Are you ready to master the art of creating an amortization schedule like a pro? Understanding how to create an amortization schedule is a crucial skill for anyone looking to manage loans or mortgages effectively. In this blog, we will guide you through the process step by step, breaking down complex calculations into simple, manageable tasks. By the end of this guide, you will have the confidence and know-how to create accurate and efficient amortization schedules like a seasoned professional. Let’s dive in and unravel the mystery behind creating an amortization schedule with ease and precision.

Introduction to Creating an Amortization Schedule

When managing loans or mortgages, understanding how to create an amortization schedule is crucial. An amortization schedule provides a detailed breakdown of periodic loan payments, including the principal and interest portions. By mastering the art of creating an amortization schedule, individuals can gain insights into how payments are structured over time.

Importance of an Amortization Schedule

An amortization schedule serves as a financial roadmap, showing borrowers the exact repayment timeline and helping them visualize the reduction of their debt. It allows borrowers to see how much of each payment goes towards interest and principal, aiding in better financial planning and budgeting.

Understanding how to create an amortization schedule also empowers individuals to make informed decisions regarding their loans, whether it’s choosing a suitable repayment term or determining the total interest paid over the life of the loan.

Components of an Amortization Schedule

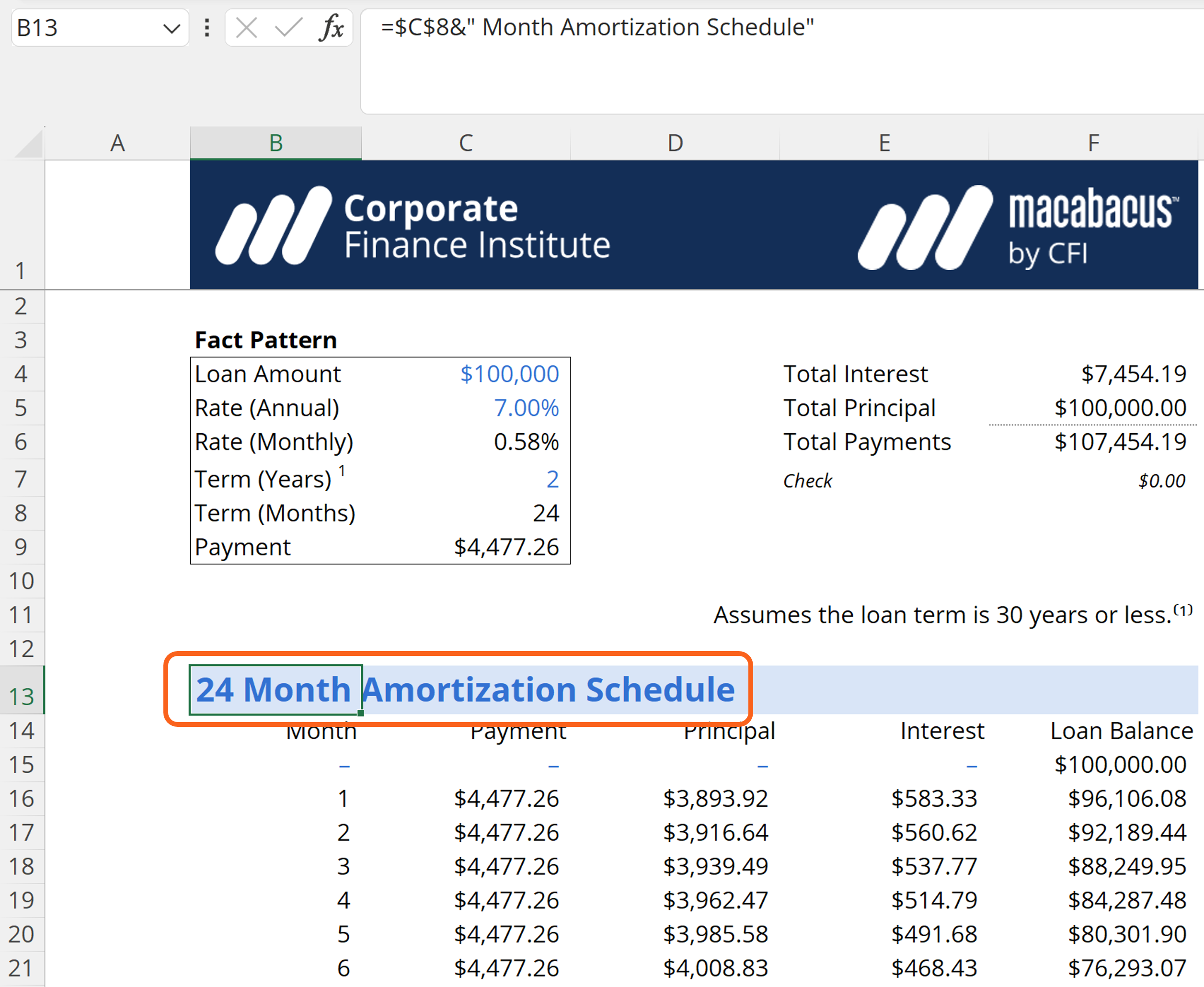

An amortization schedule typically includes details such as the loan amount, interest rate, loan term, monthly payment amount, and the breakdown of principal and interest for each payment. It illustrates how loan balances decrease over time as payments are made, providing clarity on the progress of debt repayment.

- Loan Amount: The initial amount borrowed.

- Interest Rate: The annual percentage rate charged on the loan.

- Loan Term: The length of time over which the loan is repaid.

- Monthly Payment: The fixed amount due each month.

:max_bytes(150000):strip_icc()/DiscountedPaybackPeriodFinal-3c3e5819b2364a9fac1e51fa584b17cb.jpg)

Understanding the Basics of Amortization

Amortization is the process of spreading out a loan into a series of fixed payments over time. It involves paying off both the principal amount and the interest on a loan. This method allows borrowers to see how much they owe at any point during the loan term. Creating an amortization schedule helps individuals understand how each payment impacts their balance.

Importance of Amortization

Understanding how to create an amortization schedule is crucial for borrowers as it helps in planning finances effectively. By breaking down the loan payments into smaller amounts, individuals can visualize their debt repayment journey more clearly. This knowledge is vital for budgeting and managing financial commitments.

Benefits of Amortization Schedule

An amortization schedule, generated using financial tools, provides a detailed overview of each payment’s allocation towards principal and interest. It helps in tracking the loan balance, determining the impact of extra payments, and forecasting the loan payoff date. This level of transparency empowers borrowers to make informed decisions.

Gathering the Necessary Information

Before diving into creating an amortization schedule like a pro, it’s essential to gather all the necessary information. This includes the principal amount, annual interest rate, loan term in years, and the start date of the loan. Having these details upfront will streamline the process and ensure accuracy in your calculations.

Principal Amount

The principal amount refers to the total amount of the loan that you initially borrowed. This is the base amount on which interest will be calculated throughout the loan term. It’s crucial to input the correct principal amount to get accurate results.

Annual Interest Rate

The annual interest rate is the percentage of the principal that the lender charges as interest each year. This rate plays a significant role in determining your monthly payments and the total interest paid over the loan term. Make sure to double-check the annual interest rate provided by your lender.

Loan Term in Years

The loan term in years indicates the total duration over which you will repay the loan. This timeline is divided into monthly periods for the amortization schedule calculations. Ensure that you have the accurate loan term in years to create a precise schedule.

Start Date of the Loan

The start date of the loan marks the beginning of your repayment schedule. It’s necessary to know this date to calculate the monthly payments accurately and track the progress of your loan over time. Check the loan documents or the lender’s information for the start date.

Choosing the Right Tools and Software

When it comes to creating an amortization schedule like a pro, having the right tools and software can make a significant difference in the efficiency and accuracy of your calculations.

Feature-Rich Spreadsheet Programs

Utilizing feature-rich spreadsheet programs such as Microsoft Excel or Google Sheets can streamline the process of creating and managing your amortization schedule. These programs offer robust calculation capabilities and customizable templates for amortization tables.

You can easily input your loan details, including the principal amount, interest rate, and loan term, to generate an accurate repayment schedule.

Specialized Amortization Software

Consider using specialized amortization software like Loan Amortization Calculator or TValue to automate the creation of your amortization schedule. These tools are specifically designed for loan calculations and provide detailed amortization tables with breakdowns of principal and interest payments.

Such software can save you time and effort by performing complex amortization calculations accurately.

Step-by-Step Guide to Creating an Amortization Schedule

Creating an amortization schedule can be a crucial tool in managing loans efficiently. Follow these steps to master the art of creating an amortization schedule like a pro:

Gather Loan Information

Start by gathering all necessary loan information, including the principal amount, interest rate, and loan term in years.

Calculate Monthly Payment

Next, calculate the monthly payment using the loan amount, interest rate, and loan term through the appropriate formula or an online calculator.

- Enter Loan Amount

- Input Interest Rate

- Set Loan Term

Construct the Schedule

Create a table listing each payment period, month, payment amount, interest paid, principal paid, and remaining balance for each period.

Customizing Your Amortization Schedule

When it comes to **how to create an amortization schedule**, customization can be key. Utilizing advanced tools and techniques allows for tailor-made amortization schedules that meet your specific financial goals with precision.

Utilize Online Amortization Schedule Tools

One effective way to customize your amortization schedule is by using **online amortization schedule calculators**. These tools offer flexibility in adjusting loan amounts, interest rates, and repayment terms to create a personalized schedule.

You can also take advantage of **financial planning software** that allows for more intricate customizations to align with your unique financial situation and objectives.

Adjust Payment Frequencies and Extra Payments

Another strategy to personalize your amortization schedule is by modifying payment frequencies. Opting for bi-weekly or accelerated payments can help **reduce the interest** paid over the life of the loan.

Additionally, making **extra principal payments** whenever possible can shorten the loan term and save on interest costs. This approach can be particularly beneficial for long-term savings.

Consider Refinancing Options

If your financial circumstances change or interest rates drop significantly, **refinancing your loan** can allow for a revised amortization schedule. This may involve extending or shortening the loan term to better suit your current needs.

Exploring refinancing options with different lenders can help you find a solution that offers improved terms and potentially lowers your overall interest burden.

Utilizing Your Schedule for Financial Planning

When it comes to financial planning, utilizing an amortization schedule can be a powerful tool. By breaking down your loan repayment schedule into manageable chunks, you can gain a better understanding of your financial obligations and plan accordingly.

The Basics of Amortization

Amortization is the process of spreading out loan payments over time, typically with a fixed repayment schedule. This helps borrowers know exactly how much they need to pay each month, including the breakdown of principal and interest.

Creating an Amortization Schedule

To create an amortization schedule, you can use online calculators or financial software. Input the loan amount, interest rate, and loan term to generate a detailed schedule showing each payment and how much of it goes towards interest and principal.

It’s crucial to update your amortization schedule regularly to track your progress and make adjustments as needed. This can help you stay on top of your finances and make informed decisions.

Frequently Asked Questions

- What is an amortization schedule?

- An amortization schedule is a table that shows the distribution of loan repayments towards the principal amount and the interest over the loan term. It breaks down each payment to show how much is going towards reducing the principal balance and how much is going towards paying the interest.

- Why is it important to create an amortization schedule?

- Creating an amortization schedule is important because it helps borrowers understand how their loan works, how much interest they will pay over time, and how extra payments can affect the overall repayment of the loan. It provides a clear picture of the loan repayment process.

- What information is needed to create an amortization schedule?

- To create an amortization schedule, you need to know the loan amount, interest rate, loan term (duration), and the start date of the loan. These details are used to calculate the monthly payment, interest amount, and principal amount for each period in the schedule.

- Are there online tools available to help create an amortization schedule?

- Yes, there are several online tools and calculators available that can help you generate an accurate amortization schedule. By inputting the necessary loan details, these tools can quickly create a schedule and provide insights into the repayment process.

- Can I customize the payment frequency in an amortization schedule?

- Yes, amortization schedules can be customized to reflect different payment frequencies such as monthly, bi-weekly, or quarterly payments. Adjusting the payment frequency may impact the total interest paid and the duration of the loan.

Mastering Amortization Schedules: Key Takeaways

Creating an amortization schedule may seem daunting at first, but with the right knowledge and tools, you can master this essential financial skill like a pro. By following the step-by-step guide outlined in this blog, you can accurately track your loan payments, understand how much goes towards interest and principal, and ultimately save money in the long run.

Remember to use online calculators or spreadsheet templates for convenience, stay organized with your payment schedule, and leverage the power of extra payments to reduce your overall interest costs. With practice and dedication, you’ll soon become proficient in creating and utilizing amortization schedules to manage your finances effectively. Start applying these strategies today for a brighter financial future!