Are you ready to master the 2025 IRS refund schedule chart and streamline your tax return process? As tax season approaches, understanding the IRS refund schedule for 2025 is crucial for ensuring timely refunds. This comprehensive guide will provide you with insights into when you can expect to receive your refund based on the IRS refund schedule 2025 chart. By unlocking the details of the 2025 IRS refund schedule, you’ll be equipped to plan your finances more effectively and avoid unnecessary delays in receiving your refund. Let’s delve into the intricacies of the IRS refund schedule 2025 chart and empower you with the knowledge needed for a smooth tax season ahead.

Introduction to IRS Refund Schedule 2025

IRS refund schedule 2025 chart is crucial for taxpayers to plan and manage their finances efficiently. Understanding the IRS refund schedule can help individuals anticipate the timeline for receiving their tax refunds.

Key Features of IRS Refund Schedule 2025

For the tax year 2025, the IRS refund schedule provides specific dates when taxpayers can expect to receive their refunds based on when they filed their tax returns. It outlines the schedule for processing tax refunds, ensuring transparency and predictability for taxpayers.

Being aware of the IRS refund schedule 2025 chart enables individuals to estimate the arrival of their refunds accurately, allowing them to plan their finances accordingly. Staying informed about the IRS refund timeline can prevent any unnecessary financial stress.

How to Use the IRS Refund Schedule 2025 Chart

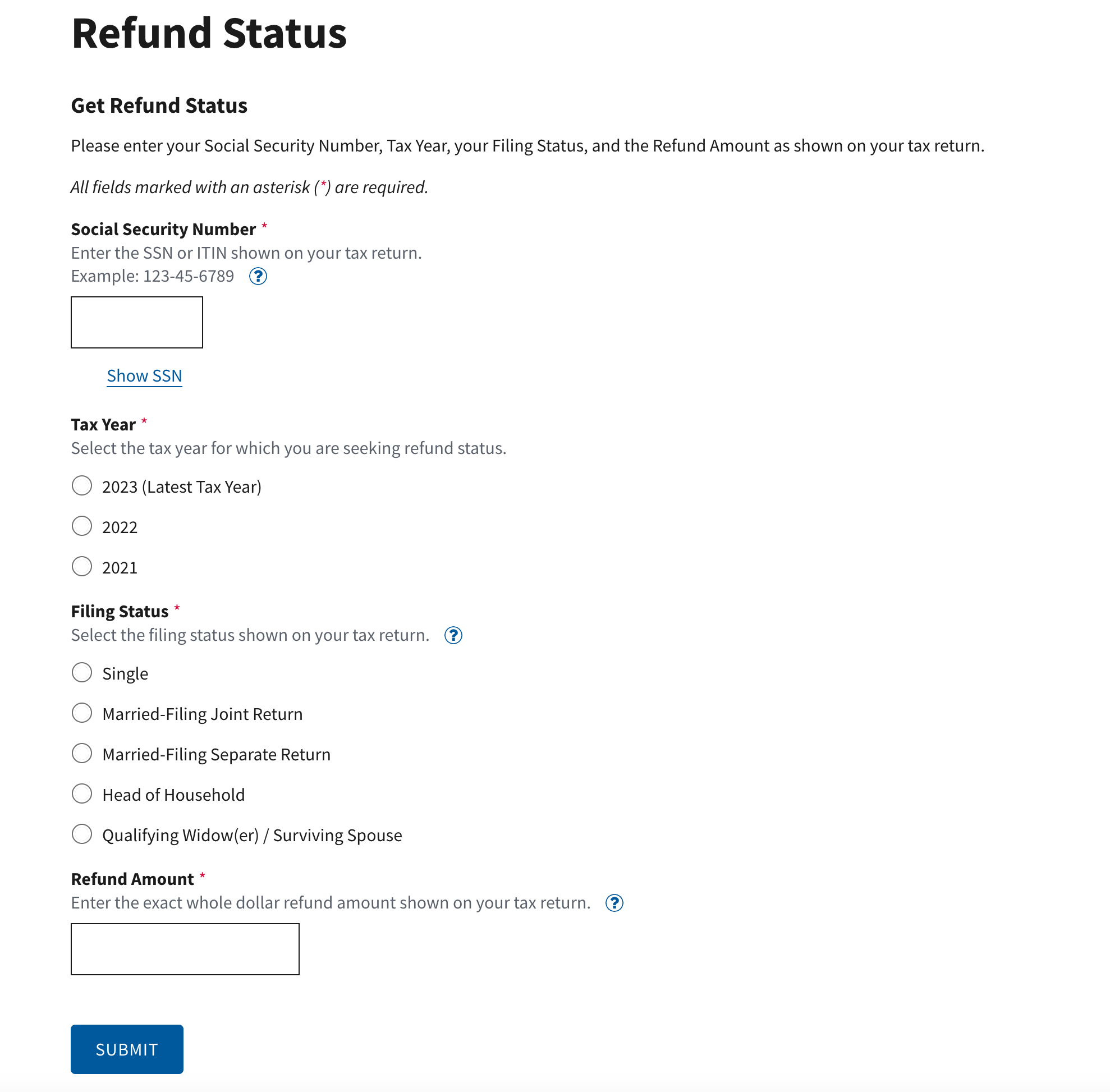

Taxpayers can easily access the IRS refund schedule 2025 chart on the official IRS website or through authorized tax preparation software. By entering essential details like their filing status and refund amount, individuals can track the status of their refund and gain insights into the estimated refund date.

- Check the IRS refund schedule regularly for updates to stay informed about any changes in refund processing timelines.

- Utilize online tools and resources to calculate the expected refund based on the IRS schedule and filing information.

Understanding the Importance of a Refund Schedule

As we delve into the realm of taxes and refunds, understanding the significance of an IRS refund schedule for the year 2025 is crucial. The IRS refund schedule 2025 chart acts as a roadmap for taxpayers to anticipate when they can expect their refunds, aiding in financial planning and ensuring timely tax returns.

Efficient Budgeting and Planning

Having access to the IRS refund schedule 2025 chart allows individuals to plan their finances more efficiently. By knowing the expected timeline for receiving their refund, taxpayers can budget and allocate funds accordingly, addressing any pending financial obligations with greater precision.

Early Tax Filing Advantage

Utilizing the IRS refund schedule 2025 chart enables taxpayers to file their taxes early, leveraging the benefit of receiving refunds sooner. Early filers not only avoid the last-minute rush but also secure their position in the queue for processing, potentially expediting the refund process.

Key Dates in the IRS Refund Schedule 2025 Chart

As taxpayers eagerly anticipate their refunds, knowing the key dates in the IRS refund schedule is crucial for timely tax returns in 2025. Understanding when to expect your refund can help you plan your finances effectively.

IRS Acceptance Start Date

The IRS typically begins accepting tax returns in late January. The exact date can vary each year, so it’s important to stay updated. For 2025, the IRS acceptance start date is expected to be in the last week of January.

Estimated Refund Deposit Dates

After your tax return is accepted, the IRS aims to issue refunds within 21 days for electronic returns. For 2025, if you file electronically, expect to receive your refund by mid-February. However, this timeline may vary based on factors like errors in the return or claiming certain credits.

Deadline for Filing Taxes

The deadline for filing your taxes and claiming a refund for the year 2025 is April 15th. Ensure you submit your tax return before this date to avoid late penalties and interest charges. If you need more time, consider filing for an extension.

How to Access the 2025 IRS Refund Schedule Chart

Accessing the 2025 IRS refund schedule chart is crucial for individuals to stay informed about the timeline of their tax refunds. To find the IRS refund schedule for 2025, taxpayers can visit the official IRS website (www.irs.gov) and navigate to the “Refunds” section. Here, they can locate the specific refund schedule for the year 2025.

Steps to Navigate the IRS Website for the 2025 Refund Schedule

1. Visit the official IRS website – IRS Website

2. Click on the “Refunds” tab on the homepage menu

3. Look for the section related to the 2025 tax year

Understanding the IRS Refund Schedule Chart for 2025

Once you have accessed the 2025 IRS refund schedule chart, it is essential to understand how the schedule works. The chart outlines the expected timeframes for refund processing based on when tax returns are filed. It provides taxpayers with an estimated timeline for when they can anticipate receiving their refunds.

For a clear visual representation, here is an image that showcases the IRS refund schedule for the year 2025:

Tips for Maximizing Your Tax Refund

When it comes to maximizing your tax refund in 2025, there are several strategies you can employ to ensure you get the most out of your return. From deductions to credits, here are some tips to help you make the most of your refund this year.

Start Early and Stay Organized

One of the best ways to maximize your tax refund is to start early and stay organized throughout the year. Keep track of all your receipts, expenses, and tax documents to ensure you don’t miss out on any potential deductions.

Don’t wait until the last minute to file your taxes, as rushing can lead to mistakes and oversights that could cost you money. By starting early and staying organized, you can maximize your refund potential.

Take Advantage of Deductions and Credits

Make sure you take advantage of all available deductions and credits to maximize your tax refund. This can include deductions for things like mortgage interest, student loan interest, and medical expenses.

Additionally, look for tax credits that you may be eligible for, such as the Earned Income Tax Credit or the Child Tax Credit. These credits can help reduce the amount of tax you owe and increase your refund amount.

Frequently Asked Questions

- What is the importance of the 2025 IRS Refund Schedule Chart?

- The 2025 IRS Refund Schedule Chart is crucial as it provides taxpayers with important dates and timelines for when they can expect to receive their tax refunds, allowing them to better plan their finances.

- Where can I find the 2025 IRS Refund Schedule Chart?

- The 2025 IRS Refund Schedule Chart is typically made available on the official IRS website as well as various tax preparation websites and resources. It is important to refer to trusted sources for this information.

- How can the 2025 IRS Refund Schedule Chart help me receive my tax refund sooner?

- By knowing the estimated timeframes provided in the 2025 IRS Refund Schedule Chart, you can prepare and file your taxes early, ensuring that your return is processed promptly and you receive your refund without delays.

- Are the dates on the 2025 IRS Refund Schedule Chart guaranteed?

- While the 2025 IRS Refund Schedule Chart provides estimated timelines, it’s important to note that these dates are subject to change based on various factors like the complexity of your return, errors, or IRS processing times.

- What if my tax refund is delayed beyond the dates on the 2025 IRS Refund Schedule Chart?

- If your tax refund is significantly delayed beyond the expected dates on the 2025 IRS Refund Schedule Chart, you may need to contact the IRS to inquire about the status of your refund and any potential issues causing the delay.

Unlocking the Future: Making the Most of the IRS Refund Schedule 2025 Chart

In conclusion, the 2025 IRS refund schedule chart is a powerful tool that taxpayers can utilize to plan for timely tax returns. Understanding the schedule can help individuals and businesses prepare for when to expect their refunds, enabling better financial management and decision-making. By staying informed about the IRS refund schedule for 2025, taxpayers can avoid unnecessary stress and delays in receiving their refunds. Remember to file your taxes early and accurately to maximize your chances of a swift refund. Take control of your tax season and use the IRS refund schedule to your advantage!