Welcome to our blog where we are excited to delve into the intricacies of the $300 CTC 2025 schedule. In this digital era, understanding how to navigate these financial waters is crucial for maximizing your potential. The CTC (Child Tax Credit) expansion brings forth significant changes that can impact your financial planning and family’s well-being.

Our goal is to guide you through this complex schedule with ease, ensuring you are well-informed and equipped to make the most out of the opportunities presented. Stay with us as we dissect the $300 CTC 2025 schedule, providing insights, tips, and strategies to empower you on your financial journey.

Understanding the $300 CTC 2025 Schedule

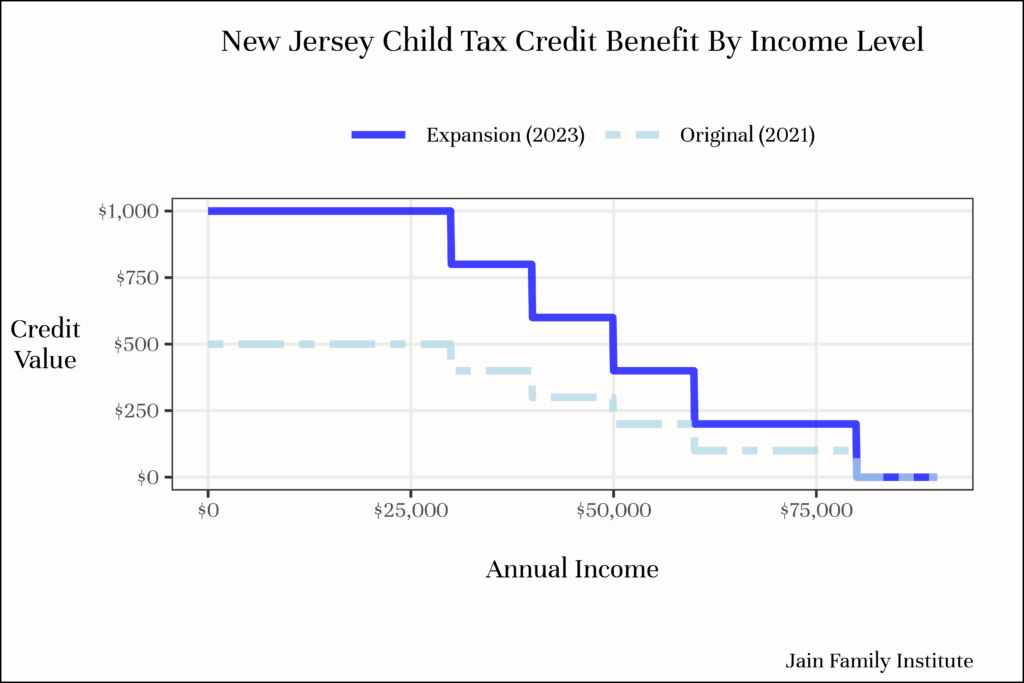

In the realm of financial planning and tax credits, the $300 CTC 2025 Schedule holds significant importance for individuals and families. This schedule outlines the potential tax benefits and credits that can be availed by eligible taxpayers. As we move towards the year 2025, it becomes crucial to understand how this schedule can impact your financial standing and overall tax liabilities.

Benefits Eligibility Criteria

One of the key aspects to grasp about the $300 CTC 2025 Schedule is the eligibility criteria for claiming the benefits. Individuals need to meet specific requirements such as income thresholds, dependent status, and filing status to qualify for the credits associated with this schedule. It’s essential to carefully review your financial situation to determine if you meet the criteria outlined in the schedule.

Impact on Tax Planning

The $300 CTC 2025 Schedule can have a significant impact on your tax planning strategies. By understanding the credits available and the conditions for claiming them, you can effectively plan your finances to maximize the benefits while minimizing your tax burden. It’s advisable to consult with a tax professional to ensure you are leveraging the schedule to your advantage.

- Utilize tax calculators to estimate potential savings

- Ensure accurate documentation to support credit claims

- Stay informed about any updates or changes to the schedule

Exploring Potential Roadblocks in the $300 CTC 2025 Schedule

As we delve into the complexities of the $300 CTC 2025 Schedule, it is crucial to be aware of potential roadblocks that may hinder smooth navigation through this financial landscape.

Inadequate Financial Planning

One of the major challenges individuals may face is the lack of comprehensive financial planning to maximize the benefits offered by the $300 CTC 2025 Schedule. It is essential to create a strategic financial roadmap tailored to your specific needs and goals.

Changing Tax Laws

Another roadblock is the dynamic nature of tax laws, which can impact the benefits and calculations related to the $300 CTC 2025 Schedule. Stay informed about any changes in tax regulations to ensure compliance and optimize your financial gains.

Strategies for Overcoming Challenges in the $300 CTC 2025 Schedule

As we navigate the complexities of the $300 CTC 2025 Schedule, it’s essential to develop effective strategies to overcome challenges and maximize productivity.

Prioritize Tasks Wisely

One key strategy is to prioritize tasks based on their importance and deadlines. This will help you stay on track and ensure critical activities are completed on time.

Time Management Techniques

Implement time management techniques such as the Pomodoro method to enhance focus and productivity. Breaking work into intervals with short breaks can improve efficiency.

- Set specific time blocks for different tasks

- Use productivity apps to track time and progress

- Eliminate distractions during work intervals

Maximizing Your Productivity within the $300 CTC 2025 Schedule

As we look ahead to the $300 CTC 2025 schedule, maximizing productivity becomes crucial to meet the demands of the evolving work landscape. Here are some key strategies to help you navigate and excel within this framework.

1. Utilize Time Blocking Techniques

Implementing a time blocking method can significantly enhance your productivity within the $300 CTC 2025 schedule. Allocate specific time slots for different tasks, ensuring focused attention and efficient task completion. This technique can help you manage your day effectively.

2. Leverage Technology Tools

Embrace productivity tools and apps that align with the $300 CTC 2025 schedule requirements. Platforms like project management software, calendar apps, and communication tools can streamline your workflow and enhance collaboration. Integrating technology can revolutionize your productivity in the designated time frame.

- Use task management apps such as Trello or Asana to organize your projects.

- Opt for communication tools like Slack or Microsoft Teams for seamless collaboration.

Frequently Asked Questions

- What is CTC 2025 Schedule?

- CTC 2025 Schedule is a structured plan outlining the activities and milestones for achieving the goals set for the year 2025 by the organization.

- How does the $300 CTC 2025 Schedule help in unlocking potential?

- The $300 CTC 2025 Schedule provides a clear roadmap and timeline for individuals to follow, allowing them to track their progress and make necessary adjustments to reach their full potential.

- What are some tips for navigating the CTC 2025 Schedule with ease?

- To navigate the CTC 2025 Schedule with ease, it’s important to break down tasks into manageable steps, prioritize tasks based on importance, and regularly review progress to stay on track.

- How can one leverage the CTC 2025 Schedule for personal growth?

- By utilizing the CTC 2025 Schedule effectively, individuals can identify areas for improvement, set specific goals for personal growth, and measure their achievements over time.

- What are the benefits of unlocking one’s potential using the CTC 2025 Schedule?

- Unlocking one’s potential with the CTC 2025 Schedule can lead to increased productivity, personal satisfaction, and a sense of accomplishment as individuals progress towards their goals.

Unlocking Your Potential: Navigating the $300 CTC 2025 Schedule with Ease

In Conclusion, mastering the intricacies of the $300 CTC 2025 schedule is key to unlocking your full potential. By understanding the schedule’s nuances and planning ahead, you can navigate it with ease and maximize your financial benefits. Remember to stay informed about any updates or changes to the schedule to ensure you are always optimizing your savings. With the right strategies in place, you can make the most of the opportunities presented by the CTC 2025 schedule. Take charge of your financial future by harnessing the power of this resource effectively. Your path to financial success starts with knowing how to leverage the $300 CTC 2025 schedule to your advantage.