Submitting a tax return can often be a daunting task for many individuals. Understanding the intricacies of a tax return schedule is crucial in navigating through the complexities of tax filing. But what exactly is a tax return schedule and why is it so important? In this blog, we will delve into the significance of decoding the tax return schedule, unveiling its true purpose, and shedding light on why it plays a critical role in the tax filing process. By unraveling the mystery behind the tax return schedule, taxpayers can gain clarity on how it impacts their financial obligations and ensures compliance with the tax laws.

Understanding Tax Returns

When it comes to finances, understanding tax returns is crucial for every individual. A tax return is a document filed with the government that declares a taxpayer’s income, expenses, and other pertinent details. The tax return schedule outlines the timeline for submitting this important document.

Importance of Tax Returns

Submitting tax returns is essential for multiple reasons. Firstly, it ensures compliance with the law, avoiding potential penalties. Secondly, it helps individuals claim any tax refunds they may be entitled to, providing a financial benefit.

What Is a Tax Return Schedule?

A tax return schedule is a detailed form that taxpayers use to report their income and tax-deductible expenses to calculate their tax liability. It helps organize financial information and ensures accurate filing.

Importance of Tax Return Schedule

Understanding what is a tax return schedule is crucial for efficient tax management. A tax return schedule outlines the deadlines and dates for filing tax returns, making it easier for individuals and businesses to stay compliant with tax regulations.

Ensuring Timely Compliance

By following the tax return schedule, taxpayers can avoid penalties and fines for late filing. Meeting deadlines ensures that tax returns are submitted accurately and on time.

Facilitating Financial Planning

The tax return schedule provides a structured timeline for tax-related activities, helping individuals and businesses plan their finances effectively throughout the year.

Components of a Tax Return Schedule

A tax return schedule is a crucial document that outlines various components related to an individual’s or organization’s tax obligations. It plays a significant role in ensuring accurate reporting and compliance with tax laws.

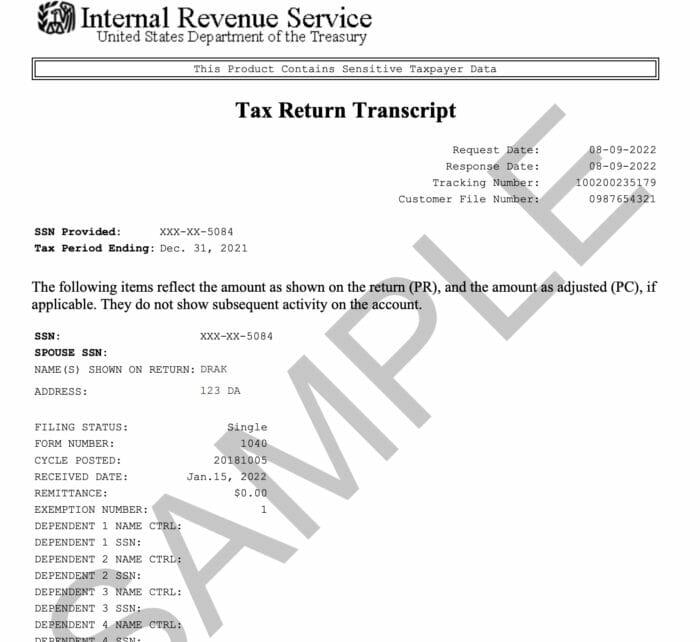

1. Personal Information

The tax return schedule typically starts with the individual’s basic details, such as name, address, social security number, and filing status. This information is essential for identification and verification purposes. 2019

2. Income Details

Income details are a critical component of the tax return schedule. They include wages, dividends, interest, rental income, and any other sources of income. Providing accurate income information ensures proper tax calculation.

- Wages

- Dividends

- Interest

- Rental Income

3. Deductions and Credits

Deductions and credits play a significant role in reducing taxable income and overall tax liability. Common deductions include mortgage interest, charitable contributions, and student loan interest. Tax credits directly reduce the amount of tax owed.

How to Fill Out a Tax Return Schedule

Completing a tax return schedule is a crucial step in the tax filing process. It provides detailed information about your income, deductions, credits, and ultimately determines how much tax you owe or are owed by the government. To accurately fill out a tax return schedule, follow these steps:

Gather Documents

Before you start filling out the tax return schedule, gather all relevant documents for the tax year, including W-2s, 1099s, receipts for deductions, and any other supporting documents.

Complete Personal Information

Enter your personal information accurately, including your name, Social Security number, filing status, and any applicable dependents. This ensures your tax return is processed correctly.

Report Income

Report all sources of income, such as wages, dividends, interest, and freelance earnings. Ensure that the income is reported accurately to avoid any discrepancies.

Claim Deductions and Credits

Take advantage of deductions and credits you qualify for, such as mortgage interest, student loan interest, or education credits. This can reduce your taxable income and potentially lower your tax bill.

Review and Submit

Double-check all information entered on the tax return schedule for accuracy. Once you are confident that everything is correct, submit your tax return either electronically or by mail before the deadline.

Tips for Maximizing Tax Deductions

When it comes to getting the most out of your tax returns, maximizing deductions is key. Here are some valuable tips to help you make the most of potential tax deductions:

Keep Track of Expenses

Make sure to keep detailed records of all your expenses throughout the year. This includes receipts for business expenses, medical bills, charitable donations, and more. Organization is key to ensuring you don’t miss any potential deductions.

Utilize Tax-Advantaged Accounts

Consider contributing to tax-advantaged accounts such as a 401(k) or IRA. These contributions can lower your taxable income, resulting in potential tax savings. Start early in the year to maximize the benefits.

- Contribute regularly to maximize tax advantages

- Take advantage of employer matching contributions

- Explore traditional vs. Roth options based on your tax situation

Common Mistakes to Avoid in Tax Returns

When it comes to filing tax returns, avoiding common mistakes can save you from unnecessary penalties and fines. Here are key errors to steer clear of:

Incorrect Information

Providing inaccurate details could trigger an audit. Double-check all data, including Social Security numbers and income figures, for mistakes.

Missing Deductions

Forgetting eligible deductions leads to overpaying taxes. *Tax returns demand careful consideration of all potential deductions.

Frequently Asked Questions

- What is a Tax Return Schedule?

- A Tax Return Schedule is a document attached to the main tax return form that provides additional information for specific types of income, deductions, or credits.

- Why are Tax Return Schedules important?

- Tax Return Schedules are important as they allow taxpayers to report detailed financial information that is necessary for accurately calculating their tax liability. They help in ensuring compliance with tax regulations and maximizing eligible deductions and credits.

- How do I know which Tax Return Schedules to use?

- The IRS provides instructions on which Tax Return Schedules to use based on the types of income, deductions, or credits you need to report. Tax software or professional tax preparers can also help determine which schedules are applicable to your tax situation.

- Can I file my tax return without completing all the Tax Return Schedules?

- It is important to complete all required Tax Return Schedules to ensure accurate reporting of your financial information. Failing to provide necessary details may result in errors, audits, or penalties.

- Are there penalties for not including Tax Return Schedules when required?

- Failing to include required Tax Return Schedules can lead to penalties or delays in processing your tax return. It is advisable to carefully review the tax instructions to determine if specific schedules are necessary for your filing.

Unlocking the Power of Tax Return Schedules

In conclusion, understanding what a tax return schedule is essential for every taxpayer. It serves as a crucial roadmap that outlines income, deductions, credits, and tax liability in a structured manner. By dissecting this document, individuals can gain insights into their financial standing and make informed decisions to optimize tax savings. While the process may seem daunting, deciphering the tax return schedule can empower you to take control of your finances and ensure compliance with tax regulations.

So, whether you’re a seasoned taxpayer or a newcomer to filing taxes, embracing the significance of tax return schedules can pave the way for financial literacy and prudent tax planning. Remember, knowledge is power when it comes to navigating the intricate world of taxes.