Are you ready to take control of your financial future? If so, you’ll be thrilled to discover that Vanguard has unveiled its highly anticipated 2025 dividend schedule. As an investor, staying informed about dividend distributions is crucial for building a sustainable portfolio. Vanguard, known for its reliable investment strategies, has provided a roadmap for dividend payments in 2025, offering valuable insights for investors looking to maximize their returns.

In this blog, we’ll delve into the details of the Vanguard 2025 dividend schedule, exploring what it means for investors like you. Understanding the dividend schedule can help you make informed decisions about your investments and pave the way for long-term financial growth. Let’s unlock the potential of your financial future together!

Introduction to Vanguard 2025 Dividend Schedule

If you are planning for your financial future, understanding the Vanguard 2025 Dividend Schedule is crucial. Investing in dividend-paying stocks can provide a steady income stream, making it a popular choice for many investors looking for reliable returns.

What is the Vanguard 2025 Dividend Schedule?

The Vanguard 2025 Dividend Schedule outlines the dates on which Vanguard’s dividend-paying stocks are expected to distribute dividends to shareholders in the year 2025. These dividends are typically paid quarterly, providing investors with regular income.

Importance of Tracking the Dividend Schedule

Investors need to monitor the Vanguard 2025 Dividend Schedule to plan their cash flow effectively. By staying informed about when dividends will be paid, investors can better manage their finances and make informed investment decisions.

- Dividend reinvestment can enhance overall returns

- Regular income provides financial stability

- Understanding payment dates aids in financial planning

Understanding the Importance of Dividend Investing

Dividend investing plays a crucial role in achieving long-term financial stability. By focusing on companies that regularly pay out dividends, investors can create a steady income stream that grows over time. This strategy is particularly appealing to those looking to build wealth while mitigating risk.

The Power of Compounding

One of the key benefits of dividend investing is the power of compounding. Reinvesting dividends allows investors to buy more shares, which in turn generate more dividends, leading to exponential growth over time. This compounding effect can significantly boost overall returns.

Diversification and Stability

Another advantage of dividend investing is the inherent diversification it offers. Investing in dividend-paying stocks across different sectors helps spread risk and enhances stability in a portfolio. Moreover, many dividend-paying companies are well-established, offering a sense of security and reliability to investors.

Overview of Vanguard’s Investment Philosophy

Vanguard’s investment philosophy revolves around the principles of long-term investing and diversification. They focus on low-cost funds that aim to minimize expenses for investors, allowing them to keep more of their returns. Vanguard believes in the power of index funds and passive investing as a way to achieve sustainable growth over time.

Core Principles

One of Vanguard’s core principles is putting investors first, which translates into offering a range of low-cost investment options to help individuals meet their financial goals. By staying true to this philosophy, Vanguard has become a trusted and renowned name in the world of investment management.

Long-Term Focus

Vanguard emphasizes the importance of long-term planning and patient investing. Their approach encourages investors to stay the course through market fluctuations and economic cycles. This strategy aligns with the objective of maximizing wealth accumulation over the 2025 dividend schedule and beyond.

Exploring the Components of the 2025 Dividend Schedule

As investors eagerly await the Vanguard 2025 dividend schedule, it’s crucial to understand the key components that shape this financial roadmap. In 2025, Vanguard is projected to offer a structured plan for distributing dividends to its shareholders based on the company’s performance and profits.

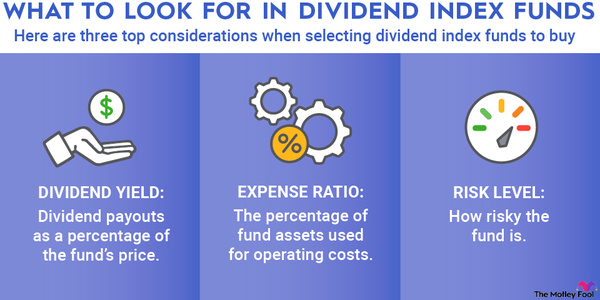

Dividend Yield

The dividend yield is a crucial metric that indicates the annual dividend payments as a percentage of the investment’s value. This can provide investors with insights into the returns they can expect.

Payment Frequency

One significant aspect of the 2025 dividend schedule is the frequency of payments. This schedule determines how often investors will receive dividend payouts, influencing their regular income stream.

- Quarterly Payments

- Annual Payments

- Monthly Payments

Benefits of Including Vanguard in Your Financial Portfolio

Investing in Vanguard can offer numerous advantages for your financial portfolio. Here are some key benefits:

Diversification

Adding Vanguard to your portfolio provides access to a wide range of investment options, including stocks, bonds, and mutual funds, enhancing diversification.

Additionally, Vanguard’s 2025 dividend schedule can offer stable income opportunities for investors.

Low Costs

Vanguard is known for its low-cost investment options, helping investors save on fees and expenses over the long term.

Investing in Vanguard’s 2025 dividend schedule can potentially maximize your returns while minimizing costs.

Tips for Maximizing Returns with Vanguard 2025 Dividend Schedule

Investors looking to maximize returns with the Vanguard 2025 Dividend Schedule should consider a few key tips. Staying informed about dividend payment dates, understanding the dividend reinvestment plan, and diversifying your portfolio are essential strategies for optimizing returns.

Stay Informed about Dividend Payment Dates

Being aware of the specific dates when Vanguard 2025 will be issuing dividends is crucial. This allows investors to plan their investment strategies accordingly and make informed decisions about when to buy or sell shares.

Utilize Dividend Reinvestment Plan (DRIP)

Consider enrolling in Vanguard’s Dividend Reinvestment Plan (DRIP) to automatically reinvest your dividends back into the fund. This can help compound your returns over time and accelerate the growth of your investment.

Diversify Your Portfolio

Diversification is key to reducing risk and maximizing returns. Spread your investments across different asset classes and sectors to minimize the impact of market fluctuations on your overall portfolio performance.

Frequently Asked Questions

- What is the Vanguard 2025 Dividend Schedule?

- The Vanguard 2025 Dividend Schedule refers to the timeline set by Vanguard for distributing dividends to investors holding shares of the Vanguard 2025 fund.

- How does unlocking your financial future relate to the Vanguard 2025 Dividend Schedule?

- By understanding and utilizing the Vanguard 2025 Dividend Schedule, investors can plan and strategize their finances to potentially boost their future financial situation through dividend payouts.

- When is the Vanguard 2025 Dividend Schedule revealed?

- The Vanguard 2025 Dividend Schedule is typically revealed by Vanguard at the beginning of the year, outlining the expected dividend distribution dates for that specific fund.

- How can investors benefit from the Vanguard 2025 Dividend Schedule?

- Investors can benefit from the Vanguard 2025 Dividend Schedule by incorporating dividend payouts into their overall investment strategy, potentially increasing their returns and building wealth over time.

Unlocking Your Financial Future with Vanguard 2025 Dividend Schedule

As we conclude our exploration of the Vanguard 2025 Dividend Schedule, it’s evident that strategic financial planning is key to securing a prosperous future. By understanding the projected dividend payouts and incorporating them into your investment strategy, you can take significant steps towards financial success. Vanguard’s transparent and reliable schedule provides investors with the necessary insights to make informed decisions and maximize returns.

In summary, the Vanguard 2025 Dividend Schedule offers a roadmap to financial stability and growth. By leveraging this valuable resource, investors can navigate the volatile market with confidence and build a solid foundation for long-term wealth accumulation. Remember, informed decisions today can pave the way for a brighter tomorrow.