Are you familiar with what is Schedule C income and how it impacts your taxes? Understanding Schedule C income is crucial for self-employed individuals and small business owners. This form is used to report profit or loss from a business you operated as a sole proprietor. Schedule C income encompasses various sources like freelance work, consulting services, or selling products online.

Knowing how to categorize and report your Schedule C income accurately can greatly influence your tax liability and deductions. In this blog post, we will delve into everything you need to know about Schedule C income, from its definition and importance to the steps involved in reporting it correctly on your tax return.

Introduction to Schedule C Income

Understanding what is schedule C income is crucial for self-employed individuals and small business owners. On Schedule C of the IRS Form 1040, taxpayers must report their business income and expenses. This form is used to calculate the net profit or loss of a business. Schedule C is commonly utilized by freelancers, sole proprietors, and independent contractors to report their earnings from self-employment.

Importance of Schedule C

Filing Schedule C accurately is essential for tax compliance and can help minimize tax liabilities. It allows individuals to deduct eligible business expenses, thereby reducing their taxable income. Keeping detailed records of income and expenses throughout the year is vital for accurate reporting on Schedule C.

Key Components of Schedule C

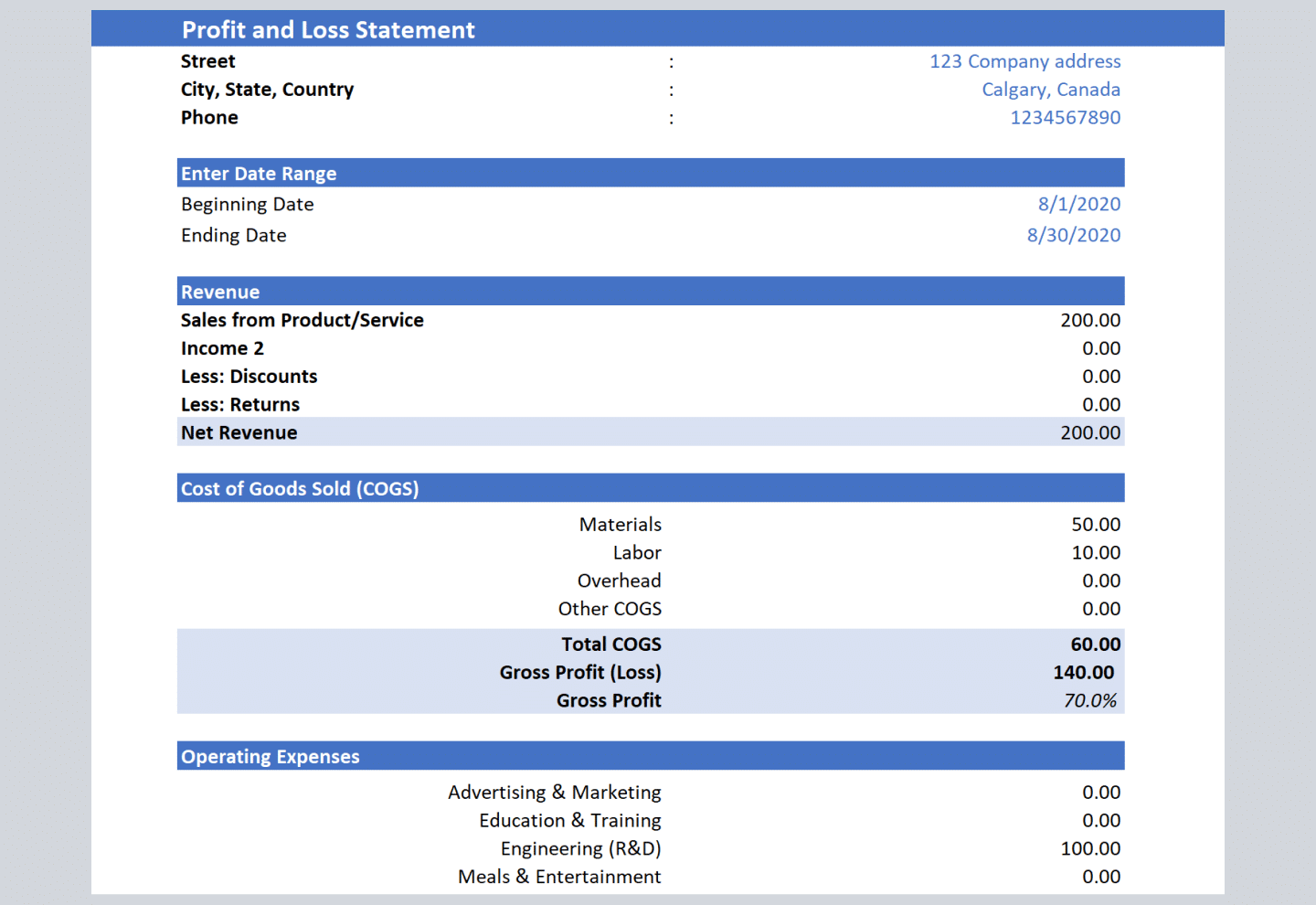

When completing Schedule C, individuals must provide information such as business income, cost of goods sold, business expenses, and net profit or loss. It is crucial to differentiate between personal and business expenses and ensure that only legitimate business expenses are claimed.

Overview of Schedule C Form

Schedule C Form, also known as Form 1040, is a crucial document used by sole proprietors and freelancers to report their self-employment income. It is used to calculate the net profit or loss of your business, which is then transferred to your personal tax return.

Importance of Schedule C

Filing a Schedule C is essential for individuals who run a business as a sole proprietor to report their income and expenses accurately. This form helps determine the taxable income of the business owner.

Key Components of Schedule C

Some key components of Schedule C include reporting business income, deducting business expenses, calculating net profit or loss, and determining self-employment tax.

Types of Income Reported on Schedule C

When filing taxes using Schedule C, it’s crucial to understand the different types of income that must be reported. Here are some common types of income that are typically reported on Schedule C:

1. Self-Employment Income

Self-employment income encompasses earnings from any work or business activity where you are not an employee of another entity. This could include income from freelancing, consulting, or running your own business.

2. Business Income

Business income refers to profits generated from operating your business. This can include sales revenue, services rendered, or any other income directly related to your business activities.

- Revenue from Sales: Income generated from selling products or services.

- Service Income: Earnings from services rendered to clients or customers.

Expenses Deductible on Schedule C

When filing your taxes and reporting income on Schedule C, it’s essential to know which expenses are deductible to reduce your taxable income. Deductible expenses are those considered ordinary and necessary for running your business.

Ordinary Business Expenses

These expenses are common and accepted in your industry or trade. They include costs such as rent, utilities, supplies, and employee salaries.

It is essential to keep detailed records and receipts for all ordinary business expenses to support your deductions.

Necessary Business Expenses

Necessary expenses are those that are helpful and appropriate for your business. This category includes expenses like advertising, travel, insurance, and professional services.

- Advertising: Expenses on promoting your business, including online ads, print media, and promotional events.

- Travel: Deductible expenses related to business travel, such as airfare, accommodations, and meals.

- Insurance: Premiums paid for business insurance policies, including liability, property, and health insurance.

- Professional Services: Fees paid to lawyers, accountants, consultants, and other professionals for business-related services.

Calculating Net Profit on Schedule C

When determining your net profit on Schedule C, it’s crucial to accurately calculate your business’s income and deductible expenses. Start by listing your total business income, including sales, services, and any other revenue streams. Next, deduct your business expenses such as supplies, advertising costs, utilities, and depreciation. The resulting figure is your net profit, which is the amount you’ll report on your tax return.

Tracking Business Income

Keep detailed records of all income sources related to your business. This includes invoices, sales receipts, and any other documentation that verifies the money coming into your business.

Use accounting software or spreadsheets to accurately track your income and ensure nothing is overlooked. Consistent record-keeping can help you stay organized.

Deducting Business Expenses

Identify all expenses that are necessary to operate your business. Keeping receipts and invoices is essential for documenting these expenses.

- Separate personal and business expenses to ensure accuracy.

- Claim all allowable deductions to minimize your taxable income.

- Consult with a tax professional to maximize your deductions and reduce tax liability.

Importance of Reporting Schedule C Income Accurately

Reporting Schedule C income accurately is crucial for self-employed individuals and small business owners.

Compliance with Tax Laws

Accurate reporting ensures compliance with tax laws, avoiding penalties and legal consequences.

Not accurately reporting Schedule C income could lead to audits and penalties.

Maximizing Deductions

Accurate reporting helps in maximizing deductions and lowering taxable income, leading to potential tax savings.

It’s essential to keep thorough records to support deductions claimed on Schedule C.

- Detailed records of business expenses

- Receipts for all expenditures

- Logs of mileage for business-related travel

Frequently Asked Questions

- What is Schedule C income?

- Schedule C income is income earned by self-employed individuals through their business or trade. It is reported on the Form 1040, Schedule C of the IRS tax return.

- Do I need to report Schedule C income?

- If you are self-employed or a sole proprietor, you are required to report your business income on Schedule C of your tax return.

- What type of income is reported on Schedule C?

- On Schedule C, you report income from your business activities such as sales of products or services, payments received, and any other business-related income.

- How do I calculate Schedule C income?

- To calculate your Schedule C income, you subtract your business expenses from your business income. The resulting amount is your net profit or loss from the business.

- Can I deduct expenses against my Schedule C income?

- Yes, you can deduct business expenses such as supplies, utilities, rent, and other relevant expenses against your Schedule C income to reduce your taxable income.

Concluding Thoughts on What is Schedule C Income

Understanding what schedule C income is crucial for self-employed individuals and small business owners. In summary, Schedule C is where you report your business income and deduct allowable expenses to determine your net profit or loss. By accurately filling out this form, you ensure compliance with the IRS and maximize your tax deductions.

Remember, maintaining detailed records, separating personal and business finances, and seeking professional advice can help you navigate the complexities of Schedule C income. It’s vital to stay informed about tax laws and regulations to avoid any penalties or audits.

Ultimately, mastering Schedule C income empowers you to manage your finances efficiently and make informed business decisions. Stay proactive, stay informed, and leverage the benefits that understanding Schedule C income can bring to your financial success.