Are you a resident or business owner in California trying to navigate the updated withholding schedules for 2025? Understanding the California withholding schedules for 2025 is crucial for accurate tax compliance and financial planning. In this blog, we will delve into the intricacies of the latest withholding schedules in California to equip you with the knowledge you need. Whether you are an employee or an employer, staying informed about the withholding schedules can impact your tax liabilities and ensure smooth operations. Join us as we decode the complexities of the California withholding schedules for 2025 and explore what you need to know to stay ahead.

Employers! Do you know where to go for updates and resources to support your business? Bookmark our California Employer News and Updates webpage! You’ll find:

✔️ Employer and payroll tax updates.

✔️ Payroll tax withholding schedules.1/2 pic.twitter.com/8xH6FyyAXE

— EDD (@CA_EDD) February 13, 2024

Understanding Withholding Schedules

Withholding schedules play a crucial role in determining the amount of state income taxes that employers withhold from employees’ paychecks. For California employers and employees in 2025, understanding the California withholding schedules is vital to ensure accurate tax deductions.

California Withholding Schedules for 2025 Overview

California withholding schedules for 2025 are designed based on the employee’s filing status, number of allowances claimed, and the payroll period. The schedules help in calculating the correct amount of state income tax to be withheld from each paycheck.

Key Components of Withholding Schedules

The withholding schedules consider various factors, including the employee’s marital status, income level, and any additional state tax withholding specified by the employee. Employers must accurately follow these schedules to avoid under or over withholding.

- Marital Status: The withholding schedules account for whether the employee is single, married, or head of household, impacting the tax rates.

- Allowances: Employees can claim allowances based on their specific tax situation, affecting the amount of tax withheld.

Significance of Withholding Schedules in California

Understanding the **California withholding schedules for 2025** is crucial for both employers and employees. Withholding schedules determine the amount of state income tax that needs to be withheld from an employee’s wages. These schedules are based on various factors such as employee income, marital status, and allowances claimed. Employers must accurately calculate and withhold the correct amount to avoid under or over withholding.

Importance of Compliance

**Proper compliance** with California withholding schedules is essential to avoid penalties and fines. Employers need to stay up-to-date with the latest **2025** schedules to ensure accurate withholding. Failure to comply can lead to legal issues and negative implications for both employees and employers.

Impact on Employees

**Employees** rely on accurate withholding schedules to manage their finances effectively. Incorrect withholding amounts can result in unexpected tax bills or lower take-home pay. By adhering to the **2025** schedules, employees can avoid financial surprises and plan their budgets more efficiently.

Changes and Updates for 2025

As we step into 2025, there are notable changes and updates to the California withholding schedules for the year. Employers and employees alike need to be aware of these modifications to ensure compliance and accurate tax deductions.

New Tax Rates Implemented

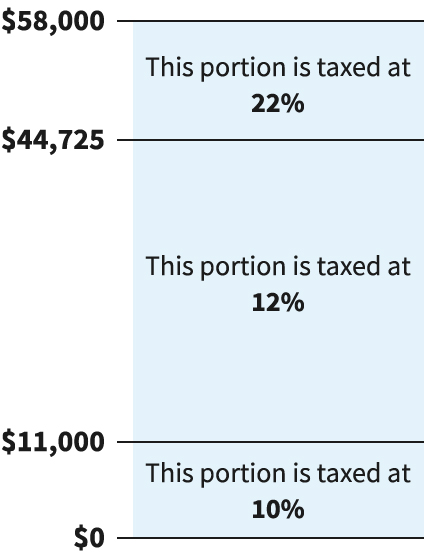

In 2025, California has implemented new tax rates affecting the withholding schedules. These updated rates directly impact the amount of tax withheld from employee paychecks. It is crucial for employers to adjust their payroll systems to reflect these changes accurately. California withholding schedules for 2025 now include updated tax brackets that individuals fall into based on their income levels.

Increased Standard Deductions

Another significant update for 2025 is the increase in standard deductions for California taxpayers. This adjustment provides individuals with higher deduction amounts, ultimately reducing taxable income. It is essential for taxpayers to be aware of these changes to maximize their deductions and minimize tax liabilities while ensuring compliance.

How Withholding Schedules Impact Taxpayers

Understanding the California withholding schedules for 2025 is crucial for taxpayers as it directly affects how much tax is withheld from their paychecks throughout the year. These schedules determine the amount of state income tax that employers withhold from employees’ wages based on factors like income level and filing status.

Impact on Cash Flow

The withholding schedules can significantly impact taxpayers’ cash flow. If the withholding rate is set too high, taxpayers may receive a smaller paycheck each pay period, leading to potential financial strain. Conversely, if the withholding rate is too low, taxpayers may end up owing more money during tax season.

Accuracy in Tax Payments

Adhering to the correct withholding schedules ensures that taxpayers make accurate and timely tax payments. This helps individuals avoid underpayment penalties and interest charges while also ensuring they do not overpay, allowing them to maintain better control over their finances.

Key Considerations for Employers and Employees

When it comes to understanding and applying the California withholding schedules for 2025, both employers and employees need to be well-informed to ensure compliance and smooth payroll processing. Here are some key considerations:

For Employers:

Employers must stay updated on the latest withholding schedules provided by the California Employment Development Department (EDD) to accurately calculate and withhold state income taxes from employee paychecks. Failure to do so can result in penalties and legal issues.

It is essential for employers to communicate any changes in withholding schedules to their payroll department promptly to avoid errors in tax deductions on employee wages.

For Employees:

Employees should review their pay stubs regularly to ensure that the correct amount of state income tax is being deducted based on the updated withholding schedules for 2025. Any discrepancies should be reported to the employer for immediate resolution.

Understanding the California withholding schedules can help employees better plan their finances and avoid any surprises during tax season. It is advisable for employees to seek guidance from tax professionals if they have specific tax-related questions.

Frequently Asked Questions

- What are California Withholding Schedules?

- California Withholding Schedules dictate the amount of state income tax that employers withhold from employees’ paychecks based on factors such as filing status and number of allowances claimed.

- Why is it important to understand California Withholding Schedules for 2025?

- Understanding the California Withholding Schedules for 2025 is crucial for both employers and employees to ensure accurate and compliant withholding of state income taxes.

- How do California Withholding Schedules for 2025 differ from previous years?

- California Withholding Schedules for 2025 may have updates to reflect changes in tax laws, rates, or brackets, so it is important to stay informed about the latest changes.

- Where can I find the California Withholding Schedules for 2025?

- The California Franchise Tax Board (FTB) provides official resources and information regarding the 2025 withholding schedules for reference.

- How can I ensure accurate withholding using California Withholding Schedules for 2025?

- Employers should regularly review and update their payroll systems to incorporate the latest California Withholding Schedules for 2025 to avoid under or over withholding state income taxes.

Unraveling the Mystery: Understanding California Withholding Schedules for 2025

As we conclude our deep dive into the California withholding schedules for 2025, it is clear that navigating the intricacies of tax deductions can be complex yet crucial. By learning about the various withholding schedules and how they impact your paycheck, you empower yourself to take control of your finances and ensure compliance with state regulations.

Remember, staying informed about these schedules can prevent any surprises come tax season and help you make informed decisions about your withholdings. So, whether you are an employee or employer in California, familiarizing yourself with these schedules is key to financial stability.

In Summary, grasp the nuances of California withholding schedules for 2025 to secure your financial future and avoid any tax-related pitfalls.