Are you eagerly waiting for the 2025 tax refund schedule stimulus details? Are you wondering when you can expect your tax refund and how the stimulus package will impact it? Look no further! This blog will unravel everything you need about the 2025 tax refund schedule stimulus. Understanding the schedule is crucial as it can affect your financial planning for the upcoming year. Stay informed about key dates, eligibility criteria, and any changes that might occur, ensuring you are prepared for the tax season ahead. Let’s dive into the details and ensure you are well-informed about the 2025 tax refund schedule stimulus.

🚨 𝗥𝗘𝗖𝗢𝗥𝗗: Cristiano Ronaldo’s YouTube channel has broke the record for the quickest page to hit 10 MILLION subscribers.

🎬 He did it in just 12 hours. 🐐

The previous record was @MrBeast and he did it in 132 days. 🤯🤯 pic.twitter.com/VuvZ3OJgnT

— Football Tweet ⚽ (@Football__Tweet) August 22, 2024

Understanding the 2025 Tax Refund Schedule

As we delve into the intricacies of the 2025 tax refund schedule stimulus, it is essential to comprehend how the timeline for tax refunds may evolve in the upcoming tax year. Understanding the schedule can help individuals plan their finances better and anticipate any potential delays or changes in the refund process.

Key Factors Impacting the 2025 Tax Refund Schedule

Several factors can influence the timeframe for receiving your tax refund in 2025. These factors include filing methods, IRS processing times, any errors in your return, and implementing new tax laws or regulations that could alter the refund schedule.

It is crucial to stay informed about these factors to clearly understand when to expect your refund and to avoid any surprises.

2025 Tax Refund Schedule Timeline

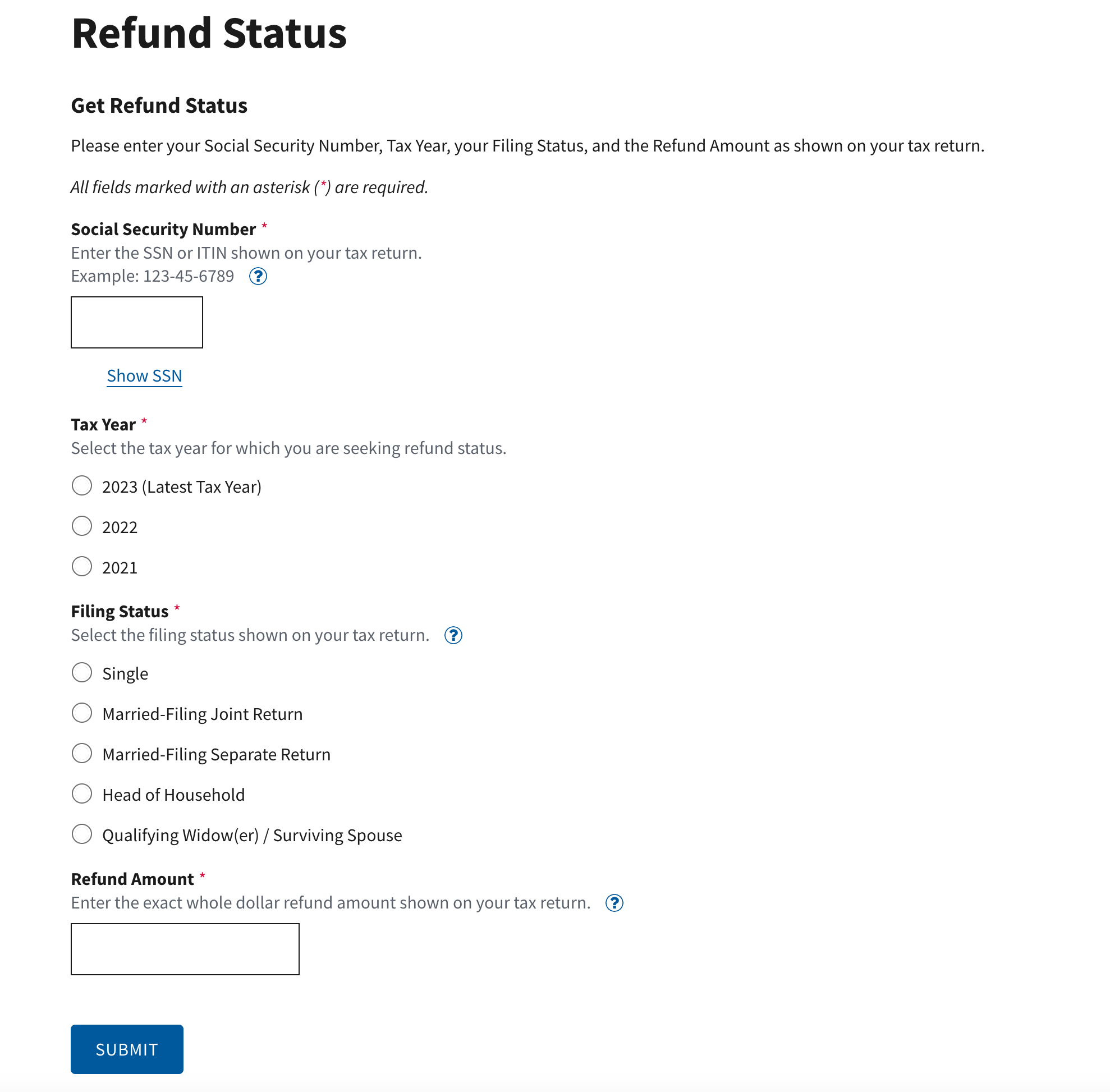

The IRS generally aims to issue tax refunds within 21 days of receiving a tax return. However, this timeline can vary depending on the factors mentioned earlier. To check the status of your refund, you can use the IRS online tool “Where’s My Refund?” or the IRS2Go mobile app for real-time updates on your refund status.

For more detailed information on the 2025 tax refund schedule stimulus, refer to the IRS official website or consult a tax professional to gain insights tailored to your tax situation.

Key Dates and Deadlines for 2025 Tax Refunds

As you navigate the 2025 tax season, staying informed about the key dates and deadlines for claiming your tax refund is crucial. Below are some important dates to keep in mind to ensure a smooth and timely refund process:

Deadline for Filing Taxes

The deadline for filing your 2025 tax return and claiming your refund is typically April 15th. However, if the 15th falls on a weekend or a holiday, the deadline may be extended to the next business day. It’s important to file your return by this date to avoid any penalties or late fees.

Estimated Refund Arrival Time

Once you have successfully filed your taxes, the estimated time for receiving your tax refund can vary. On average, most taxpayers receive their refunds within three weeks of filing. To ensure a faster refund, consider filing electronically and selecting direct deposit.

IRS Processing Time

The IRS processes tax returns in the order they are received. It typically takes the IRS around 21 days to process a tax return and issue a refund. However, factors such as errors on the return, incomplete information, or claims for certain credits may result in additional processing time.

Implications of Stimulus on Tax Refunds

As we dive into the 2025 tax season, understanding the impact of stimulus checks on tax refunds is crucial. The stimulus packages rolled out by the government can influence the amount of refund you receive.

Timing of Refunds

With the 2025 tax refund schedule stimulus in place, the timing of your refund may vary. Stimulus payments might delay or accelerate the processing of your tax refund.

It’s important to stay updated on any changes to the schedule that could affect when you get your refund 2025 tax refund schedule stimulus.

Impact on Refund Amount

The stimulus checks received throughout the year can also impact your tax refund amount. Depending on your income level and eligibility for certain credits, the stimulus payments may affect your final refund.

- Be sure to accurately report all stimulus payments received to avoid discrepancies.

- Consult with a tax professional to understand how the stimulus may affect your specific tax situation.

Factors Affecting Your 2025 Tax Refund Amount

When it comes to determining your 2025 tax refund amount, several factors play a crucial role in influencing the final figure you receive. Understanding these factors can help you increase your refund or avoid unexpected tax season outcomes.

Income Level

Your income level is a significant determinant of your tax refund. Higher-income earners often receive fewer refund amounts due to being in higher tax brackets. On the other hand, individuals with lower incomes may qualify for refundable tax credits, boosting their overall refund.

Deductions and Credits

Maximizing your deductions and credits can positively impact your tax refund. Make sure to claim all eligible deductions, such as student loan interest, mortgage interest, and charitable contributions. Tax credits like the Earned Income Tax Credit or Child Tax Credit can significantly increase your refund amount.

Tips for Maximizing Your Tax Refund in 2025

As you prepare for your tax refund in 2025, consider these tips to maximize your return and get the most out of your hard-earned money. Staying informed about the latest tax laws and regulations is critical to claiming all eligible deductions and credits.

Start Early and Stay Organized

Begin organizing your tax documents early to avoid any last-minute rush. Keep track of all receipts, forms, and any relevant paperwork. Use online tools or apps to help you stay organized throughout the year.

Ensure you have all necessary documents, such as W-2s, 1099s, and receipts for deductions like charitable donations or business expenses.

Maximize Deductions and Credits

Take advantage of all available deductions and credits to reduce your taxable income. Consider contributions to retirement accounts, healthcare expenses, and educational expenses that may qualify for tax breaks.

Explore tax credits for energy-efficient home improvements, education expenses, or childcare costs to further boost your refund.

Consider Itemizing Deductions

Consider itemizing deductions instead of taking the standard deduction if you have significant expenses in categories like medical costs, state and local taxes, mortgage interest, or charitable contributions. This can lead to a higher tax refund.

Keep detailed records of all itemized deductions, including receipts and invoices, to support your claims in case of an audit.

Frequently Asked Questions

- What is the 2025 Tax Refund Schedule Stimulus?

- The 2025 Tax Refund Schedule Stimulus is a plan by the government to provide refunds to taxpayers for a given tax year in 2025. It may include special stimulus measures or tax adjustments due to economic conditions or other factors.

- How does the 2025 Tax Refund Schedule Stimulus differ from a regular tax refund?

- The 2025 Tax Refund Schedule Stimulus differs from a regular tax refund because it may involve additional or one-time payments beyond the standard tax refund. These payments are often aimed at stimulating the economy or relieving taxpayers in unique circumstances.

- When can taxpayers expect to receive the 2025 Tax Refund?

- The government and tax authorities will determine the specific schedule for the 2025 Tax Refund. Taxpayers should stay updated on announcements and official communications regarding the refund timeline.

- Are there any eligibility criteria for receiving the 2025 Tax Refund?

- The government and tax authorities will outline the 2025 Tax Refund Schedule Stimulus eligibility criteria. These criteria may include income thresholds, filing status, and other requirements that taxpayers must meet to qualify for the refund.

- How can taxpayers track the status of their 2025 Tax Refund?

- Taxpayers can track the status of their 2025 Tax Refund by using the official online tools provided by tax authorities. These tools typically allow taxpayers to check the processing status of their refund and receive updates on expected payment dates.

Final Thoughts on the 2025 Tax Refund Schedule Stimulus

As we delve into the intricacies of the 2025 tax refund schedule stimulus, it becomes clear that understanding the timing and eligibility criteria can significantly impact your financial planning. By keeping abreast of the latest updates and deadlines, you can ensure a smooth tax refund process and potentially benefit from any stimulus packages that may be in place.

Remember, timely filing and accurate information are key to maximizing your refunds and receiving any additional stimulus funds. Stay informed, consult with tax professionals if needed, and seize the opportunities presented by the 2025 tax refund schedule stimulus to secure your financial well-being.