Understanding the intricate details of the IRS pay schedule 2025 is crucial for taxpayers and professionals alike. As we look ahead to the upcoming year, it is essential to stay informed about any changes or updates that may impact your finances. The IRS pay schedule 2025 outlines the dates when federal employees can expect to receive their salaries, making it a significant aspect of financial planning. By delving into the specifics of the IRS pay schedule 2025, individuals can better anticipate their income and plan their budgets accordingly. Join us as we navigate through the key information regarding the IRS pay schedule for 2025 and equip ourselves with the knowledge needed to stay financially prepared.

Thanks to hard work and long hours by dedicated #IRS employees, Economic Impact Payments are going out on schedule, as planned, without delay, to the nation. The IRS employees are delivering these payments in record time. #COVIDreliefIRS pic.twitter.com/cXOgNh87Ah

— IRSnews (@IRSnews) April 15, 2020

Introduction to IRS Pay Schedule 2025

Understanding the IRS Pay Schedule 2025 is essential for individuals anticipating their tax refunds or making estimated tax payments. The IRS Pay Schedule outlines the dates when taxpayers can expect to receive their refunds based on when they filed their tax returns. It provides a structured timeline for processing tax refunds, ensuring efficiency and transparency in the tax system.

Key Features of IRS Pay Schedule 2025

For the tax year 2025, the IRS has introduced some significant changes to the Pay Schedule to streamline the refund process. Taxpayers can now track the status of their refunds more easily through the IRS website, allowing for improved communication and access to real-time information.

Additionally, the IRS has announced faster processing times for electronic returns, reducing the waiting period for taxpayers to receive their refunds. This enhancement aims to provide individuals with quicker access to funds and promote greater financial stability.

Important Dates to Remember

Taxpayers must be aware of key dates in the IRS Pay Schedule 2025 to plan their finances effectively. Filing your tax return early can expedite the refund process, potentially resulting in faster receipt of your refund. Stay informed about important deadlines and submission dates to avoid any delays in receiving your tax refund.

Mark your calendar for the opening of tax season, the deadline for filing your return, and expected refund disbursement dates according to the IRS Pay Schedule 2025. By staying organized and proactive, you can navigate the tax process with ease and maximize the benefits of timely refunds.

Changes and Updates for IRS Pay Schedule 2025

As we delve into the IRS Pay Schedule for 2025, it’s crucial to stay updated on the latest changes and updates to ensure smooth financial transactions. The IRS periodically revises its payment schedule to streamline processes and enhance efficiency for both taxpayers and the government.

New Tax Bracket Adjustments

The IRS has introduced updated tax bracket adjustments for the year 2025, impacting how individuals and businesses calculate their tax obligations. These adjustments aim to reflect the current economic landscape and ensure fair tax assessments.

Additionally, tax credits and deductions have been revised to align with the evolving financial scenarios.

Revised Payment Processing Timelines

One of the significant updates for the IRS Pay Schedule 2025 includes revised payment processing timelines. Taxpayers can expect more efficient processing of refunds and payments, reducing delays and enhancing overall satisfaction.

- Enhanced electronic payment options for faster transactions

- Improved processing mechanisms for quicker refund disbursements

Understanding the IRS Pay Schedule 2025

As we delve into the intricacies of the IRS pay schedule for the year 2025, it is essential to comprehend the timeline and structure dictating when taxpayers can expect to receive their refunds or make payments to the IRS. The IRS Pay Schedule 2025 outlines the specific dates and frequency at which payments are processed, reflecting the latest guidelines and regulations issued by the Internal Revenue Service.

Key Features of IRS Pay Schedule 2025

One of the significant aspects of the IRS pay schedule for 2025 is the emphasis on timely payments and refunds to taxpayers. With evolving tax laws and economic conditions, the schedule aims to streamline the process and ensure efficiency in financial transactions.

The IRS pay schedule 2025 also accounts for various factors such as electronic filing, paper checks, and direct deposits, offering taxpayers flexibility in choosing their preferred mode of payment or refund receipt.

Important Dates and Deadlines

For taxpayers eagerly anticipating their refunds, understanding the critical dates in the IRS pay schedule 2025 is paramount. IRS Pay Schedule 2025 highlights key deadlines for filing returns and making payments, helping individuals and businesses plan their finances effectively.

- January 31, 2025: Deadline for employers to issue W-2 forms

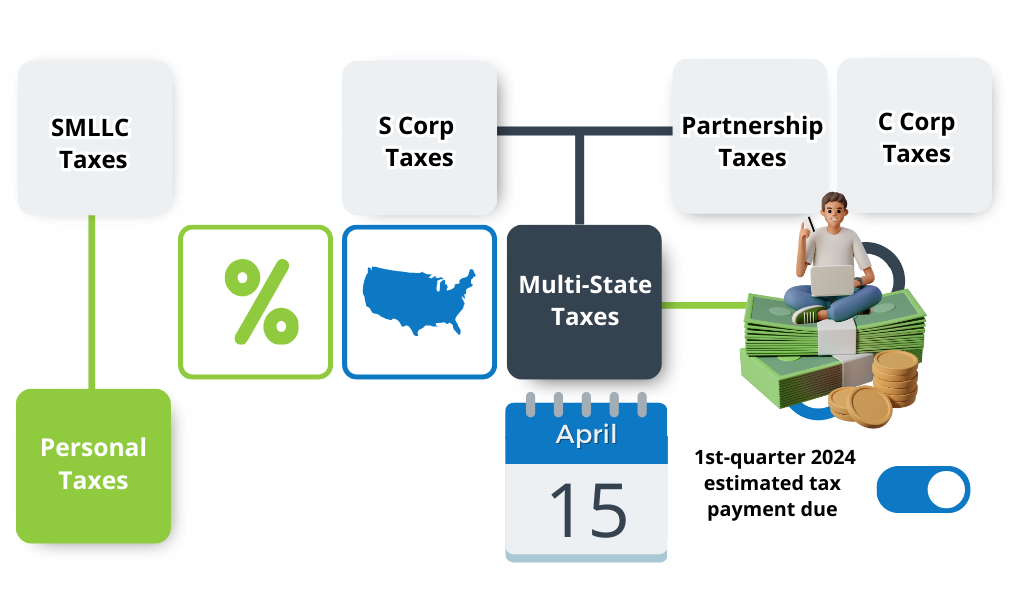

- April 15, 2025: Deadline for filing individual tax returns

- October 15, 2025: Extension deadline for filing tax returns

Important Dates to Remember for IRS Pay Schedule 2025

As you plan your finances for the year 2025, it’s crucial to keep track of the key dates related to the IRS pay schedule. Ensuring you adhere to these dates will help you avoid any potential penalties or delays in receiving your payments.

Key Dates

Below are some important dates you need to remember for the IRS pay schedule in 2025:

- January 10, 2025: Deadline for employers to provide W-2 forms to employees.

- April 15, 2025: Deadline for individuals to file their tax returns for the year 2024.

- June 15, 2025: The second quarterly estimated tax payment is due for self-employed individuals.

- September 15, 2025: Third quarterly estimated tax payment due for self-employed individuals.

- December 31, 2025: Deadline for making any last-minute tax-deductible donations for the year.

Impact of IRS Pay Schedule 2025 on Taxpayers

With the upcoming changes to the IRS Pay Schedule 2025, taxpayers need to be aware of the potential impacts on their financial planning and budgeting. The new schedule could affect the timing of when individuals receive their tax refunds or make tax payments, leading to adjustments in cash flow management.

Delayed Refunds

One significant impact of the IRS Pay Schedule 2025 is the possibility of delayed tax refunds for taxpayers. This delay can affect those who rely on their refunds for essential expenses or financial goals. Individuals must pay and be prepared for potential delays in receiving their refunds.

Adjusted Payment Deadlines

Additionally, the new pay schedule may lead to adjusted tax payment deadlines. Taxpayers need to be aware of any changes in due dates for tax liabilities to avoid penalties or interest charges. Staying informed and setting reminders can help individuals meet their payment obligations on time.

Tips for Managing Finances with IRS Pay Schedule 2025

Managing finances effectively with the IRS Pay Schedule 2025 is crucial for financial stability. Here are some tips to help you navigate the pay schedule efficiently:

1. Create a Budget and Stick to It

Creating a detailed budget that aligns with your IRS pay schedule can help you track your income and expenses effectively. Make sure to review and adjust your budget as needed regularly.

2. Build an Emergency Fund

Having an emergency fund is essential to cover unexpected expenses that may arise between paydays. Ensure you set aside a portion of your income to build up your emergency fund gradually.

- Set a specific savings goal for your emergency fund.

- Consider automating your savings to make the process easier.

Frequently Asked Questions

- What is the IRS Pay Schedule for 2025?

- The IRS Pay Schedule for 2025 outlines the dates when employees can expect to receive their salary or wages from the Internal Revenue Service. It typically specifies the pay periods, the dates of payment, and other relevant details.

- How can I find the IRS Pay Schedule for 2025?

- To access the IRS Pay Schedule for 2025, you can visit the official IRS website or contact your HR department for the information. The schedule is usually published online and may be available through internal company communications as well.

- Are there any changes in the IRS Pay Schedule for 2025 compared to previous years?

- Changes in the IRS Pay Schedule for 2025, if any, will be communicated by the IRS or your employer. It’s essential to review the updated schedule to ensure you are aware of any modifications in pay dates or processes.

- What happens if there is a delay in the IRS Pay Schedule for 2025?

- In case of a delay in the IRS Pay Schedule for 2025, employees are advised to contact their HR department or the appropriate IRS representatives for clarification. Delays could be due to various reasons, so it’s crucial to seek accurate information and updates.

- Can I request early payment from the IRS Pay Schedule for 2025?

- Requests for early payment from the IRS Pay Schedule for 2025 may be subject to company policies and IRS regulations. It’s recommended to follow the standard pay schedule unless alternative arrangements have been officially communicated and approved.

Final Thoughts: Navigating the IRS Pay Schedule 2025

Understanding the IRS pay schedule for 2025 is crucial for all taxpayers and employers. As we have delved into the details of this topic, it is evident that changes lie ahead in how the IRS will process payments in the coming year. By staying informed and being aware of key dates and guidelines, individuals can effectively plan their finances and avoid any potential issues with tax payments.

Remember, the IRS pay schedule 2025 plays a significant role in ensuring timely and accurate tax payments, so it is essential to keep track of updates and announcements from the IRS. Stay proactive, stay informed, and remain compliant to make your tax journey smooth and hassle-free in the upcoming year.