Are you ready for tax season 2025? The IRS open date 2025 schedule has been announced, and it’s time to mark your calendars for the important tax deadlines ahead. Knowing the key dates for filing your taxes and making payments is crucial to staying organized and avoiding any penalties. In this blog, we will guide you through the IRS open date 2025 schedule, highlighting the key deadlines that you need to be aware of. Stay tuned as we provide you with essential information to help you navigate the upcoming tax season smoothly and efficiently. Get ready to take charge of your finances and stay on top of your tax obligations!

#IRS has kicked off the 2023 tax filing season. This year, the tax deadline is April 18, 2023 for most people. Gather all information you need to prepare a complete and accurate tax return before you file to reduce errors. See: https://t.co/c7Ocqeejxb pic.twitter.com/6l3M8vgpcZ

— IRSnews (@IRSnews) January 23, 2023

Introduction to IRS Open Date 2025 Schedule

Filing taxes is a crucial annual task for individuals and businesses. The IRS Open Date 2025 Schedule marks the start of a new tax season, bringing with it important deadlines and milestones. This schedule provides taxpayers with the necessary information on when they can begin preparing and submitting their tax returns for the 2025 financial year.

Understanding the IRS Open Date

Each year, the IRS releases a schedule outlining key dates for taxpayers to keep in mind. The IRS Open Date 2025 Schedule sets the stage for when individuals can expect to start filing their taxes for the year.

Key Dates and Deadlines

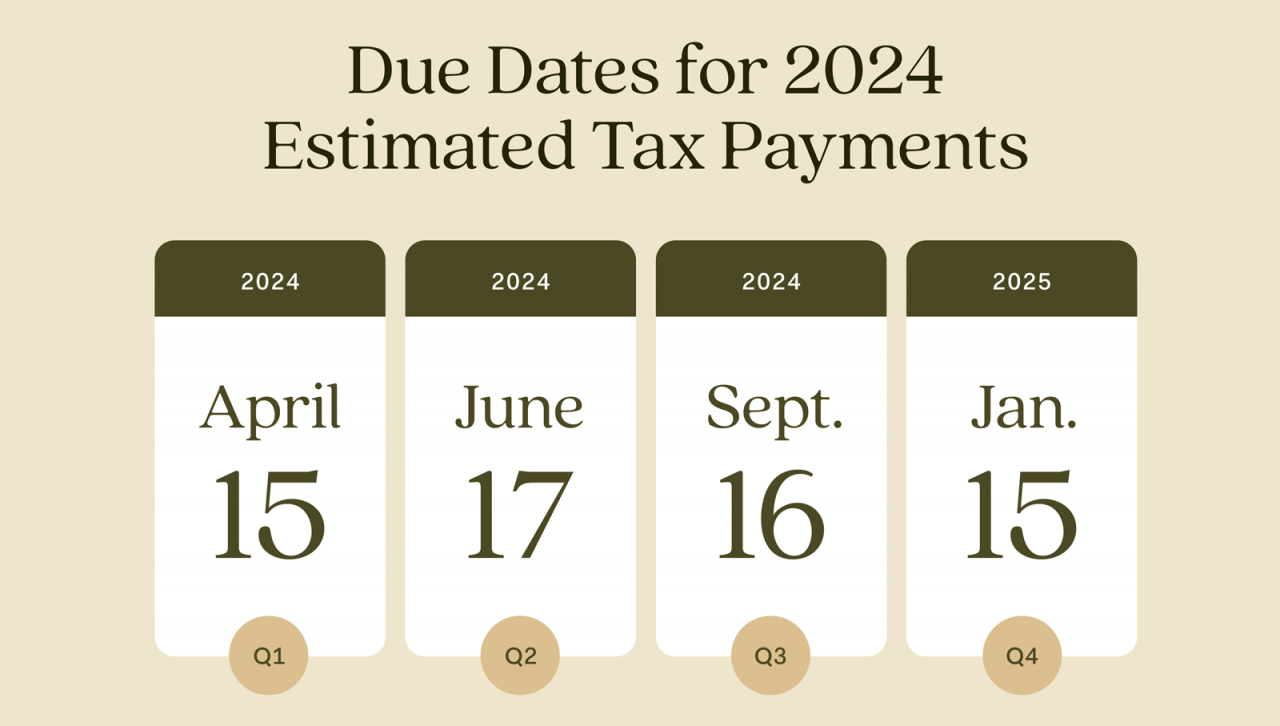

It is essential to stay informed about important tax deadlines to avoid penalties or late fees. The IRS Open Date 2025 Schedule includes crucial dates such as the deadline for filing taxes, estimated tax payment due dates, and more.

- April 15, 2025 – Deadline for filing individual tax returns

- June 15, 2025 – Estimated tax payment due for taxpayers who are self-employed or have additional sources of income

- October 15, 2025 – Extended filing deadline for taxpayers who filed for an extension

Important Tax Deadlines for 2025

As per the IRS open date 2025 schedule, it is crucial for taxpayers to mark their calendars with important tax deadlines to avoid penalties and ensure timely compliance. Below are the key deadlines for the tax year 2025:

1. Individual Income Tax Deadlines

Individual taxpayers need to be aware of the following deadlines:

- April 15, 2025: Deadline to file income tax returns and pay any taxes owed.

- October 15, 2025: Final deadline with extension for filing tax returns.

2. Business Tax Deadlines

Businesses have specific deadlines to adhere to:

- March 15, 2025: Deadline for S-Corporations and partnerships to file tax returns.

- April 15, 2025: Deadline for C-Corporations to file tax returns.

Key Dates to Remember for IRS Filing

Mark your calendars for the important tax deadlines in the IRS Open Date 2025 Schedule. Staying informed about these key dates will help you stay organized and avoid any penalties or late fees.

IRS Open Date 2025 Schedule Overview

As per the IRS Open Date 2025 Schedule, the tax filing season will officially begin on January 27, 2025. This is the date when the IRS will start accepting tax returns for the year.

Deadline for Tax Return Submission

The deadline to submit your tax return for the year 2025 is April 15, 2025. It’s crucial to file your taxes on time to avoid any penalties.

Extensions and Late Filing

If you need more time to file your taxes, you can request an extension until October 15, 2025. Keep in mind that while an extension grants you more time to file your return, it does not extend the deadline for paying any taxes owed.

Updates and Changes in the 2025 IRS Schedule

As we approach the IRS open date 2025 schedule, it’s crucial to stay informed about any updates or changes in the IRS schedule to ensure compliance with tax deadlines. The IRS periodically releases updates to its schedule, which taxpayers should be aware of to avoid any penalties or issues with their tax filings.

New Tax Deadlines

For the year 2025, the IRS has introduced several new tax deadlines that taxpayers need to be mindful of. These deadlines may impact various types of tax filings, including individual income tax returns, business tax returns, and more. It is essential to review these changes and adjust your tax preparation accordingly.

Modified Filing Procedures

The IRS has also made some modifications to the filing procedures for the 2025 tax year. These changes may include updates to electronic filing requirements, documentation submission guidelines, or other procedural adjustments aimed at streamlining the tax filing process for taxpayers.

- Electronic filing mandate updates

- Documentation submission guidelines

- Procedural adjustments for tax filing

Tips for Efficient Tax Planning

Efficient tax planning is crucial to ensure compliance with the IRS Open Date 2025 Schedule and maximize savings on taxes. Here are some essential tips to help you navigate the tax season smoothly:

Start Early

Begin organizing your financial documents well in advance to avoid any last-minute rush during tax filing. Starting early will give you ample time to gather all necessary information.

Utilize Tax-Advantaged Accounts

Consider contributing to retirement accounts such as IRA or 401(k) to reduce your taxable income. Maximizing contributions to these accounts can lead to significant tax savings.

- Contribute to HSA for healthcare expenses.

- Utilize FSA for eligible expenses.

Resources for Taxpayers for IRS Open Date 2025

As the IRS Open Date 2025 schedule approaches, it’s crucial for taxpayers to stay informed about important tax deadlines and resources available. Being prepared and organized can help streamline the tax filing process and ensure compliance with tax laws.

IRS Website

One of the primary resources for taxpayers is the official IRS website. Here, you can find a wealth of information, forms, publications, and guidelines to help you navigate the tax season smoothly. The website also provides updates on tax law changes and deadlines.

For more details, visit the IRS website.

Tax Filing Software

Utilizing tax filing software can simplify the process of preparing and filing taxes. Many software options offer step-by-step guidance, error checks, and electronic filing options to make the tax process more efficient.

Explore popular tax software such as TurboTax, H&R Block, or TaxACT for an easier tax season.

Tax Preparation Checklist

Creating a tax preparation checklist can help you gather all necessary documents and information needed for filing your taxes accurately. This checklist can include W-2 forms, investment statements, and receipts for deductions.

Stay organized with a comprehensive tax preparation checklist for IRS Open Date 2025.

Frequently Asked Questions

- What is the significance of IRS Open Date 2025 Schedule?

- The IRS Open Date 2025 Schedule marks the start of the tax year for 2025, setting important deadlines for filing taxes and making payments.

- Why is it important to mark the IRS Open Date 2025 Schedule on your calendar?

- Marking the IRS Open Date 2025 Schedule on your calendar ensures that you are aware of important tax deadlines and can plan ahead to avoid penalties for late filing or payments.

- What are some of the key tax deadlines to note from the IRS Open Date 2025 Schedule?

- Some key tax deadlines to note from the IRS Open Date 2025 Schedule include the deadline for filing individual tax returns, making estimated tax payments, and submitting business tax forms.

- How can individuals stay informed about changes to the IRS Open Date 2025 Schedule?

- Individuals can stay informed about changes to the IRS Open Date 2025 Schedule by regularly checking the IRS website, signing up for tax alerts, or consulting with a tax professional.

Conclusion: Stay Ahead with IRS Open Date 2025 Schedule

In conclusion, the IRS Open Date 2025 Schedule is a vital tool for every taxpayer to mark their calendars with important tax deadlines and stay ahead of their financial responsibilities. By keeping track of key dates such as filing deadlines, extension deadlines, and payment due dates, you can avoid last-minute stress and potential penalties. Utilizing the IRS Open Date 2025 Schedule ensures a smooth tax season and helps you effectively manage your finances. Remember, early preparation is key to a successful filing process. So, take note of the schedule, plan ahead, and make sure you meet all the necessary deadlines to stay compliant with the IRS regulations.