Have you ever been bewildered by the Schedule 1 tax form? Do you find yourself asking, “What is Schedule 1 tax form?” If so, you are not alone. Understanding tax forms can be a daunting task, but fear not, we are here to unravel the mystery for you. In this blog, we will delve into the intricacies of Schedule 1 tax form, deciphering its purpose, components, and significance. Whether you are a seasoned taxpayer or a novice navigating through tax season, knowing about Schedule 1 can help you ensure accurate tax filings and maximize your refunds. So, let’s demystify Schedule 1 tax form together and equip ourselves with the knowledge needed to tackle tax obligations effectively.

Introduction to Schedule 1 Tax Form

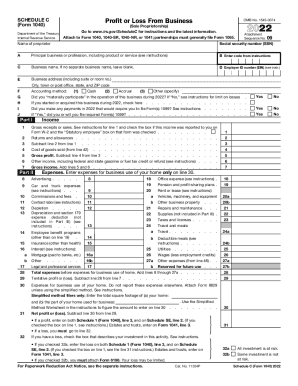

When filing your taxes, you may come across the Schedule 1 tax form, which is used by taxpayers to report certain additional income or adjustments to income. This form is crucial for individuals who have income sources beyond their regular wages, salaries, and tips. Understanding what is schedule 1 tax form and how to fill it out correctly can help you avoid any potential issues with the IRS.

Importance of Schedule 1 Tax Form

Filing Schedule 1 is essential for taxpayers who have received income from sources such as freelance work, rental properties, or investments. It helps ensure that all your income is properly accounted for in your tax return.

Key Features of Schedule 1

One significant feature of Schedule 1 is its ability to capture income adjustments or additional income that do not fit on the main Form 1040. This form includes sections for reporting items such as alimony received, business income or losses, and deductible expenses.

Purpose of Schedule 1 Tax Form

When it comes to taxes, understanding the purpose of Schedule 1 tax form is crucial for accurate filing. This additional form, often referred to as “Form 1040 Schedule 1”, is used to report various types of income that are not typically listed on the main Form 1040. It helps taxpayers include income sources such as business income, alimony, rental real estate, gambling winnings, unemployment compensation, and more.

Importance of Schedule 1

Filing Schedule 1 is essential for individuals who have income streams beyond their regular wages. This form ensures that all sources of income are properly accounted for, thereby reducing the risk of audit or penalties due to underreporting.

Types of Information Included

Within Schedule 1, taxpayers are required to provide detailed information about their additional income sources. This may involve reporting specific amounts received from various sources as well as any associated deductions or credits related to that income. The form also allows for the disclosure of adjustments to income that can affect the taxpayer’s overall tax liability.

Understanding the Sections of Schedule 1

Schedule 1 is an additional form used with the main tax return to report certain types of income or adjustments that can’t be entered directly on the Form 1040. Let’s dive into the different sections of Schedule 1 to understand its components better.

Income

One of the key sections of Schedule 1 is the Income section. Here, you’ll report various sources of income such as freelance earnings, rental income, interest, dividends, and other types of income that need to be included in your tax return.

Adjustments to Income

This section allows you to report certain adjustments to your income that can lower the amount of income subject to tax. Common adjustments include educator expenses, student loan interest, tuition fees, and contributions to retirement accounts like IRAs or Health Savings Accounts.

Tax Credits

Another important part of Schedule 1 is the Tax Credits section. Here, you can claim various tax credits you qualify for, such as the Child Tax Credit, Earned Income Credit, or education-related credits. Tax credits directly reduce the amount of tax you owe, providing a valuable tax benefit.

Commonly Asked Questions About Schedule 1

Many taxpayers have questions regarding Schedule 1 of their tax forms. Here are some commonly asked questions to help clarify any confusion.

What is Schedule 1?

Schedule 1 is a supplementary form used to report additional income or adjustments to income that aren’t listed on the standard Form 1040. This form is essential for ensuring accurate tax filings.

Why do I need to fill out Schedule 1?

Individuals may need to fill out Schedule 1 if they have additional sources of income such as rental or investment income that are not included on the main tax form.

Is Schedule 1 mandatory for everyone?

Not everyone is required to file Schedule 1. It depends on the individual’s financial situation and the types of income they have. If you’re unsure, it’s best to consult a tax professional.

Tips for Filing Schedule 1 Accurately

When it comes to filing your taxes, accuracy is key. Here are some tips to help you navigate through Schedule 1 form with ease:

Understand the Purpose

Before filling out Schedule 1, it’s essential to grasp what the schedule is for and how it affects your tax return. This will help you provide the necessary information correctly.

Organize Your Documents

Keep all relevant documents like income statements, receipts, and other supporting papers in one place to ensure accurate reporting on Schedule 1 form.

- Income Statements

- Expense Receipts

- Proof of Deductions

Frequently Asked Questions

- What is a Schedule 1 tax form?

- A Schedule 1 tax form is used to report additional income and adjustments to income that are not listed on the standard Form 1040.

- Why do I need to fill out a Schedule 1 tax form?

- You may need to fill out a Schedule 1 tax form if you have additional sources of income, deductions, or credits to report that are not included on the main tax form (Form 1040).

- What are some common items that require a Schedule 1 tax form?

- Common items that may require a Schedule 1 tax form include unemployment income, educator expenses, student loan interest, and health savings account contributions.

- When is the Schedule 1 tax form due?

- The Schedule 1 tax form is typically due at the same time as your main tax return, which is usually April 15th of each year. However, the deadline may be extended in certain circumstances.

- Can I file my taxes without a Schedule 1 tax form?

- If you don’t have any additional income or adjustments to report, you may not need to include a Schedule 1 tax form with your tax return. However, it’s important to review the requirements and instructions to determine if you need to file one.

Unlocking the Secrets of Schedule 1 Tax Form: A Comprehensive Guide

Understanding the Schedule 1 tax form is crucial for every taxpayer. It is an additional form that allows you to report specific types of income and adjustments to income that may impact your tax liability. By decoding the intricacies of this form, you can ensure compliance with tax laws and maximize your deductions.

Whether you need to report capital gains, unemployment compensation, or deductible expenses, Schedule 1 provides a clear framework for organizing your financial information. It serves as a roadmap to navigate the complexities of the tax system and optimize your tax return.

In conclusion, Schedule 1 is not just a form but a gateway to financial clarity. By familiarizing yourself with its purpose and requirements, you can empower yourself to make informed decisions and secure your financial well-being. Take charge of your taxes by mastering Schedule 1 today!