Are you eager to unravel the mysteries of the 2025 state tax refund schedule? Understanding the intricacies of state tax refund processes can help you plan your finances effectively. As tax laws evolve, being informed about the upcoming 2025 state tax refund schedule is crucial for maximizing your refunds and ensuring a smooth filing experience. In this blog, we will delve into everything you need to know about the 2025 state tax refund schedule – from key dates to important changes, we’ve got you covered. Get ready to navigate the world of state tax refunds with confidence and stay ahead of the game in managing your finances.

I'm going to put money back into the pockets of Pennsylvanians by sending a gas tax refund of $250 per car — up to four per family.

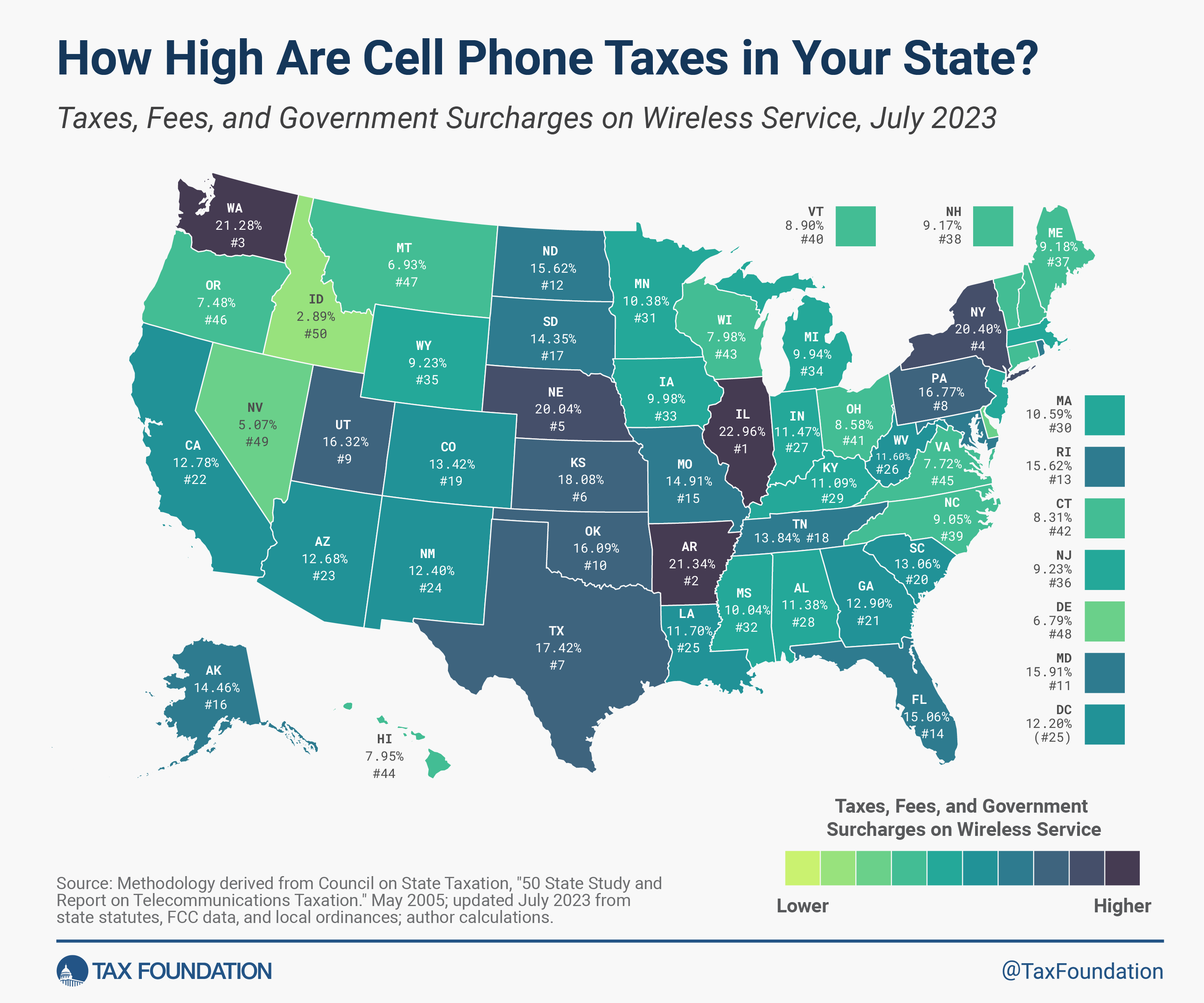

I'm eliminating taxes on your cell phone bill. 11% of state taxes on every monthly bill — back in your pocket.

— Josh Shapiro (@JoshShapiroPA) March 17, 2022

Understanding State Tax Refunds in 2025

When it comes to navigating the 2025 state tax refund schedule, taxpayers need to stay informed about the latest updates and changes to avoid any potential delays or confusion.

State-Specific Refund Timelines

Each state has its own unique timeline for processing and issuing tax refunds. It’s essential to familiarize yourself with your state’s specific guidelines to know when to expect your refund.

For example, some states may expedite refunds for electronic filers, while others may have a set timeframe for processing paper returns.

Filing Methods Impact on Refund Timing

The method you use to file your taxes can also affect the timing of your refund. E-filing typically results in quicker processing and turnaround times compared to traditional paper filing.

By choosing direct deposit for your refund, you can further expedite the process and receive your funds faster.

Importance of Knowing the 2025 Tax Refund Schedule

Understanding the 2025 state tax refund schedule is crucial for individuals and businesses alike. By knowing when to expect your tax refunds, you can better plan your finances and make informed decisions. Missing the deadlines could result in delays in receiving your refund, which might impact your financial stability.

Planning Financial Goals

Knowing the 2025 state tax refund schedule enables you to incorporate it into your financial planning. Whether you are looking to make major purchases, investments, or savings goals, having a clear idea of when your tax refund will arrive can help you strategize effectively.

It is advisable to use your tax refund wisely, such as paying off debts, boosting emergency savings, or investing for the future.

Compliance and Avoiding Penalties

Being aware of the 2025 tax refund schedule helps you stay compliant with tax laws and regulations. Filing your taxes on time and meeting refund deadlines can prevent unnecessary penalties and fees.

Missing the tax refund schedule can lead to complications with the IRS and may result in additional fines, so staying informed is essential.

Key Deadlines for State Tax Refunds in 2025

As taxpayers eagerly await their state tax refunds in 2025, it’s essential to be aware of the key deadlines to ensure a seamless refund process. Timely filing and meeting deadlines are crucial to receiving your refund promptly. Below are the important dates to mark on your calendar:

Filing Deadline

The filing deadline for state tax refunds in 2025 is generally April 15th. It’s crucial to submit your state tax return by this date to avoid penalties and delays in receiving your refund. However, it’s advisable to file your return as early as possible to expedite the refund process. Taxpayers can use electronic filing methods for quicker processing.

Estimated Refund Date

Once you’ve filed your state tax return for 2025, the next vital date to keep in mind is the estimated refund date. Refunds are typically issued within 3 to 4 weeks after the return is processed. To track the status of your refund, you can use the online tools provided by your state’s taxation department.

Tips for Maximizing Your State Tax Refund in 2025

Maximizing your state tax refund in 2025 requires strategic planning and knowledge of the current tax laws. To make the most of your refund, consider the following tips:

1. Stay Informed About Tax Law Changes

Keeping up to date with any changes in the tax laws for the 2025 state tax refund schedule is crucial. Understand how new regulations might impact your refund amount.

2. Take Advantage of Deductions and Credits

Ensure you claim all eligible deductions and credits to reduce your taxable income and increase your potential refund. Be aware of specific deductions or credits introduced in 2025.

3. File Early and Electronically

Filing your tax return early and electronically can expedite the refund process. By filing online, you can receive your refund faster and avoid any delays.

Changes and Updates to State Tax Refunds in 2025

In 2025, there are significant changes and updates to the state tax refund process that taxpayers need to be aware of. Keeping track of the 2025 state tax refund schedule is crucial for proper financial planning and budgeting.

New State Tax Refund Processing System

States have implemented a new streamlined process for issuing tax refunds in 2025 to expedite the refund timeline. Taxpayers can now expect quicker processing and delivery of their refunds.

Enhanced Security Measures

Due to the increasing incidents of tax refund fraud, states have bolstered their security measures in 2025 to safeguard taxpayers’ personal information and financial data. This additional layer of security aims to prevent identity theft and fraudulent refund claims.

Electronic Filing Encouragement

In 2025, states are actively promoting electronic filing for tax returns to streamline the refund process further. Taxpayers who file electronically can expect faster processing times and expedited refund disbursement.

Frequently Asked Questions

- What is the 2025 State Tax Refund Schedule?

- The 2025 State Tax Refund Schedule is a timetable outlining when state tax refunds for the year 2025 will be issued by each state’s revenue department.

- Why is it important to know the 2025 State Tax Refund Schedule?

- Knowing the 2025 State Tax Refund Schedule is crucial for taxpayers as it helps them anticipate when they can expect to receive their tax refunds and plan their finances accordingly.

- How can I access the 2025 State Tax Refund Schedule for my state?

- You can typically find the 2025 State Tax Refund Schedule for your state on the official website of your state’s revenue department or tax agency.

- Are there any changes in the 2025 State Tax Refund Schedule compared to previous years?

- The 2025 State Tax Refund Schedule may have changes compared to previous years due to updated tax laws, processing timelines, or other factors. It’s advisable to review the latest schedule for accurate information.

- What should I do if my state tax refund is delayed based on the 2025 schedule?

- If your state tax refund is delayed according to the 2025 schedule, you may need to contact your state’s revenue department or tax agency to inquire about the status of your refund and any potential reasons for the delay.

Unlocking the 2025 State Tax Refund Schedule: Final Thoughts

As we conclude our exploration of the 2025 state tax refund schedule, it becomes clear that staying informed and planning ahead are key to maximizing your tax refund benefits. By understanding the timelines, requirements, and possible delays associated with state tax refunds, you are better equipped to manage your finances efficiently.

Remember to file your taxes on time, utilize online tools for tracking refunds, and consider direct deposit for faster processing. Stay updated with any legislative changes that may impact your refund schedule, and seek professional assistance if needed.

Empower yourself with knowledge and stay proactive to ensure a smooth and timely refund process. Here’s to a financially savvy 2025!