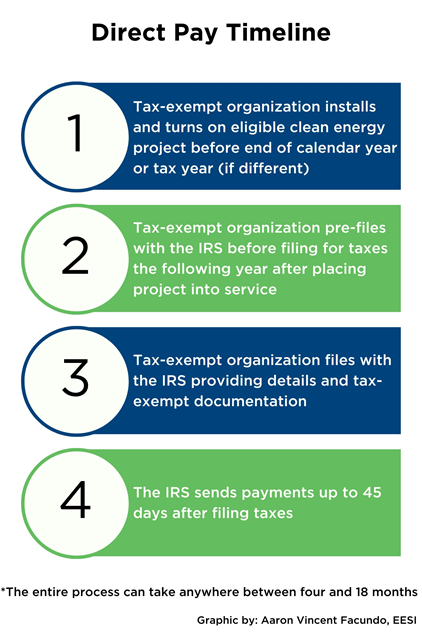

2. Direct Deposit Initiation

IRS usually issues refunds faster through direct deposit than paper checks. Taxpayers opting for direct deposit should ensure they provide accurate bank details so they can receive their refunds promptly.

3. Refund Processing Time

After filing the tax return, the refund processing time varies. The IRS states that most refunds are issued within 21 days if filed electronically, but it may take longer if filed by mail.

Understanding the IRS Refund Payment Schedule 2025

As taxpayers eagerly anticipate their refunds from the IRS, it is crucial to understand the IRS refund payment schedule for the year 2025. The IRS refund payment schedule outlines the timeline for taxpayers to receive their refunds based on various factors such as filing method, refund method, and any additional processing times.

Key Dates for IRS Refund Payment in 2025

It is essential to stay informed about the key dates related to IRS refund payments in 2025. Taxpayers can expect the IRS to start issuing refunds in February, depending on when the tax return was filed. The IRS typically issues refunds within 21 days of receiving a tax return, provided the return is error-free.

Factors Affecting Refund Timing

Several factors can impact the timing of IRS refund payments in 2025. Filing a paper return, claiming certain tax credits, or undergoing additional reviews by the IRS can result in delays in receiving a refund. Taxpayers opting for direct deposit typically receive their refunds faster than those receiving a paper check.

- Direct Deposit: Taxpayers who opt for direct deposit can expect to receive their refunds sooner than those who receive a paper check.

- Errors in Tax Return: Any errors or inconsistencies in a tax return can delay processing and issuing refunds.

- Additional Reviews: The IRS may review some tax returns additional times, which can prolong the refund process.

Tips for Maximizing Your IRS Refund in 2025

Maximizing your IRS refund in 2025 requires strategic planning and awareness of the latest regulations. Here are some tips to help you make the most of your refund:

File Early

Submitting your tax return early can expedite the processing of your refund. The earlier you file, the sooner you may receive your money back.

Claim Relevant Deductions

Claim all eligible deductions to reduce your taxable income and potentially increase your refund amount. This includes deductions for charitable contributions, education expenses, and more.

Consider Tax Credits

Explore tax credits that you qualify for, such as the Earned Income Tax Credit or the Child Tax Credit. These credits can directly reduce the amount of tax you owe and increase your refund.

Utilize Direct Deposit

Opting for direct deposit can help you receive your refund faster than waiting for a paper check in the mail. Provide accurate bank account information to avoid any delays.

Frequently Asked Questions

- What is the IRS Refund Payment Schedule for 2025?

- The IRS Refund Payment Schedule 2025 is the timeline in which taxpayers can expect to receive their refund after filing their tax returns for 2024.

- How can I check the status of my IRS refund for 2025?

- You can check the status of your IRS refund for 2025 by using the ‘Where’s My Refund’ tool on the IRS website or by calling the IRS refund hotline.

- Are there any changes to the IRS refund process for 2025?

- It is important to stay updated with any changes or updates to the IRS refund process for 2025 by checking the IRS website or consulting with a tax professional.

- What factors can affect the timing of my IRS refund for 2025?

- Several factors can affect the timing of your IRS refund for 2025, including errors on your tax return, discrepancies in information, or any delays in processing by the IRS.

- Is the IRS Refund Payment Schedule for 2025 the same for everyone?

- The IRS Refund Payment Schedule for 2025 may vary for each individual based on factors such as filing method, tax credits claimed, and any issues or discrepancies in the tax return.

Unlocking IRS Refund Payment Schedule 2025: A Roadmap to Financial Planning

As we explored the IRS refund payment schedule for 2025, we’ve gained valuable insights into the timelines and processes governing tax refund distributions. Understanding key dates, such as the start of tax season and the expected refund arrival times, is crucial for effective financial planning. By staying informed and organized, taxpayers can easily navigate the refund process and make informed decisions about their finances. Remember to file early, use e-filing options, and consider direct deposit for faster refunds. Let’s empower ourselves with knowledge and proactive tax strategies to maximise our refunds in the coming year!